Gold Coast developers including Craig Gore and Christopher Skase and how they were undone by crime

He’s one of the most infamous figures in Gold Coast history – from an assault charge to business collapses, these are Christopher Skase’s tales. SEE THE FULL LIST

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

- Gold Coast business people who committed crimes and lost it all

- Life, death and drugs: Coast’s most dangerous bikies

THEY were once Gold Coast’s highest flyers ... before these developers ended in before the courts.

Meet our city’s powerbrokers who had their empires crushed by the law.

RANKED: Gold Coast’s 20 most influential developers

Craig Gore

THE former rich lister was found guilty in 2020 of using self-managed money from super fund investors to pay company debts and rent on his Queensland home.

The son of Sanctuary Cove developer Mike Gore faced trial over 12 counts of fraud, totalling about $350,000, which is alleged to have occurred between 2013-14 at Southport.

He was found guilty of six counts of fraud for the benefit of the companies Arion Financial and Arion Group through the high-interest debentures scheme and was sentenced to five years’ jail.

The twice-bankrupt developer will remain in jail until 2022, being denied permission by the court to temporarily return to Sweden where his wife and children now live.

Gore has since returned to Queensland’s highest court to argue his investment fraud conviction should be overturned.

His lawyers lodged a bid to the Queensland Court of Appeal to have his conviction overturned and released from jail, arguing the verdict against him could not be supported by the evidence.

The appeal is still before the courts.

Steven John Seabrook

THE Gold Coast property developer was sentenced in 2018 to six years in jail for his part in a drug ring.

Seabrook supplied the drug cocaine 169 times to 17 regular customers out of a Tedder Ave, Main Beach, business over eight months in 2016.

Mr Seabrook pleaded guilty to more than 50 charges, including trafficking dangerous drugs, supplying dangerous drugs, possessing dangerous drugs, fraud and forgery.

His wife, Rachel Elizabeth Seabrook, also dabbled in selling the cocaine and was caught supplying the drugs five times.

Mrs Seabrook pleaded guilty to seven charges including supplying dangerous drugs and possessing the property from the proceeds of crime.

Mrs Seabrook walked from court on parole after being sentenced to two years prison.

Bradley Keith Silver

THE former property developer and company director was sentenced to eight years jail in 2019 for dishonest offences that reaped $4.7million.

The court heard Silver had run a sophisticated scheme involving “calculated dishonesty”.

The Commonwealth Department of Public Prosecutions case followed an ASIC investigation, which culminated in July 2017 when he was nabbed at Brisbane Airport after flying in from Hobart, where he’d been living and operating a strip club.

Silver pleaded guilty in March 2019 to seven counts of fraud to the value of $2.763 million and six counts of dishonestly using his position as a director in the amount of $2.01 million.

ASIC Commissioner Sean Hughes said Silver “deliberately targeted the elderly, promised investors up to 20 per cent returns and convinced investors to borrow against their homes, which in many cases, was their only financial asset”.

ASIC’s investigation found Silver dishonestly induced Westpac Banking Corporation to deliver property in the amount of $2.763 million to Westpac customers for investing in two scheme companies: Capital Growth International Club Pty Ltd and All About Property Pty Ltd, between July 2008 and July 2010.

ASIC further revealed that between April 2009 and May 2010, Silver, while a director of CGIC and associated with AAPD, dishonestly used his position with the intention of causing a detriment in the amount of $2.015 million.

In February 2011, the companies were placed into liquidation owing investors approximately $9 million.

Matthew Michael Nair

IN March 2020 the Gold Coast man pleaded guilty to more than a dozen charges after forging documents to get $1.8 million in loans for properties and a Porsche.

The fraudster was sentenced to seven years in jail and will be eligible for parole in December 2021.

Fijian-born Nair’s frauds were described by Judge Smith as multi-faceted, persistent and sophisticated.

They included using false documents to claim he earned a higher salary and false bank statements to obtain the loans and making false statements to obtain an Australian passport while in California to avoid prosecution of charges in the United States.

While still on bail in 2017, Nair allegedly posed as a developer and sold contracts for house and land packages at Pimpama that were never realised.

Nair operated out of the business Oz Builds, which had its headquarters in Bundall, and another business called Millionair Enterprises.

However, because he did not enter into any deal, the court heard this was not a breach of his bail at the time.

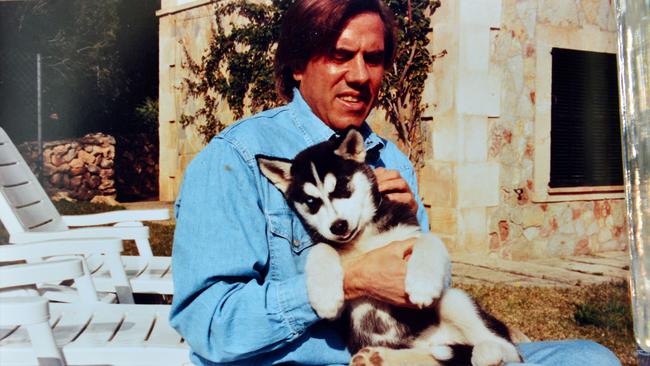

Christopher Skase

A DEVELOPER and business baron, the Melbourne-born Skase became one of the Gold Coast’s best-known figures in the 1980s, with his company Qintex Group becoming a major player.

Skase built Marina Mirage and the Sheraton Mirage on The Spit, co-founded the Carrara-based Brisbane Bears Australian rules team and built its stadium and the Seven network.

Skase’s $3.3 billion company owned the Channel Seven network, a string of resorts under the Mirage brand and the AFL Brisbane team.

He went bankrupt in 1991 with debts of $172 million after Qintex collapsed.

In 1990 he was charged with assault and wilful damage over an incident involving newspaper photographer Nathan Richter at a Gold Coast resort.

‘Skase Curse’, sporting graveyard: Gold Coast’s time for change

He was on trial in May 1991 but was living in Spain at the time and the matters would not proceed after Skase’s solicitor Bill Potts had sought a ruling there was no case to answer.

Mr Skase’s lawyer said he sought the order because of the relatively minor nature of the charges and the length of time involved in bringing them before a court.

Skase remained on the Spanish island of Majorca and refused to come back to Australia to face fraud charges over claims he propped up his share price.

Skase’s business dealings in Spain on potential developments were unable to match his early success in Australia.

Skase died in 2001, aged 52.