Closing Bell: ASX clings to gains as initial trade talk optimism wears thin

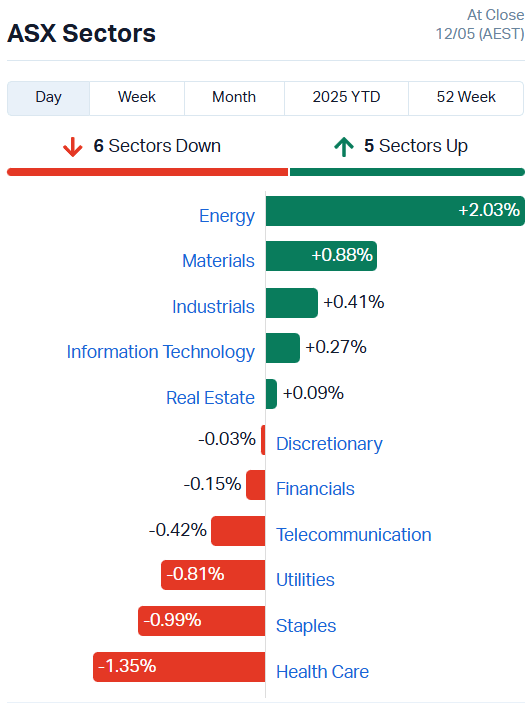

The ASX crept up less than 0.10pc in trade on Monday, wary of a lack of substance in US-China trade talks. Strength in Energy kept the bourse afloat.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX jumped 0.5pc just before midday but pared back to just 0.03pc

US-China trade negotiation announcement due this evening

Energy sector once again leads gains as Healthcare falls

While the first word out of the US-China trade negotiations has been a positive one, it’s also been empty of substance.

Both parties made a lot of noise about how optimistic they were on the progress already made, but neglected to detail any of that alleged development.

Still, investors seem pretty desperate for any sign things will improve – the US market futures are looking very optimistic, up between 1.09% and 1.96% for the three major indices.

A break in mounting hostilities between India and Pakistan might have something to do with that.

The two nuclear-capable nations are now in a ceasefire after exchanging blows on the Kashmir border over the last four days, offering some hope the conflict will not continue to escalate.

With something approaching calm settling over international relations – however briefly – oil has begun to climb and gold has started to sink.

Brent added 1.67%, climbing to $63.91 a barrel, while gold slipped 1.57% to US$3274.18 an ounce.

ASX holds onto gains… by the fingertips

The ASX jumped about 0.5% in the first hour of trading this morning, but wasn’t able to hold onto those gains, falling back to lift just 0.03%.

Investors were initially keen, lifting seven sectors higher, but have since re-evaluated.

In fact, the market was threatening to go negative in the last hour of trade, managing to cling to gains only through a strong showing from the Energy sector and strength in the ASX200 Resources and All Technology indices.

Perhaps tonight's announcement will offer a little more substance.

Onto today's leaders and laggards.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.002 | 100% | 1725001 | $4,109,881 |

| CZN | Corazon Ltd | 0.003 | 50% | 2828544 | $2,369,145 |

| QXR | Qx Resources Limited | 0.005 | 43% | 3839576 | $4,586,151 |

| MHC | Manhattan Corp Ltd | 0.024 | 41% | 44668632 | $3,993,281 |

| CUF | Cufe Ltd | 0.008 | 33% | 2964390 | $8,079,449 |

| DTM | Dart Mining NL | 0.004 | 33% | 8868350 | $3,594,167 |

| RGT | Argent Biopharma Ltd | 0.15 | 30% | 30458 | $8,301,063 |

| HCT | Holista CollTech Ltd | 0.056 | 30% | 1359267 | $12,287,969 |

| ANX | Anax Metals Ltd | 0.009 | 29% | 2551369 | $6,179,653 |

| BKT | Black Rock Mining | 0.025 | 25% | 9779497 | $29,388,798 |

| LCY | Legacy Iron Ore | 0.01 | 25% | 2293122 | $78,096,341 |

| TFL | Tasfoods Ltd | 0.005 | 25% | 715317 | $1,748,382 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 1157211 | $13,151,701 |

| SMM | Somerset Minerals | 0.021 | 24% | 25468332 | $7,186,472 |

| WMG | Western Mines | 0.21 | 24% | 859939 | $15,360,068 |

| PUA | Peak Minerals Ltd | 0.016 | 23% | 79418905 | $36,495,177 |

| VRX | VRX Silica Ltd | 0.07 | 23% | 5401812 | $42,596,287 |

| VRL | Verity Resources | 0.027 | 23% | 7442119 | $5,438,421 |

| BEL | Bentley Capital Ltd | 0.011 | 22% | 285826 | $685,151 |

| PHO | Phosco Ltd | 0.066 | 22% | 1007879 | $23,669,359 |

| BMR | Ballymore Resources | 0.175 | 21% | 818272 | $25,625,935 |

| EXR | Elixir Energy Ltd | 0.03 | 20% | 7738444 | $34,990,553 |

| MTC | Metalstech Ltd | 0.15 | 20% | 400157 | $26,090,203 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 2000000 | $12,497,745 |

| EM2 | Eagle Mountain | 0.006 | 20% | 527069 | $5,675,186 |

Making news…

Manhattan Corp (ASX:MHC) said it was snapping up the Hook Lake project in Nunavut, Canada, home to the high-grade Turquetil Lake gold deposit and a bunch of other promising gold and VMS (volcanogenic massive sulphide) prospects.

