One stock surging in ASX drop amid warnings of ‘stagflation’

The Australian stock exchange is falling again today, but there’s one major stock that is massively outperforming the market.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

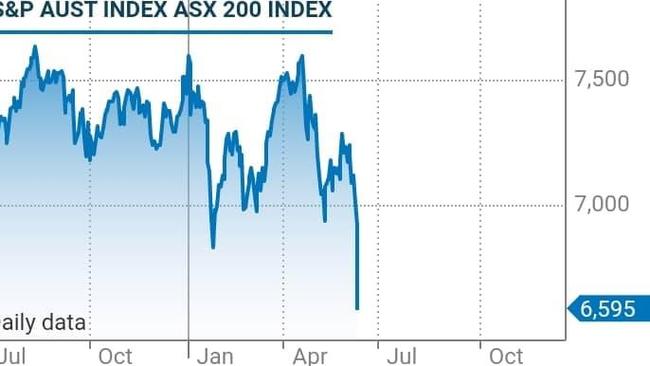

The Australian stock market is falling again today after Tuesday’s $116 billion wipe-out amid warnings we are headed towards a crippling 1970s-style “stagflation”.

The ASX saw its most brutal day of trading since the start of the pandemic on Tuesday – as ordinary Australians saw their portfolios collapse and some of the nation’s biggest rich-listers lost $12 billion in a matter of hours.

Any hopes of a quick rebound have been dashed as the Aussie market opened lower on Wednesday.

By 12.40pm, S&P/ASX 200 index dipped 0.4 per cent to 6629.2 with health care and tech stocks leading losses.

A daily close below 6673.26 would make it the lowest close since at least February 2021.

The one big stock surging

There are however a few companies doing fairly well today, and one is surging.

Financial stocks were among the four categories posting small gains, following a horror past week. Major banks were mixed with NAB and CBA up 0.1 per cent, while Westpac and ANZ shed up to 0.8 per cent. Macquarie Group rose by 1.5 per cent.

However, the best performer in the top 200 companies is GrainCorp.

Australia’s largest listed bulk grain handler has seen its share price rise sharply since the start of the year as it has benefited from global supply constraints due to the Ukraine war.

Australia, the world’s sixth-largest wheat exporter, is set to ship a record volume this year as buyers look for suppliers to replace cargoes from Russia and Ukraine.

Today, its share price is surging by 4.4 per cent to over $10 as of 1pm.

Mining giants are also seeing small gains, but energy stocks dropped slightly.

Battery technology company Novonix was the worst performer on the index, down 7.5 per cent, followed by telco infrastructure company Megaport which is trading 6.7 per cent lower.

Concerns for Fed rate decision

Despite some winners emerging today, there real concern about what will happen on Thursday.

Like many parts of the world, the Australian market pays careful attention to what is happening on Wall Street, and there is an ominous decision looming in the United States.

Bloodbath on the #ASX this morning. #ASX200 -4.92%#AllORDS -5.02%#panic#plunge#marketcrash#stockmarketcrash#sharemarketpic.twitter.com/yJuJvAq6QX

— Eightcap (@Eightcap_aufx) June 14, 2022

There, the US Federal Reserve is expected to hike rates by 0.75 percentage points on Thursday morning, Australian time, in a bid to tackle soaring inflation of 8.6 per cent.

Investors are becoming increasingly worried that central banks will be forced to choke off the post-pandemic global recovery and trigger a recession in the coming year.

There are concerns about interest rises here in Australia too with the Reserve Bank governor warning that interest rates will surge and inflation could peak as high as 7 per cent.

KPMG chief economist Brendan Rynne flagged more pain was to come with interest rate hikes on the agenda.

“The likelihood is we are going to see further reductions in share price values over time as central banks around the world continue to lift interest rates upwards,” he told 7 News.

“The trajectory for the cost of debt we are facing is only rising, fundamentally, because those emergency levels of interest rates that were set during Covid now have to rise.”

Stream more finance news live & on demand with Flash. 25+ news channels in one place. New to Flash? Try one month free. Offer ends October 31, 2022 >

The dire economic situation has stoked concerns Australia may be headed towards a crippling 1970s-style “stagflation” – a mix of the words stagnation and inflation, which describes an economy with low growth and high prices.

DNR Capital chief investment officer Jamie Nicol said investors are worried that high inflation is here to stay, and that it could get much worse in Australia.

“It’s all about inflation, and people are finally capitulating to the idea that inflation is going to be around for longer, and that central banks are going to have to go harder to stop it, which then runs the risk of stagflation – which is the concern,” Mr Nicol told The Australian. “Inflation is worse overseas, but if there is inflation everywhere else, it’s only a matter of time before we import it.”

Revealing a steep cut in the global economic outlook for this year, World Bank president David Malpass said: “The war in Ukraine, lockdowns in China, supply chain disruptions and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid.”

Inflation could hit 7 per cent by Christmas

There are already signs Australia will be hit a lot harder by inflation in the coming months, with the Reserve Bank governor warning it could peak as high as 7 per cent.

Dr Philip Lowe predicted that inflation would hit 7 per cent by Christmas and that it wouldn’t begin to fall until the first quarter of the next year.

He added that the RBA would do “what’s necessary” to tackle rising inflation and that the bank was determined to return inflation to between 2 and 3 per cent.

“It’s unclear at the moment how far interest rates will need to go up to get that,” Dr Lowe told the ABC’s 7.30.

“I’m confident that inflation will come down over time but we’ll have to have higher interest rates to get that outcome.”

"I think Australians need to be prepared for higher interest rates. We had emergency settings during the pandemic, I think that was the right thing to do, but the emergency is over." – Philip Lowe, RBA Governor #abc730pic.twitter.com/l2KrEPtCjU

— abc730 (@abc730) June 14, 2022

Dr Lowe admitted that Australian families would find the rise in interest rates tough to take, especially at a time when grocery and fuel prices are rising astronomically.

Last October, the RBA said interest rates would not rise before 2024, only for the cash rate to be put up by 50 basis points last week – the second rate rise in as many months.

“At the individual level some people have taken loans that they may not have wanted to take out in retrospect, but the overall picture, which is really very much the focus of the Reserve Bank, is a pretty resilient economy,” Dr Lowe said.

“Sometimes my comments get interpreted as me having made a promise, or a very strong statement, that interest rates would stay where they were to 2024. In our own communication, in our own way of thinking, it was very much a conditional statement.

“The economy didn’t evolve as we expected, it’s been much more resilient and inflation’s been higher and we thought we needed to respond to that.”

– with NCA NewsWire

More Coverage

Originally published as One stock surging in ASX drop amid warnings of ‘stagflation’