Resources Top 5: Manhattan Corp jumps out of the water on Canadian gold-copper buy

A binding agreement to acquire Hook Lake gold and copper project in underexplored eastern Nunavut, Canada, has seen Manhattan Corp surge.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Manhattan Corp is acquiring the Hook Lake gold and copper project in an underexplored region of Canada

Historical resources in Finland will be verified by Nordic Resources after it confirmed broad, high-grade drilling results

The drill bit is spinning again at the Thomson project of Legacy Minerals in far west NSW

Your standout resources stocks for Monday, May 12, 2025

Manhattan Corp (ASX:MHC)

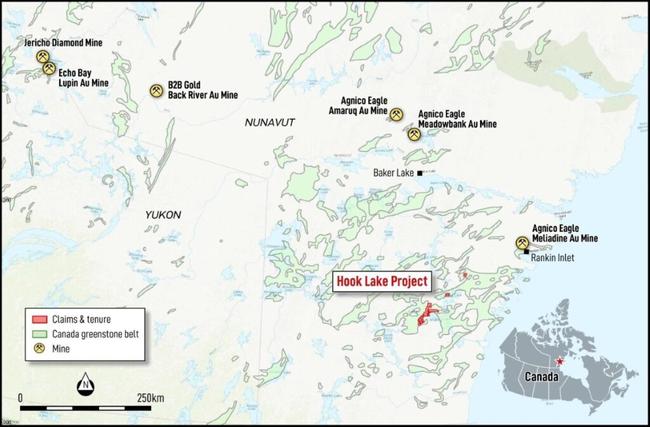

After reeling in a binding agreement to acquire the Hook Lake gold and copper project in a highly prospective yet underexplored region of Canada, including a 285,000oz non-compliant resource, Manhattan Corporation has jumped out of the water, more than doubling to 3.7c.

This represents a new 12-month high and was 117.7% up on the previous close on volume of almost 67m.

Hook Lake, which has remained largely dormant since 1988, hosts the Turquetil Lake High Grade Gold deposit and several further gold and polymetallic volcanogenic massive sulphide (VMS) prospects in remote eastern Nunavut.

Previous drilling defined a non-JORC estimate of 3.4Mt at 2.38g/t golf for ~285,000oz Au over a 940m strike length at Turquetil Lake and there is considerable exploration upside as it remains open in all directions, including down plunge and dip.

The estimate is considered to be a ‘Foreign’ estimate and is not reported in accordance with the JORC code or previous iterations of acceptable reporting codes.

Previous drill testing was only to a maximum of ~190m vertical depth and results include:

- 27.58m at 3.33 g/t Au from 44.35m, including 13.01m at 6.29 g/t from 53.04m;

- 15.2m at 4.50 g/t from 14.70m;

- 52.78m at 3.38 g/t from 89.22m, including 46.22m at 3.80 g/t from 89.78m; and

- 16m at 5.04 g/t Au from 52m.

Hook Lake also includes the Heninga Lake prospect, a VMS system that has previously returned results of 10.51m at 2.91% copper, 6.70% zinc, 95.67 g/t silver, 1.04 g/t gold and 0.48% lead from 41.76m, and 13.71m at 1.51% Cu, 2.06% Zn, 47.23 g/t Ag 0.56 g/t Au and 0.09% Pb from 70.26m.

The project covers 423km2 in the underexplored Rankin-Ennadai Greenstone Belt, one of the Archean Greenstone Belts in Nunavut and about 130 to 225km southwest of Agnico Eagle’s 6.7moz Au Meladine Mine (34.3Mt at 6.12 g/t Au).

Other belts host the in-development Back River Gold District, Goose & George project hosting 9.2Moz at 6.04 g/t with an anticipated 310,000oz annual production.

To support the proposed acquisition, MHC has appointed successful mining and resources industry company director and entrepreneur Gavin Rezos as a non-executive director and Eric Sondergaard as technical advisor.

Rezos recently delivered significant value as the former founding chairman of Vulcan Energy Resources, which grew from a market cap of $10m to more than $1b.

