The dream to build STH BNK by Beulah, the tallest building in Australia, appears to be turning into a nightmare

It promises to be a new crown jewel in Melbourne’s ever-soaring skyline – 102 storeys of cutting edge luxury living among the clouds – but uncertainty now looms over the $2.7bn STH BNK by Beulah project.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

It promises to be a new crown jewel in Melbourne’s ever-soaring skyline – 102 storeys of cutting edge luxury living among the clouds.

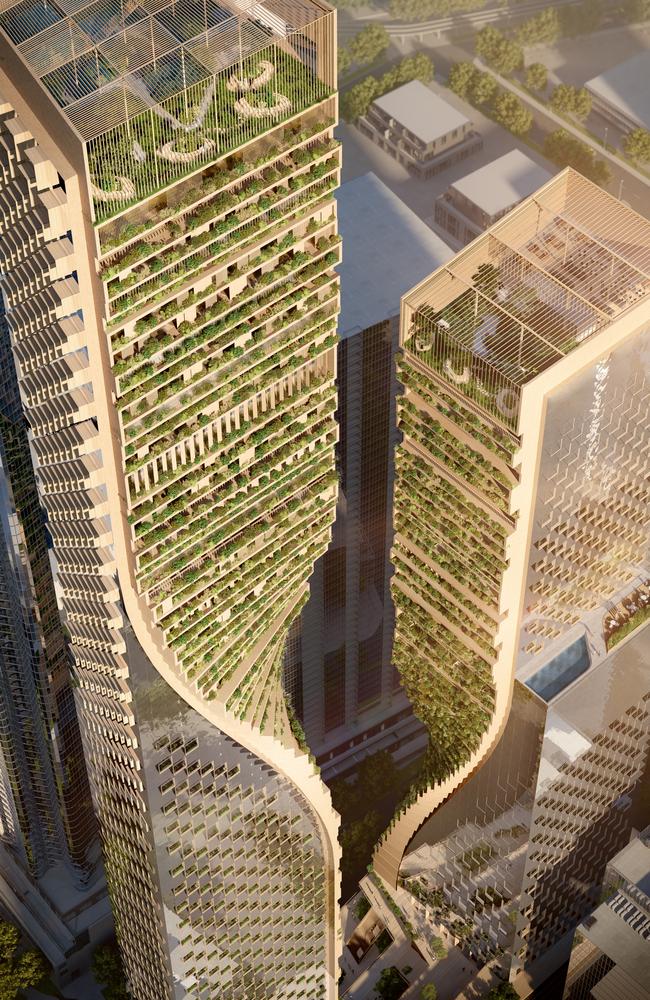

The ambition – dual towers, an internationally renowned hotel, the world’s tallest vertical garden – is as big as the record it aims to topple; becoming the nation’s tallest building.

Welcoming STH BNK by Beulah to Melbourne in 2023, then Lord Mayor Sally Capp noted it was an “awe-inspiring and jaw-dropping” development that would “have a ripple effect in spreading confidence throughout the city and abroad”.

That was the hope.

But uncertainty now looms over the $2.7bn project after developer Beulah International put its project management arm into administration after being chased for unpaid bills.

Malaysian-backed Beulah, which specialises in high-spec, eco-friendly developments, is also desperately hunting for a new cash injection to keep the project afloat, as well as reviewing how it can slash costs.

The financial woes of one of the most prestigious residential projects in the nation – which had already sold 80 per cent of its apartments – has sent shockwaves through the state’s real estate industry and generated calls for action from the nation’s peak property development group.

“It’s alarming,” Australian Property Developers Association president Alex Huang told the Herald Sun.

“It’s also another blow to Victoria’s tarnished reputation as the least favourable place for property development”.

A towering vision

The project aims to replace a former BMW car dealership with dual towers, 365m and 295m in height, housing the world’s highest vertical garden, a Four Seasons hotel and an auto club fleet of 50 luxury cars for residents

Beulah first purchased the site, located on Southbank Boulevard, in 2017 for an estimated $101m.

The developer conducted a contest to determine the architect for the project.

A collaborative bid by UNStudio and Cox Architecture secured the commission, with the winning design announced in 2018.

The plan received approval from the City of Melbourne in 2020.

Beulah then acquired 158 City Road in 2021, which is currently home to a seven storey commercial building dubbed Hanover House, with the intention of expanding the development.

Planning Minister Sonya Kilkenny gave the green light for an amended permit to demolish existing buildings and construct the towers at City Rd in 2023.

Multiplex was then announced as the project’s building partner in 2023.

Beulah told media in 2023 that they had sold 80 per cent of its apartments before it started its build.

Sales reportedly averaged out at $1.5m, ranging from $534,000 to a record $38m sub-penthouse sale.

From ambition to administration

Rising construction costs and bad timing for residential projects created a “perfect storm” for Beulah, industry experts say.

It comes after Beulah put the STH BNK project manager into administration earlier this month after architecture firms Cox Architecture and UN Studio lodged a winding-up order against it.

The project manager was housed in a company called BSSPV.

Documents filed with the Supreme Court reveal Cox is chasing debts of $748,039, while UN Studio said they are owed $434,368.

