Beulah International plans to sell Southbank tower site as creditors accept deal from directors

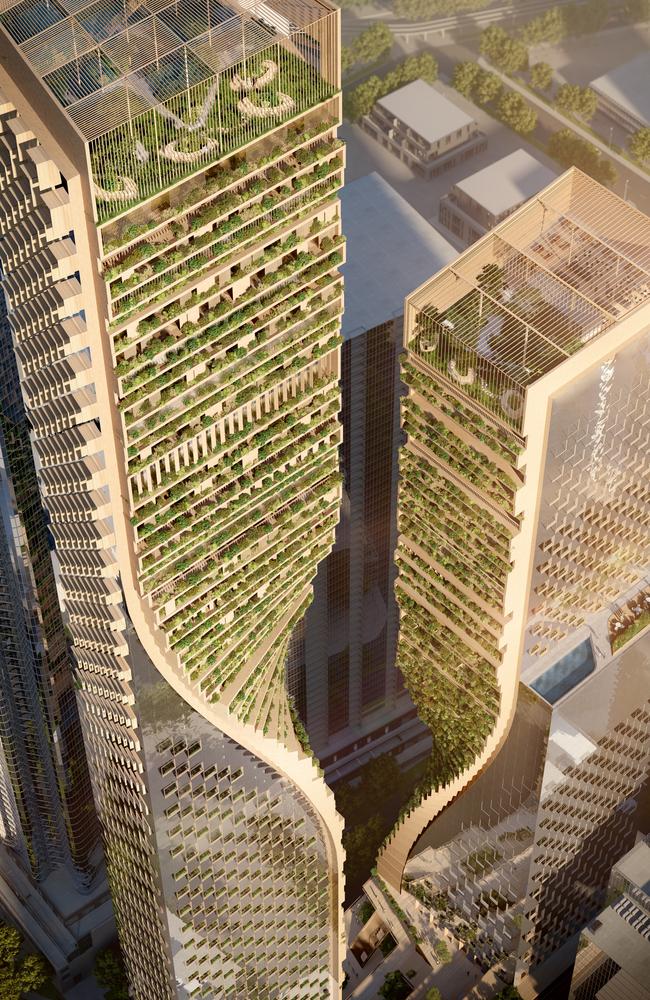

The Southbank site housing Australia’s tallest residential development, the $2.7bn STH BNK by Beulah, is being put up for sale as creditors accept a deal that could hand them big losses.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

The Southbank site housing Australia’s tallest residential development will be put up for sale while creditors in its collapsed project management arm have agreed to settle for as little as a quarter of what they are owed.

Beulah International, which is behind the $2.7bn STH BNK by Beulah tower, called in administrators to project manager BSSPV last month after it collapsed owing more than $100m.

The majority of that is owed to associated entities within the Malaysian-backed developer’s empire, but a number of local businesses are facing hefty losses with trade creditors totalling $5.3m.

Among this group are Cox Architecture and UN Studio – the designers of the project owed $616,322 and $334,494 respectively — structural engineer AECOM ($362,181) and KPMG Financial Advisory Services ($364,650).

BSSPV creditors voted to accept a proposal put by its directors on Wednesday under which they are expected to reap between 21c and 94c on the dollar.

Control of BSSPV will then reverted back to Beulah.

But the value creditors receive ultimately depends on the amount raised by the sale of the prime Southbank site on the former BMW showroom on City Rd.

The site is owned by another Beulah company SB Nominees which is not in administration.

It will run a sales campaign with the aim of selling the site in whole or as part of a joint venture with Beulah.

Pitcher Partner administrator David Vasudevan warned creditors it was not clear if the sale would raise enough fund to hit certain financial milestones mapped out in the BSSPV deed of company arrangement.

“The (deal) proposal, simply put, allows the vendors time to continue with the expression of interest campaign as the sale of (the properties) represents the best means for the company to receive funds,” he said.

Mr Vasudevan said taking into account the scale of the two properties, the proposed sale and settlement time frame of up to 18 months was “not unreasonable”.

If the BSSPV creditors voted to liquidate the company, they would only receive between 2c and 8c on the dollar, Mr Vasudevan warned.

“The alternative option, being liquidation, will create adverse consequences to the director personally, his private companies and the group which may cause some distraction and detriment to the expression of interest campaign,” they said.

Beulah managing director Jiaheng Chan said the company was grateful for the “unanimous approval received” from creditors and their decision to accept the deal.

“This important step will support Beulah’s continued efforts to achieve the best commercial outcome for all stakeholders in the STH BNK project,” he said.

Early works on the STH BNK project were slated to start early this year.

Designs featured the dual towers, estimated to be 365m and 295m in height, which would be home to the world’s highest vertical garden, a Four Seasons hotel and an auto club fleet of 50 luxury cars for residents.

But it was hit by rising construction costs and bad timing for residential projects, even though it had record pre-sales, including a $35m sub-penthouse.

Originally published as Beulah International plans to sell Southbank tower site as creditors accept deal from directors