Sondergaard is responsible for sourcing and planning exploration at White Cliff Minerals’ Rae project, also in Nunavut, delivering an exceptional hole consisting of 175m at 2.5% Cu from 7.6m and ending at 4.46% Cu, remaining open at depth.

“The acquisition of the project brings with it a highly experienced and successful team, expected to join Manhattan’s board and management upon completion," Manhattan Corporation CEO Kell Nielsen said.

"This team will play a critical role in unlocking value by advancing the historically defined high-grade Turquetil Lake gold deposit through modern exploration techniques and by honouring the current agreement with Inuit landowners.

"Upon the transfer of the project, there is a clear pathway for Manhattan to test the mineralised system further along strike and at depth at Turquetil Lake and deliver near-term maiden mineral resources.

"Shareholder value is further underpinned by the acquisition of 423km2 of underexplored Archean Greenstone Belts in northern Canada, a Tier-1 mining jurisdiction. The belt already hosts three large operating gold mines, evidencing nearby proven gold endowment and existing mines and infrastructure.

"Archean Greenstone Belts like Nunavut, host much of the world’s gold and mineral endowment such as the familiar and tightly held Superior Province (Canada), Yilgarn Craton (Western Australia) and the Birimian Supergroup (Africa). Hook Lake also provides Manhattan with the potential to discover large, district-scale BIF hosted gold deposits.”

Nordic Resources (ASX:NNL)

Making strong progress in validating the prospectivity of three Finnish gold projects being acquired from Swedish-listed Northgold AB is Nordic Resources, which is moving to verify historical resource estimates after confirming broad, high-grade drilling results.

The company has found up to 5.31g/t gold while reviewing historical data at the soon-to-be acquired Kiimala Trend gold project and shares have been as much as 11.12% higher to 6c.

Kiimala is an important part of the company’s regional gold strategy, lying just 45km from the Kopsa project that hosts a near-surface resource of 23.2Mt at 1.09g/t gold equivalent for 814,800oz gold equivalent.

While Kopsa remains the primary project, Nordic Resources (ASX:NNL) also considers the Kiimala Trend to be extremely prospective for gold and copper.

The project hosts a cluster of 12 gold prospects, of which eight have been drilled with all eight reporting some significant near-surface gold intersections while historical, non-compliant gold resources have been reported at the Angesneva and Vesipera prospects.

The data review highlighted intersections at Angesneva of:

- 122.4m at 1.52g/t gold and 0.12% copper from 57.2m

- 79.8m at 1.85g/t Au and 0.18% Cu from 127.8m; and

- 73.7m at 1.73g/t Au and 0.13% Cu from 247.2m incl. 15.2m at 5.31g/t Au and 0.31% Cu from 272.1m.

Intersection highlights at Vesipera include 10.4m at 4.93g/t gold from 53.5m and 12m at 2.99g/t from 88m.

And Kimala prospect returned 17.3m at 2.27g/t gold and 0.28% copper from 42.6m, and 9m at 1.46g/t Au and 0.02% Cu from 182.4m.

The company is also working to validate the historical exploration database for another of the projects, Hirsikangas, and potentially bring to JORC (2012) compliance.

All three of the projects being acquired are advanced and represent substantial near-term upside to NNL’s strong operational platform in Finland – while the company continues its earn-in and joint venture discussions around the extensive Pulju nickel-copper sulphide project.

“With regard to its recently announced gold project acquisitions, Nordic is focused on further exploration and development of the substantial Kopsa gold-copper project as the near-term priority,” executive director Robert Wrixon said.

“However, the exploration upside at the Kiimala Trend project is hard to ignore as it is an extremely strong gold project.

The proposed transaction is subject to shareholder approval at both Nordic and Northgold’s upcoming general meetings, and is expected to complete in early June 2025.

Nordic intends to begin its first drill program at Kopsa as soon as possible thereafter.

Legacy Minerals Holdings (ASX:LGM)

The drill bit is spinning again at the Thomson project of Legacy Minerals in far west NSW following recent regional flooding which put a stop to activities.

Drilling is targeting large gold-copper systems and Legacy believes there is a world-class discovery opportunity across the 5,500km2 belt-scale project and securities have been up to 10% higher at 22c.