Consulting agency Ubris and engineering giant Arup, who say they are owed $137,182 and $1,092,456 respectively, are also listed as supporting creditors, the documents show.

A spokesperson for COX and UNStudio told the Herald Sun the winding up application was issued after a “long period” of trying to work with the Beulah group to resolve the debt owed.

“Throughout the project, we have worked closely with the Beulah team to find solutions to address the external influences that both the project and the industry more widely have been exposed to over the last five years, whilst continuing to investigate Beulah’s brief and project aspirations,” they said.

“Despite all of the hard work and effort of the combined team, the market environment remains extremely challenging.”

A report by Pitcher Partners administrators of BSSPV said the company collapsed owing creditors $102m, although much of that is to related Beulah entities.

BSSPV owes $5.3m to trade creditors, including Arup ($979,223), Cox ($616,322), structural engineer AECOM ($362,181) UN Studio ($334,494) and KPMG Financial Advisory Services ($364,650).

The report said BSSPV collapsed with just relatively few assets, with one bank account containing $450.66, another empty and another with just 73c.

Company wide projects

Beulah’s bid to transform the CBD skyline isn’t the only project it’s rolling out in Melbourne — or the only one facing pressure.

The developer is also building 23 all-electric two-storey townhouses on Hodgson St in Brunswick.

Their website says construction was starting in early 2025, with three-and-four-bedroom townhomes already selling from $1.8m.

Beulah is also building 15 houses on the banks of Merri Creek, dubbed The Wilds, on Cunningham St in Northcote.

While that project’s website says construction is “well underway”, numerous people who have reportedly bought these properties off the plan have voiced concerns online about delays and “poor communication”.

Two reviewers said they had gotten their deposits refunded after three years of “bluff and bluster, spin and false starts”.

A Beulah spokesperson said despite their best efforts, The Wilds was not able to be delivered within its original timeline due to factors “outside (of their) control”.

“The construction industry has encountered major challenges in recent years, such as global supply chain disruptions, delays, price fluctuations in materials, and labour shortages,” the spokesperson said.

“Despite this, we have persevered and construction has commenced and is underway.

“We have successfully delivered seven residential projects, spanning boutique to high rise, with no issues prior to 2022.

“Our projects are not immune to market conditions and, like many other developers, we have navigated industry disruptions as best we can, ensuring we keep our purchasers updated every step of the way.”

Beulah has two other new acquisitions, including plans to build 44 residences alongside two retail spaces on George St in Fitzroy, and a residential, retail and dining complex on Commercial Rd in Prahran.

The developer previously built the apartment complex Fawkner House in South Yarra.

It featured nine large-scale residences, positioned within the exclusive Domain precinct near Fawkner Park.

They are also behind the 48-level residential tower Paragon on Queen St in the CBD, which they say featured Australia’s first indoor urban forest as well as Habitus – a collection of 25 terrace homes on Boundary St in South Melbourne.

They’ve completed projects in Melbourne’s suburbs including a 136-apartment block in Doncaster, 32 luxury residences in Ivanhoe, 21 large-scale apartments in Kew and 12 penthouse-scale residences in Camberwell.

Victoria in crisis

The cloud hanging over STH BNK has sparked a grim warning from the nation’s peak development lobby group.

Australian Property Developers Association president Alex Huang said the collapse of BSSPV was yet another blow to Victoria’s “already tarnished reputation as the least favourable place for property development”.

“It’s alarming that even seasoned developers with strong track records – like Beulah – struggled to keep a high-profile project like STH BNK afloat, despite reportedly securing over 80 per cent in pre-sales,” he said.

Mr Huang said escalating supply chain costs, driven by rising material prices and a severe shortage of skilled construction labour, exacerbated by competition from government infrastructure projects, played a major role in the collapse.

He also said an ageing construction workforce was another issue, raising long-term sustainability concerns for the industry.

“Adding to the pressure, the cash rate has been sitting at a 13-year high of 4.35 per cent, significantly increasing borrowing costs for developers and buyers alike,” he said.

“This has strained project feasibility, tightened access to finance, and dampened demand, making it even harder to bring developments to market.”

Beyond financial pressures, Mr Huang said the relentless expansion of property taxes and levies over the past decade had pushed many developers, financiers, and industry partners to the brink.

“These burdens have severely eroded developers’ holding capacity, depriving them of the critical time needed to restructure and relaunch projects,” he said.

“As if that weren’t enough, the bureaucratic red tape surrounding planning approvals adds significant delays, costs, and complexity — even for minor permit modifications.

“The result is a perfect storm of challenges.

“It’s no surprise that even high-caliber, job-creating, and economically significant landmark projects are collapsing one after another.”

Property Council of Australia Victorian executive director Cath Evans said economic pressures, higher taxes, slow and complex approval processes were all putting pressure on the market and slowing down housing supply.

“In recent years, the property industry has faced a rapid escalation in construction costs and labour shortages, straining project feasibility and timeline,” she said.

“The government needs to lay out the welcome mat for investors and developers to build the homes we desperately need by cutting red tape in the planning system, growing the construction workforce and eliminating taxes discouraging investment.”

Originally published as The dream to build STH BNK by Beulah, the tallest building in Australia, appears to be turning into a nightmare