Mooners and Shakers: Sell in May and go away? Not so fast… Bitcoin’s stirring again

Bitcoin and the broader crypto market staged a strong comeback in April and that’s continued to surge ahead in May so far.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Stockhead’s monthly crypto wrap, Mooners and Shakers, is brought to you by

- Bitcoin and the broader crypto market staged a strong comeback in April

- May has taken that ball and run with it, surging over six figures US once more

- Standard Chartered analyst admits he wasn't bullish enough

Well, look at what we have here then. A crypto recovery – of a reasonably prolonged nature, too. That is to say, at least a couple of weeks.

About this time last month the cryptoverse on the whole seemed to be, if not completely tariffied to the core, then certainly pretty shaky round the edges. But… things have changed.

At the time of writing, Bitcoin (BTC) is looking much healthier indeed with a six-figure glow – $US104,116 and up 24% over the past 30 days – while Ethereum (ETH) is now in the process of making an even more startling comeback, rising 60% over the past 30 days and currently changing hands for US$2,562 after wallowing well under $2,000 for the best part of a month.

This is why you probably shouldn't panic sell. Very bad days in crypto are quite often followed by very good ones.

Woods? Not out of them yet it probably has to be said, but the odd clearing in the thickets has emerged as we tiptoe round the bear poo. (Too much?)

Let's get into it, but first a bit of a recap on how Bitcoin managed to keep the scorers busy in April.

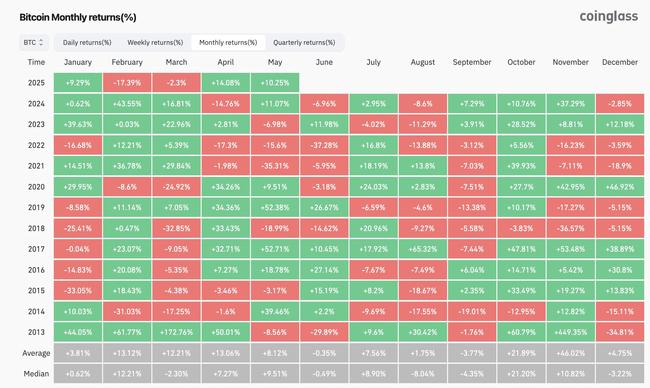

Bitcoin’s April monthly return

The OG, bull goose digital currency and grandaddy of all things crypto (that'd be Bitcoin) registered a strong double-digit comeback in April, after a rubbish February and a tepid March.

Is May now lining up for 2017 or 2019-like epic-ness to bely the old "walk away" investment adage? That'd be nice and it's certainly off to a decent start, and there are indeed some factors at play that provide a little hopium on that front (see further below).

Before we look at those, however, crypto exchange Binance provided us with rather more salient analysis on the crypto market in April. Let's delve into some of that expertise…

Crypto's April according to Binance

"The cryptocurrency market staged a strong comeback in April, rising 9.9% after the previous month's volatility," noted the world's biggest crypto exchange by trading volume (that'd be Binance), adding that this was largely buoyed by Donald Trump's temporary 90-day suspension of US tariffs.

However, investor sentiment remains cautious amid ongoing global macroeconomic uncertainty, according to the latest Binance Australia Monthly Crypto Market Insights report.

"The tariff pause provided temporary breathing space for markets, but investors recognise the relief may be short-lived," noted James Quinn-Kumar, Director of Community Engagement for Binance Australia and New Zealand.

"This caution is leading crypto investors to rotate from speculative tokens into established, blue-chip cryptocurrencies like Bitcoin and Ethereum rather than exiting the asset class entirely."

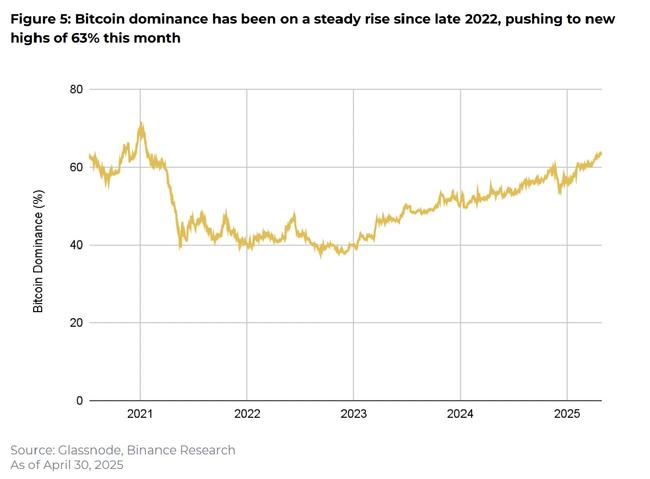

In fact, backing this up, Bitcoin was one of the most notable performers among top cryptos in April – according to the Binance report, it reasserted its dominance to reach a four-year high at 63% of total crypto market value.