The project hasn’t been touched since 1988, when a “foreign” estimate (not JORC-compliant) clocked in at 3.4 million tonnes grading 2.38g/t for around 285,000 ounces of gold. The project’s sitting in a prime spot in Nunavut’s Greenstone Belt, not far from Agnico Eagle’s massive Meladine mine.

Peak Minerals (ASX:PUA) reckons it’s discovered a rutile province in Cameroon, hitting natural titanium (rutile) mineralisation in all 12 holes drilled at the Minta rutile project and averaging 63.2% rutile in the discovery hole.

The company says the results from this first round of drilling are “exceptional”, grading up to 4m at 2.9% – and that’s without taking into account the presence of oversized rutile nuggets which could materially add to the overall grade of 304 pending drill assays.

Black Rock Mining (ASX:BKT) has signed two big agreements with Tanzania’s TANESCO for its Mahenge graphite project. Faru, its 84%-owned subsidiary, will build a new 220kV power line connecting Mahenge to hydro-powered electricity.

Faru will get back the construction costs from TANESCO over four years of mine production. On top of that, the Tanzanian Mining Commission has lifted a default notice on Mahenge’s licence, clearing the way for Black Rock to get things moving.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LSR | Lodestar Minerals | 0.009 | -50% | 21095361 | $5,731,629 |

| CP8 | Canphosphateltd | 0.016 | -47% | 50000 | $9,202,816 |

| SRH | Saferoads Holdings | 0.11 | -37% | 293257 | $7,648,446 |

| PAB | Patrys Limited | 0.002 | -33% | 2354606 | $6,172,342 |

| VML | Vital Metals Limited | 0.002 | -33% | 30000 | $17,685,201 |

| VPR | Voltgroupltd | 0.001 | -33% | 511548 | $16,074,312 |

| DY6 | Dy6Metalsltd | 0.099 | -27% | 2455652 | $7,902,337 |

| 1AD | Adalta Limited | 0.003 | -25% | 313019 | $2,572,891 |

| GGE | Grand Gulf Energy | 0.003 | -25% | 32438765 | $11,201,549 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 2436170 | $4,349,768 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 31642241 | $15,115,373 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1038245 | $1,946,223 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 511000 | $7,480,156 |

| TEM | Tempest Minerals | 0.004 | -20% | 389556 | $3,672,649 |

| VHM | Vhmlimited | 0.265 | -18% | 741426 | $71,223,734 |

| 8IH | 8I Holdings Ltd | 0.009 | -18% | 45185 | $3,829,769 |

| FGH | Foresta Group | 0.009 | -18% | 2740289 | $29,181,971 |

| RR1 | Reach Resources Ltd | 0.009 | -18% | 949349 | $9,618,745 |

| ENV | Enova Mining Limited | 0.0075 | -17% | 11199012 | $12,721,507 |

| ASP | Aspermont Limited | 0.005 | -17% | 16000 | $14,820,070 |

| ERL | Empire Resources | 0.005 | -17% | 2292630 | $8,903,479 |

| MEM | Memphasys Ltd | 0.005 | -17% | 385909 | $11,901,589 |

| MTB | Mount Burgess Mining | 0.0025 | -17% | 324577 | $1,055,108 |

| PLC | Premier1 Lithium Ltd | 0.01 | -17% | 1122120 | $4,416,727 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 58910 | $6,267,702 |

IN CASE YOU MISSED IT

Maronan Metals (ASX:MMA) has tapped mining engineer Matthew Hine as non-executive director, effective today. Hine has 20 years’ operational and technical experience spanning underground and open pit operations across Australia, New Zealand and Europe.

He’s previously held senior roles as chief operating officer at Adriatic Metals (ASX:ADT), general manager for OceanaGold (ASX:OGC) Waihi and Macraes operations and manager mining at Evolution Mining (ASX:EVN) Mungari operation.

In the path to mine approval for the Tumblegum South gold project in WA, Star Minerals (ASX:SMS) has appointed ResourcesWA as a consultant. They will assist with all aspects of the mine approval process, including environmental.

“At this time of robust gold prices, it is fantastic to have a resource on granted mining tenure that we can progress toward production,” Star Minerals MD Ashley Jones said. “Star Minerals’ goal is to transition to gold producer in early 2026, generating cash flows.”

Trading Halts

Ridley Corporation (ASX:RIC) – cap raise

Peak Rare Earths (ASX:PEK) – cap raise

At Stockhead, we tell it like it is. While Maronan Metals and Star Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX clings to gains as initial trade talk optimism wears thin