Gold Coast property: More owners risking default, shock new data shows

Shock new data shows thousands of Coast households are a month away from defaulting on their home loans. Here’s what to do if you’re among those struggling.

Real Estate

Don't miss out on the headlines from Real Estate. Followed categories will be added to My News.

THE number of Gold Coast households a month away from defaulting on their home loans has risen 25 per cent in a year, new figures show.

Data compiled by firm Digital Finance Analytics (DFA) reveals 1900 homeowners are under enormous financial pressure, up from 1500 in January 2019.

Of the city’s 89,161 borrowing households, 15,036 are deemed in mortgage stress. It means they are spending at least 30 per cent of their income on their mortgage.

Despite about 13,000 people migrating to the Coast each year, DFA principal Martin North predicted 2020 would be a “tough year” amid fears of a recession.

“Financial pressure is growing and households are feeling it,” he said.

“Income continues to be flat or worse in real terms. The cost of living is rising and despite the fact that interest rates are low because of the Reserve Bank’s most recent decision, this has not translated to lower mortgage rates for people.

“Ratings agencies are seeing a rise in default rates across Australia and this is consistent with what is being seen on the Gold Coast.”

According to the data, published this month, homeowners in Pacific Pines, Nerang, Highland Park, Gaven and Carrara are most at risk.

Yatala, Stapylton and Steiglitz also feature highly on the list.

About 433 of the 722 houses (60 per cent) in the 4225 postcode, which takes in Coolangatta and Bilinga, is experiencing some form of financial pressure.

However, only 1.5 per cent of those were close to defaulting.

Mr North said many Gold Coasters struggled with underemployment, particular in the fields of construction and car sales.

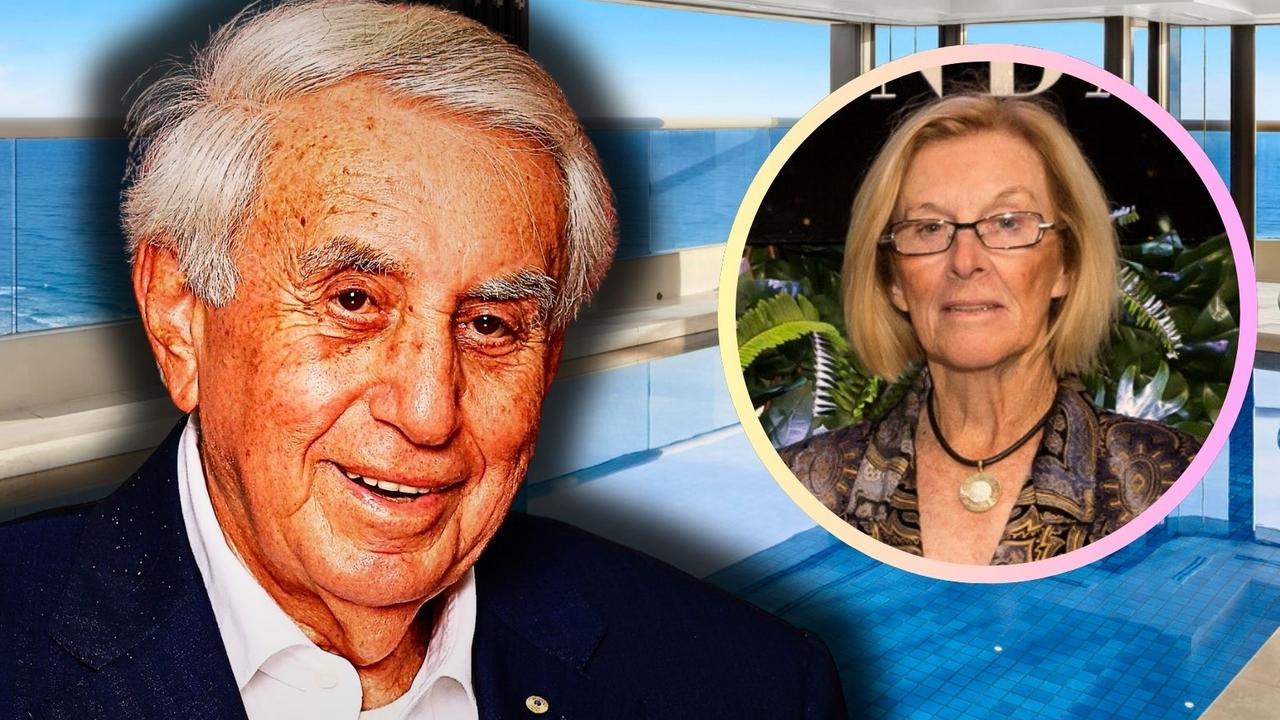

Top real estate figure Andrew Bell said many Gold Coasters needed to take a careful accounting of their expenses to minimise stress.

“It is not just your mortgage that people have to deal with it is other expenses we did not have 15 years ago. Like gym memberships, takeaway coffee, Netflix and apps on your phone,” the boss of Ray White Surfers Paradise said.

“Interest rates are the lowest they have been, and they will continue to drop. But when you look at mortgage stress, you also need to consider your household expenses.

“People tend to know how to spend $30 here and $50 there, on social media and racking up high data charges. It is easier for them to pay for those little things and then put off the big mortgage payments.

“Mortgage stress is a result of people spending beyond their means, spending it on the little things that add up.”

OTHER NEWS

Bizarre find at Coast creek after flash flooding

First details on The Villa golf course sale

Construction begins on new Raptis tower

The DFA data comes just weeks after the Bulletin revealed the Gold Coast’s construction market was slowing.

In a Christmas Eve report, a new council report showed the number of development applications becoming a reality had dropped dramatically.

The number of development applications fell 13.4 per cent in the first quarter of the current financial year, compared to the corresponding three-month period in late 2018.

The number of plumbing applications declined 69.5 per cent.

Plumbing applications are made by developers as an immediate precursor to construction beginning on their project and are seen as a bellwether for the strength of the building industry.

Oasis Financial Planning owner Stephen Pollard urged homeowners under financial stress to seek professional advice, negotiation insurance rates and do not spend beyond their means.

He said any household spending more than 30 per cent of their income on a mortgage was in trouble as it was unlikely to be sustainable.

“Interest rates are falling so banks are willing to negotiate,” he said.

“They will not voluntarily do it, but if you threaten to go to another bank they will.

“With repayments you also need to make sure you know what you are getting yourself into.”