Bitcoin, ethereum price in danger as European Union considers limiting cryptocurrency

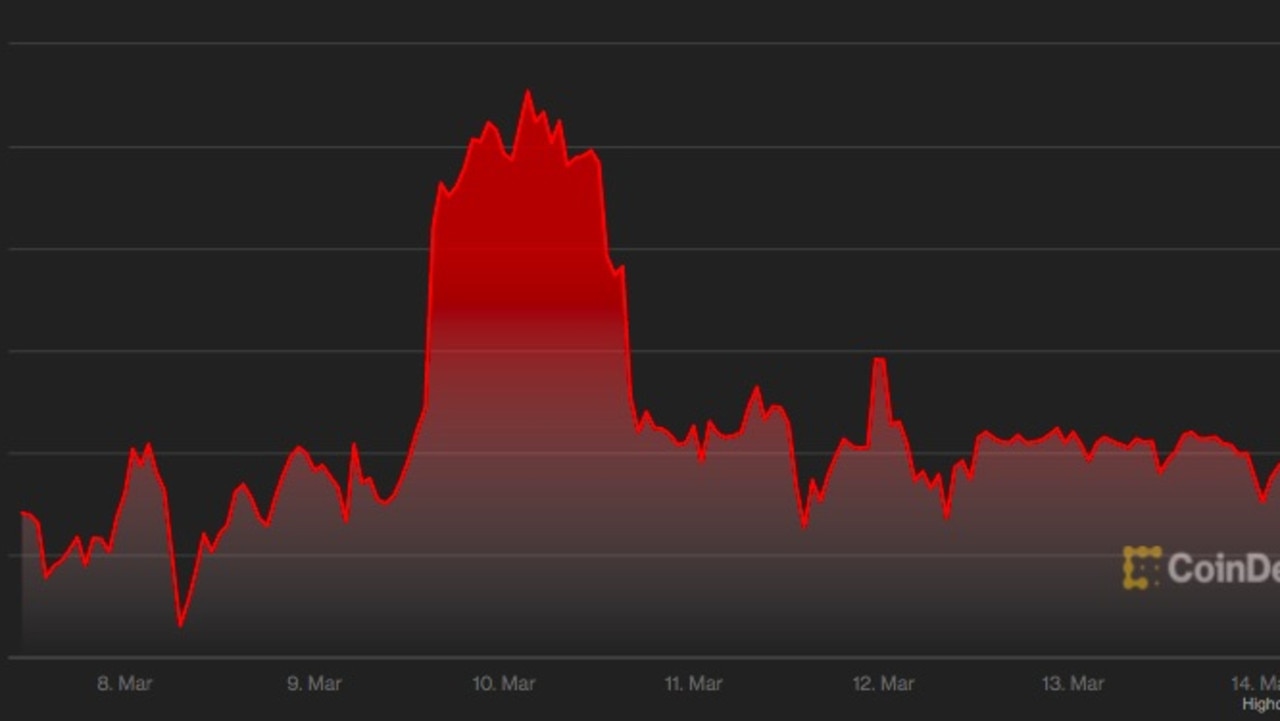

Cryptocurrency could soon endure a fresh pummelling because the European Union is seriously considering a ban of sorts on blockchain.

Cryptocurrency could soon endure a fresh pummelling because the European Union is seriously considering a ban on digital assets.

Blockchain investors are waiting with bated breath for the outcome of a vote in the EU parliament which will determine the future of cryptocurrency on the continent.

The parliamentary vote will occur on Monday local time, which will be later today for those on Australian time zones.

Members of the EU’s economic and monetary affairs committee are set to vote on a draft of the proposed Markets in Crypto-Assets (MiCA) framework.

Were the proposal to go ahead, it could be bad news for cryptocurrency investors.

An eleventh-hour addition to the framework is calling for a limit on the use of cryptocurrency, including “phasing out” pre-existing tokens like bitcoin and ethereum that are already being traded in European countries.

And it seems the outcome is too close to call, with insiders predicting the vote may be defeated by a very slim majority, CoinDesk reported.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Environmental concerns at centre of proposal

There have been concerns in recent weeks that Russia is circumventing economic sanctions imposed on it because of its invasion into Ukraine by using cryptocurrency to safeguard wealth and trade.

Some, including Ukraine’s Vice Prime Minister Mykhailo Fedorov, called for cryptocurrency exchanges to ban all Russian transactions.

However, the EU is citing environmental concerns as its main reason for cracking down on cryptocurrency in the radical proposal.

The draft aims to limit the use of cryptocurrencies because of its high energy use.

In fact, the process of creating bitcoin to spend or trade consumes a whopping 91 terawatt-hours of electricity annually, which is more than a small country, like Finland, uses in an entire year.

The late amendment was added to the proposal because bitcoin’s excessive carbon footprint could break the rules surrounding the EU’s environmental standards.

Cryptocurrencies must adhere to “minimum environmental sustainability standards with respect to their consensus mechanism used for validating transactions, before being issued, offered or admitted to trading in the Union,” one draft proposal sighted by CoinDesk read.

One crypto pro said the move was “extraordinarily concerning” and the vote later today was incredibly important.

Jeremy Allaire, founder of Circle Pay, wrote online: “Extremely high stakes vote in the EU.

“That such a proposal made it this far is extraordinarily concerning and unlikely to stand up to practical reality.”

Extremely high stakes vote in the EU. That such a proposal made it this far is extraordinarily concerning and unlikely to stand up to practical reality. https://t.co/t8xA0EnVfE

— Jeremy Allaire (@jerallaire) March 12, 2022

A complete or partial ban on cryptocurrency is not entirely unheard of.

In January, Russia indicated it was looking to ban the digital assets entirely over money laundering and environmental concerns.

China went a step further and completely banned all things crypto at the end of September last year in a major tech crackdown.

Egypt, Iraq, Qatar, Oman, Morocco, Algeria, Tunisia and Bangladesh have also banned cryptocurrency.

In November, Indonesia banned cryptocurrency for its entire Muslim population because it contained “elements of wagering”.

Crypto enthusiasts have already dodged one bullet in the past week when it came to government crackdowns on digital assets.

More Coverage

Last week, US President Joe Biden signed a historic executive order on cryptocurrency.

People were concerned that he would be seeking to ban the digital assets amid rumours that Russians were evading economic sanctions by trading cryptocurrency.

However, after the exec order was announced, the price of bitcoin actually jumped by 10 per cent, buoyed by the general consensus that the changes were positive.