Despite briefly correcting to approximately US$75,000 early in the month, Bitcoin swiftly rebounded, finishing April above US$90,000.

"This rebound underlines Bitcoin's resilience, reinforcing its appeal as a 'digital gold' asset and a key hedge against broader economic volatility," noted Binance.

“The resurgence in Bitcoin dominance clearly shows its strength as a defensive asset,” Quinn-Kumar added. “When traditional assets experience turbulence, investors tend to look to alternative assets to diversify their portfolios. Bitcoin, with its widespread adoption and established track record, has emerged as a haven within the crypto space.”

The crypto exchange's report also highlighted the fact Bitcoin spot ETFs also experienced the largest inflows since the start of 2025, "marking a dramatic increase in market appetite for Bitcoin".

Of course, it's not all just been about Bitcoin…

… there are thousands of other cryptocurrencies after all, which begs the question, why do we need so many? (Answer: we don't, but moving on.)

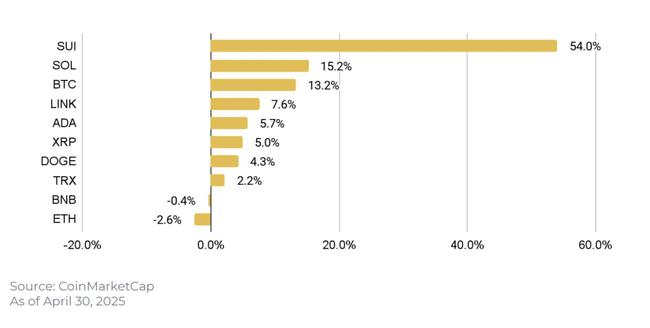

Other notable high-market-cap cryptos that performed well in April, and indeed into May, have included the layer 1 blockchain token SUI.

In April, Sui (SUI) rose by 54.0%, alongside a sustained growth in daily active addresses, hitting a peak of 2.5m in the month of April and a 40% growth in total value locked (TVL).

As Binance noted, this could be due to two major pieces of news — Grayscale launching a dedicated SUI trust which offers institutional investors exposure to the token and the SUI foundation partnering with xPortal and xMoney to issue a virtual Mastercard linked to SUI, enabling 2.5 million users across Europe to spend using the SUI token.

Solana (SOL) meanwhile experienced a 15.2% gain in April following the launch of the first spot SOL ETF in Canada, and Chainlink (LINK) climbed 7.6%.

The latter, noted Binance, was "potentially attributed to significant exchange outflows of over US$120m in April. There is also growing institutional adoption from entities such as SWIFT and DTCC on Chanlink’s Cross-Chain Interoperability Protocol (CCIP)."

Fear and Greed

Right then, because the Fear & Greed Index always effectively tells a simple visual story, how's its crypto market sentiment read looking at the time of putting this article together?

Optimism is certainly on the rise (and we don't mean the Layer 2 crypto that goes by that name, although that's up 31% over the past month, too), despite uncertainties very much remaining amid the macroeconomic landscape, including China-US trade talk variables and Trump's tendency to pump and roil markets within pretty much any given day. Hour even.

Is the bull market back?

Did it ever leave? Maybe it just took a nap. Here are some recent/latest newsy reasons to keep believing…

• The Fed may be striking a red pen through rate cuts for now, but globally we're seeing things happen that will likely keep liquidity flowing. Here's something – ahead of its current trade talks with the US, China unleashed a new stimulus package designed to boost its economy hit hard by the tariffs impact. The package includes liquidity injection and reducing its seven-day reverse repo rate.

• The next Consumer Price Index (CPI) data in the US is imminent. The previous CPI print came in lower than expected, and, because oil prices collapsed in April thanks to the increase in production from OPEC, this one has every chance to turn out lower still, which could help add positive fuel to any good news we're possibly continuing to receive out of the US-China trade powwow.