Thomson shares similar characteristics to other major intrusion-related gold and copper districts, such as Paterson Province in WA, where recent major IRG-Cu discoveries have been made at Winu and Havieron.

The resumed drilling program has started at Cut B anomaly which is prospective for gold, silver and niobium. Historical 2011 drilling targeted the magnetic anomaly but didn’t test the gravity anomaly, which can indicate increased sulphide abundance associated with an intrusion.

Drilling has also been completed at the previously untested F4 anomaly with assays pending.

In addition, a review of historical drilling results from Cut A led the company to conclude that the potential for IRG and IRG-Cu deposits had not been sufficiently considered nor tested historically - which presented a significant discovery opportunity.

Further sampling (80m) and assaying is planned to be undertaken further up the hole between 216m to 136m.

“After the successful test of the F4 gravity and magnetic anomaly, our current focus is the Cut-B target; one of many discovery opportunities within the 5,500km² tenement at Thomson,” LGM CEO and managing director Christopher Byrne said.

“This campaign marks the first test of the gravity anomaly at Cut-B.”

Waratah Minerals (ASX:WTM)

Exploration at the Spur gold-copper project west of the massive Cadia Valley operation of Newmont Mining in the Lachlan Fold Belt of NSW will be accelerated after Waratah Minerals raised $8.4m in a placement.

Firm commitments have been received for the placement to institutional, sophisticated and professional investors at $0.275 per share and the company is pleased with the strong demand from existing shareholders and new investors, including offshore resources funds.

Waratah will accelerate exploration at the Spur Project, targeting epithermal gold and porphyry copper-gold, to follow up on recent encouraging drilling results.

Specifically, the company will continue to focus on the Spur Gold Corridor, where epithermal gold mineralisation has been mapped 1km along strike, remains open in multiple directions and has strong similarities to the Dalwhinnie/GRE46 discovery at the Cowal deposit of Evolution Mining (ASX:EVL).

Additionally, drilling will continue to investigate the Breccia West Prospect, where the nature of mineralisation, host rock and assay intercepts show strong similarities to the nearby Ridgeway deposit at Cadia Valley..

“Waratah thanks its shareholders for their strong and continuing support, while welcoming new institutional shareholders to our register,” Waratah managing director Peter Duerden said.

“This cash injection will accelerate our exploration activity targeting epithermal gold at the Spur Gold Corridor and porphyry copper-gold at Breccia West.

“It is very exciting to have these opportunities at a time of historically strong gold and copper prices, against a backdrop of heightened exploration efforts by the world’s major mining companies across the Lachlan Fold Belt.

“With our strategic location, only 5 kilometres west of Newmont’s Cadia Valley project, and our accomplished and dedicated team, we are ready and funded for a period of aggressive and systematic drilling that has the potential to unlock material value for shareholders.”

Shares reached 34c, an 11.48% increase on the previous close.

Locksley Resources (ASX:LKY)

(Up – over past week – on no news)

Basking in the glory of a positive update last week from the Mojave antimony and rare earths project in the US is Locksley Resources, which earlier climbed another 28.6% to 5.4c with around 42m shares changing hands. At close of play, mind, it had given up those gains.

Mojave is about as well located as a critical minerals project could be in 2025, sitting just 1.4km from Mountain Pass, the only operating rare earths mine in the United States.

Since Donald Trump’s March 20 executive order calling for the US to boost domestic minerals production and Chinese export controls on the heavy rare earths in which it dominates supply, there’s been fresh steam for explorers previously weighed down by weak NdPr prices.

Locksley has already found rock chips grading up to 46% antimony and 1022g/t silver from the Desert antimony mine, part of the Mojave land package and has now formally submitted a drilling permit to the Department of the Interior’s Bureau of Land Management.

It is bullish that the permitting process could be fast-tracked following the EO, with the BLM confirming it will undertake any initial enviro assessment requirements that may have otherwise held up approvals for a 12-month period.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Nordic Resources and Legacy Minerals are Stockhead advertisers, they did not sponsor this article.

Originally published as Resources Top 5: Manhattan Corp jumps out of the water on Canadian gold-copper buy