VCON collapses owing more than $11m to creditors and nearly $2m to staff

The directors of high-end construction company VCON have been chased by residents over allegedly shoddy work, as new details of its more than $13m collapse are laid bare.

The directors of a luxury Melbourne building group were being chased over allegedly shoddy work at multiple upmarket apartment block complexes in the months before they tipped one of their key corporate vehicles into liquidation.

The Herald Sun can also reveal VCON collapsed owing more than 280 creditors upwards of $11m, as well as nearly $2m to staff.

VCON Group and VCON (Aust) were put into liquidation last month, with dozens of employees sacked on the spot, this masthead previously revealed.

The companies appear to be the key businesses holding the assets of luxury builder VCON which operated across Melbourne’s southeast and on the Mornington Peninsula.

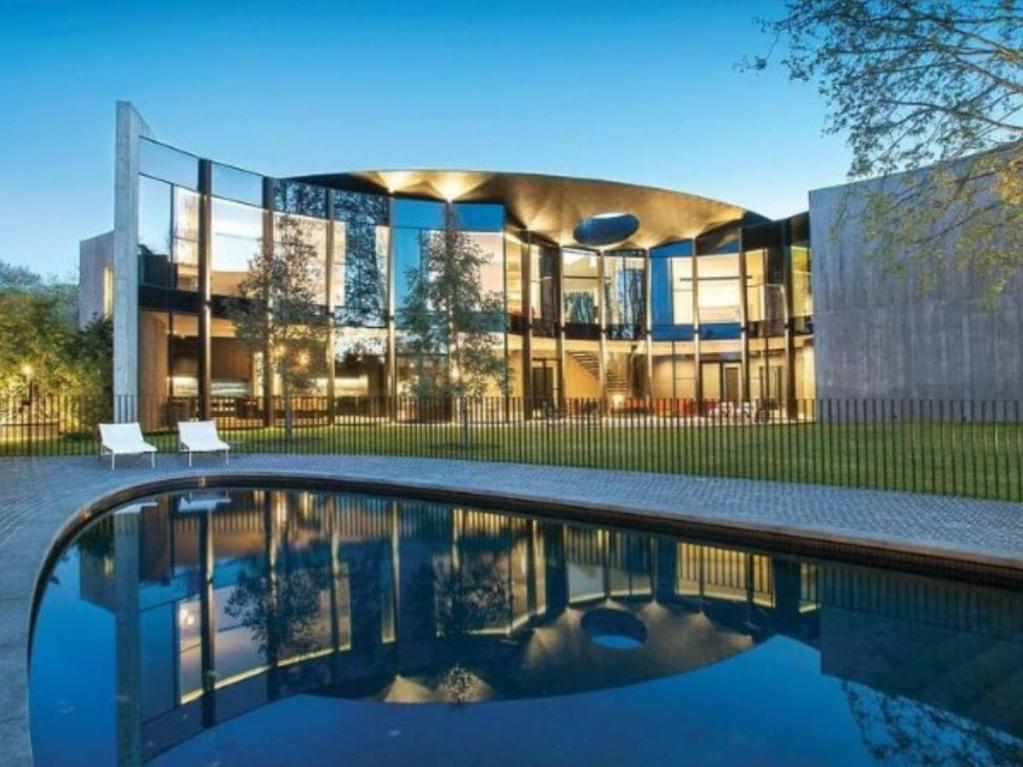

VCON, which described itself as “one of Melbourne’s most prestigious construction companies”, was operated by brothers Anthony and Robert Morton.

The company had various luxurious, award-winning developments, including apartment building Fawkner House in South Yarra.

They also worked on the $40m development of Jackalope Hotel in Merricks North which included a 143-year-old homestead and winery with a 46-room hotel.

VCON (Aust) went bust with $25,000 in the bank and owing close to $11.3m to more than 280 unsecured creditors, new corporate documents lodged by director Robert show.

This included $173,858 owed to the Australian Taxation Office, $191,402 to law firm Moray and Agnew Solicitors, $186,176 to tiling company Vic Star Tiling, and $186,547 to concrete contractor JA and JA Concreting.

Other companies owed money included Neptune Swimming Pools ($155,019), Moorabbin Cabinets ($150,770), IBM Tiling Victoria ($137,793) and Fast Labour Hire Melbourne ($116,278).

The business entered liquidation with a string of related inter-company debts, including $3.2m owed to VCON Group, $60,568 to V-Struct and $251,890 to EV Aust.

VCON Group collapsed owing $1.8m to 39 employees, including $91,311 in wages, $358,099 in annual leave, $248,722 in long service leave and $823,804 in redundancy payments, additional documents from the corporate regulator revealed.

The company owed $2.9m to 30 unsecured creditors and $94,611 to secured creditors, the ASIC report submitted by director Anthony showed.

It collapsed with $23,789 in the bank and owing the tax office $2.3m, as well as $191,912 to Victoria’s State Revenue Office and $83,117 to WorkCover.

The Morton brothers also run another construction company in Melbourne, Element Five, which focuses on high end multi-residential and commercial projects.

A Melbourne resident, who bought a high-end penthouse apartment off the plan in the city’s inner southeast with Element Five in 2017, took the construction firm to the Domestic Building Dispute Resolution Victoria over faulty building works in October.

He claimed his aircon unit was “non-compliant and unsafe” and the cabinetry throughout the apartment was “falling apart”.

“The doors on the cabinetry are falling off. I can’t even put new doors on the wood. It is so inferior, it can’t grip into it,” he told the Herald Sun.

“I can’t change the filters on the aircon unit. I get asthma pretty badly and I need to have these units cleaned and filtered out.”

A report by Buy Property Australia on the luxury property said the works were “defective and not fit for purpose”.

“We believe the installation has been completed by several different contractors, which affects the quality of the product,” it read.

Another report by Property & Strata Group detailed “ongoing defects” including water ingress issues on the terrace and in the living room and bathroom, leading to moss growth, deteriorated floorboards and rust stains.

“Left unaddressed, these defects may worsen over time, potentially leading to adverse effects on the structural integrity of the building or habitability concerns,” it read.

The resident said Element Five denied any wrong doing.

A certificate from the DBDRV confirmed the matter was left “not resolved”.

“I’m a self-employed professional and have been trying to run a successful business while dealing with this for more than four years,” he said.

“I’ve spent hundreds and hundreds of hours sending emails and meeting tradies on site.

“And now they just wipe their hands of this, clearly, the system is failing me.”

Director of owners corporation management company Stratabase Richard Reid, who is the manager of the Element Five building in question, said the resident’s experience “is not unique” with the construction firm.

“While the building is actually very well constructed, as are other Element Five buildings, their delaying tactics with regard to defect rectification has been unconscionable,” he said.

“From my experience with them, their strategy appears to have been to make it difficult for owners to claim on the builders’ warranty.

“It takes a great deal of persistence to get them to undertake any rectification work.

“(Another apartment) owner was advised that an Element Five employee would attend to rectify some defects only to find that the employee was made redundant within days of them making this promise”.

Grant Thornton’s Andrew Hewitt was appointed liquidator of VCON (Aust) and VCON Group in December.

A Grant Thornton spokesperson previously said the companies had ceased trading.

VCON and Element Five were contacted for comment.