• The Trump admin's Strategic Bitcoin Reserve and Digital Asset Stockpile is still on the table and being nutted out in the background. In fact, further details were supposed to have been announced already. Cardano (ADA), Solana (SOL) and XRP will all supposedly be included in the stockpiling.

• Coinbase has agreed to buy Dubai-based crypto derivatives platform Deribit for $2.9 BILLION, with the deal set to be completed by the end of the year. It's the biggest acquisition deal in the global crypto market's history. Do you think that'd be happening in a bear market? (Unless it's a top signal… shhh, don't jinx it.) Derebit, by the way is the world's biggest trading platform for Bitcoin options.

• Ethereum received a significant upgrade on May 7 with its long-awaited Pectra update. This might've flown a little under the radar broadly, but some anticipation for it may well have contributed to the number two crypto's recent surge. The upgrade gives the blockchain bigger staking limits, bigger blobs (larger amounts of data storage off chain) and smarter wallets.

• And… per Binance… "April was a positive month for US crypto regulation – marked by landmark acts and executive orders, including the nullification of the IRS’s digital asset reporting obligations for DeFi platforms. Furthermore, .S bank regulators eased restrictions on bank crypto activities, which means banks no longer have to notify the FED about such activities. Together, these developments indicate a clear trend toward the mainstream adoption and deeper integration of digital assets into the traditional financial system."

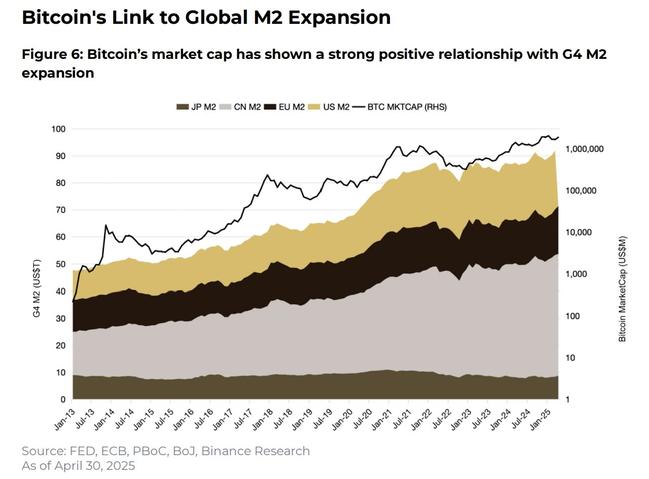

• Then there's Bitcoin's tie-in/correlation with the global M2 money supply of the G4 economies, which has been showing a steady long-growth trend.

Per Binance again, "Bitcoin’s market cap has shown a strong positive relationship with the G4 M2 expansion. Major surges in Bitcoin’s value have often coincided with periods of sustained growth in G4 M2. This relationship is supported by quantitative evidence: the 24-month rolling correlation coefficient between G4 M2 and Bitcoin’s market cap remains firmly positive, currently standing at 0.79, indicating a strong directional alignment."

"Looking ahead," reads the Binance report, "with the U.S. in a rate-cutting cycle and Quantitative Tapering (QT) gradually halting, G4 M2 could continue setting new records over the next one to two years. If historical patterns hold, further monetary expansion may sustain a favourable macro backdrop for the broader cryptocurrency market."

One more thing

This…

JUST IN: Standard Chartered apologises for $120,000 Bitcoin prediction for being "too low".

SEND IT!

— Bitcoin Archive (@BTC_Archive) May 8, 2025

Now that Bitcoin has hit six figures again, seemingly breaking out of its accumulation phase, Standard Chartered analyst Geoffrey Kendrick has issued an apology and notable change on his Bitcoin outlook, acknowledging that the cryptocurrency’s recent surge had surpassed his expectations.

Essentially, he's now saying that US$120k by end of Q2 simply isn't bullish enough, with a fresh target of around US$200k by year's end.

Stranger things have most definitely happened as we well know – many of them within the past six months.

Binance Australia sponsored this article. Nothing in this article should be construed as financial advice. At the time of writing, the author held Bitcoin and a handful of other cryptocurrencies.

Originally published as Mooners and Shakers: Sell in May and go away? Not so fast… Bitcoin’s stirring again