Financial woes of developer giant Bensons laid bare in new report

New details have emerged from the collapse of Melbourne-based Bensons Property Group which entered insolvency with a whopping $811m in debts.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Major Melbourne-based property developer Bensons Property Group collapsed owing creditors more than $800m, it can be revealed.

Bensons, which collapsed in December with more than 1000 homes under construction worth about $1.5b, also entered administration with $163,672 in the bank.

The details are contained in a new report lodged with the corporate regulator by administrator Craig Shepard of accounting firm Korda Mentha.

Bensons is the latest high-profile property developer to run into trouble, although the group – which has projects on the go in Victoria, Queensland and Tasmania – has said it intends to trade throughout the administration process.

The developer collapsed into insolvency owing a total of $811,984,166 to creditors.

Substantial liabilities include loans from landowners paid to Bensons for development, including $11.2m for a Footscray development on Warde St.

A loan totalling $190m is also owed to investment company Banner Asset Management for the ongoing construction of an almost-$485m 41-level tower on the Gold Coast’s Chevron Island.

Trade creditors include 882 Hospitality ($519,760), SRIG Special Projects ($330,265), Home of the Arts ($125,000) and J Group Aviation International ($176,580).

More than $173,000 is owed to employees, including $25,761 in superannuation and $88,907 in long service leave.

Over $1m is owed to related party employees.

Assets include more than $15m in related party loans, upwards of $17m in loans to residential and childcare landowners, $174,809 worth of artwork, and $83,662 in property plant and equipment.

More than $101m is owed to the company, including from accrued development fees, shares in controlled entities, trade debtors and loans.

Bensons previously said the company had more than $1.5b in projects coming through and would work with developers to complete them.

In a new statement released this week, Bensons said staff have returned to work and construction had resumed on all projects following the planned holiday break.

“Under a proposal to be put to BPG’s creditors, it is intended that BPG will continue to trade beyond the administration and receivership period,” they said.

“Keith Crawford and Matthew Caddy of McGrathNicol, who were appointed as receivers and managers of BPG, continue to oversee ongoing operations of the business.”

The company said tough conditions in the industry, including higher interest rates and increasing construction costs, contributed to the administration.

Bensons is currently building more than 1300 apartments across Victoria, Tasmania and Queensland.

These projects are understood to include the construction of 740 apartments across Melbourne’s suburbs, with an estimated collective value of $452m.

One of Bensons’ key projects in Melbourne, luxury apartment block Society Armadale, is described as “beautifully crafted boutique residences with large terraces and courtyard-style gardens” on their website.

Other projects in Melbourne include 24-level Footscray apartment building Liberty One and high end block of residences St James Park in Hawthorn.

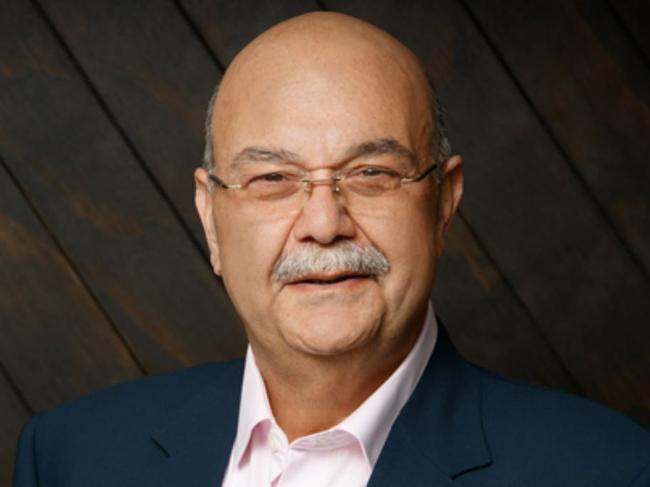

The business was founded in 1994 by self-made developer Elias Jreissati.