Owners refuse to pay million dollar special levies create beachfront safety risk

Residents are claiming owners are ‘manipulating’ body corporate laws, creating safety risks – including falling balcony railings, loose windows and failing lifts. See where

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

Unit owners are refusing to pay million-dollar special levies delaying maintenance, in a deliberate move to trigger a sale of their building to circling developers in beachfront suburbs a state parliamentary committee has been told.

The “manipulation” of weak body corporate laws is creating safety risks – including falling balcony railings, loose windows and failing lifts.

Some ageing Gold Coast apartment blocks in Main Beach and Surfers Paradise are losing their insurance coverage as a result.

A Queensland parliamentary committee is being urged to introduce tougher fines of body corporates along with independent audits of their ‘sinking funds’ or savings.

The Legal Affairs and Safety Committee is seeking feedback on a body corporate and community management amendment bill creating a “75 per rule” where a majority, rather than all owners are required to support a vote to sell a building.

Surfers Paradise business leader Debra Kelly has called for wider reforms, warning that older buildings have body corporates refusing to budget to meet future sinking funds forecasts.

“Owners or committees who wish to terminate can manipulate the situation,” she wrote, in her submission.

The existing laws requires a body corporate to budget for and maintain buildings along with

common property but Ms Kelly claims “many don’t do it” leading to owners later facing a special levy.

“I’m dealing with one right now with a special levy of $37,000 per lot to bring maintenance

up to standard,” she said in the submission.

“Another building in which I owned until recently required a $15,000 special levy to cover

overdue critical maintenance.

“Both of these buildings have their insurance suspended because they were critical safety

items – failing balcony balustrades on a 16-floor building and windows falling out of a 22-floor building.”

Ms Kelly also wrote that some committee members aware of the future maintenance costs deliberately delayed work.

“They were doing it to artificially depress levies on the basis that by the time the chickens

came home to roost, they would have moved on and thus avoided the contribution that should

have been made to the sinking fund during their tenure,” she said.

“This practice could easily lead to a situation where the building becomes uneconomical to

maintain in many buildings.”

The existing laws work on an “honour system” believing “rational self-interest will collectively prevail”.

“But if they don’t do that there is no penalty and no oversight, other than by other owners

who mostly take no interest until something goes wrong, or who are incapable of

understanding that the budgeting is insufficient, or who simply feel relieved that levies have

not increased,” Ms Kelly said.

“If the government does wish to bring the changes in the bill into law, it must address the

weakness in the existing legislation that allows buildings to go under budgeted for years on

end.”

A body corporate source said there was no “legislative limit” on the amount for a special levy.

“They have to collect what they need and replenish their administrative fund,” the source said.

But the source confirmed some body corporates were refusing to spend more than $1 million on urgent maintenance items like removing building materials which could create fires.

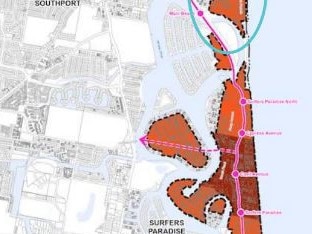

Detailed surveying by the Main Beach Association found those buildings which have been maintained and others left in a poor condition. Maps show sites likely to be redeveloped.

MBA leader Sue Donovan in her group’s submission opposing the 75 per cent rule said the majority of the suburb’s 3500 residents lived in buildings older than 35 years.

“What we discovered was that the great majority of older buildings were, thanks to conscientious body corporates, in excellent condition,” Ms Donovan said.

“However they are also located on the prime sites highly prized by property developers.

“Almost all, whether 3-storey walk-ups or highrises, have been aggressively pursued by property developers for many years, so far to no avail, given a significant number of ‘holdouts’.”

Ms Donovan said the 75 per cent per cent rule should include the requirement for a building to be economically unviable before all owners were forced to sell.

She said the economic reason for compulsory termination of a community titles scheme was that it would be not viable to carry out repairs or maintenance to the building.

“In other words, the cost of sinking fund levies will be unaffordable and therefore the only solution is to sell the building to a developer, as long as 75 per cent of owners agree to the sale,” she said.

Ms Donovan said it was disappointing that leading property groups at a public hearing had argued the 75 per cent rule should apply even if the building a developer wanted to buy was in perfect condition.