The scams being targeted at different Victorian age groups and how much money is being lost

As a shocking report lifts the lid on Australia’s huge scamming problem, the devious ways swindlers are targeting different Victorian age groups has been exposed.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Victorians are among the most scammed Australians in the nation — and Millennials are being hit hardest.

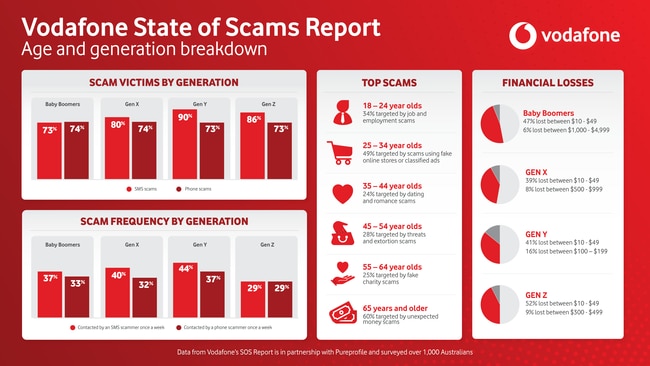

New Australian phone and text scam data from telecommunications provider Vodafone — provided exclusively to the Herald Sun — reveals what scams are being targeted to what age groups, who is falling victim to them and how much money is being lost.

Sadly, it shows unscrupulous scammers are preying on the goodwill of those aged between 55 and 64 with charity scams, and hitting those aged over 65 with money scams.

Australians aged 18 to 24 are being targeted with job and employment scams, 25 to 34-year-olds with online sale scams and 35 to 44-year-olds with romance scams.

Terrifyingly, 45 to 55-year-olds are being threatened and falling victim to extortion attempts.

Vodafone’s first State of Scams (SOS) Report, which claims to lift the lid on Australia’s huge scamming problem, shows SMS and phone crooks are relentlessly targeting Australians from all walks of life to swindle their hard-earned cash, with more than 80 per cent of Australians haven fallen victim to an SMS scam and almost three quarters having been hit by phone fraudsters.

And Victoria is above the national average in text scams, with 83 per cent of the population hit.

The SOS report — compiled following a national, industry-wide survey between January and June this year — shows the most common financial loss from scammers was between $10 to $49 with nearly half (44 per cent) of Australians affected.

Nearly three million Australians had losses of between $50 to $99 per scam and 4,143,30 Australians handed over $10,000 or more to fraudsters, the report says.

However, it found a shock 75 per cent of victims had not reported the scams they had been targeted with to police, and well under half (41 per cent) had reported them to Scamwatch, operated by the country’s consumer watchdog, the Australian Competition and Consumer Commission (ACCC).

Vodafone Australia general manager of corporate security Simone Sant said scams did not need to be elaborate or involve losses of thousands of dollars to hurt people.

“It doesn’t matter where you come from, or your generation, fraudsters sending scam SMS and making scam calls are defrauding Australians every day. Keeping our customers safe and secure is a key priority,” she said.

“Our SOS Report is a wake-up call to remind Australia that scams are widespread and can affect anyone. It is more crucial than ever for Australians to stay vigilant and be aware of the common tricks used by these scammers.”

Using an SMS security firewall and artificial intelligence, Vodafone had blocked more than 38.8 million scam text messages since the start of 2023 and almost six million scam phone calls, but “relentless SMS and phone fraudsters are sneaking through to more than one third of Australians at least once a week on average”, she said.

Just last month the 96 year-old, not-for-profit Upwey Tecoma Bowls Club fell victim to an elaborate scam when paying for a replacement green it had lost due to floods in November of last year.

The Dandenong Ranges club, which was inundated when a nearby creek broke its banks, had its main green destroyed.

While the green was covered by insurance and replaced in April 2023, the club fell victim to an elaborate email compromise scam that involved a hacker infiltrating an email account, searching out an invoice and then masquerading as the legitimate business from which the original invoice came — but with altered bank account details.

A few weeks later, when the contractor chased up the club for payment, it was revealed $118,000 had been lost to the scammer.

“The club has since worked with the bank and the contractor, reported the scam to the appropriate bodies, warned the wider bowls community and invested in legal advice, but our money has gone,” a bowls club spokesman said.

“We are seeking support from the wider community to help us raise funds so that we can continue to provide a facility widely used by the local community. Please help our small sporting club get back on its feet and enable us the chance to reach our centenary year.”

The Herald Sun has also been told of Victorians being targeted by overseas scammers after putting items up for sale on Facebook Marketplace, followed by demands for them to hand over banking details and then nasty threats of legal action for a “broken contract” when they suspected they were being scammed and discontinued communication.

Carlton star Jacob Weitering, 25, revealed earlier this year he had lost his life savings in an unbelievably sophisticated phishing scam.

The former No.1 draft pick said the scammers went to incredible lengths over seven days to get him to hand over everything he’d worked so hard for during his career.

It had started with a text message he received in September 2022.

“I honestly didn’t think it was going to happen to me, and it did. It could happen to anyone,” he said.

The message said: “A suspicious transaction has been made using your accounts, please give us a call if this is not you”.

Weitering said he trusted it because it remarkably somehow appeared in an existing legitimate text message thread from his bank NAB about past suspicious transactions.

“I remember it being a Friday. So I wanted to get onto it pretty fast as I didn’t want my accounts to be drained over the weekend,” he said.

Then he received calls from a number that appeared as the fraud line from NAB on his phone.

“They spoke perfect English, the guy almost sounded as if he were an Englishman,” he said.

“They went through the suspicious transaction, and played on my emotions a little bit.

“It was perfect. The text, the caller ID, the blocking of the suspicious transaction.”

Weitering was told his accounts had been frozen but the money needed to be moved into what they called a “safeguarding account”.

Over the next week he sent amounts up to his daily transaction limit directly to the fraudsters – until all his accounts had been emptied.

“I sent them the money directly,” Weitering said. “That was the biggest mistake that I made, and that was built off the perfect role-playing at their end.

“We cleared all the accounts until they were empty, into what I thought was a safe account.”

Weitering said that once he had realised what had happened, he was devastated.

“It was a very significant amount of money that I’ve struggled to deal with over the last six months,” he said.

“It was that the money that I’d worked hard for, and saved, was all taken away. All gone.”

Ms Sant said to check if they were being scammed by SMS or phone, people should use the “three S” approach:

• Scrutinise: Be on the lookout for suspicious or unfamiliar numbers, names, or addresses.

• Strange: Stay alert to strange or unusual requests for financial and personal information.

• Seek: Seek out official phone numbers and websites when SMS or callers say they are from a specific organisation or company.