Lunch Wrap: Bulls back in control after US-China truce; tech, commodities rally

For investors, this truce between the US and China is a shot of adrenaline, giving sectors like tech and commodities room to breathe.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX jumps as US-China call a truce

Wall Street roars back, Big Tech surges

Commodities rally as iron ore jumps back above US$100

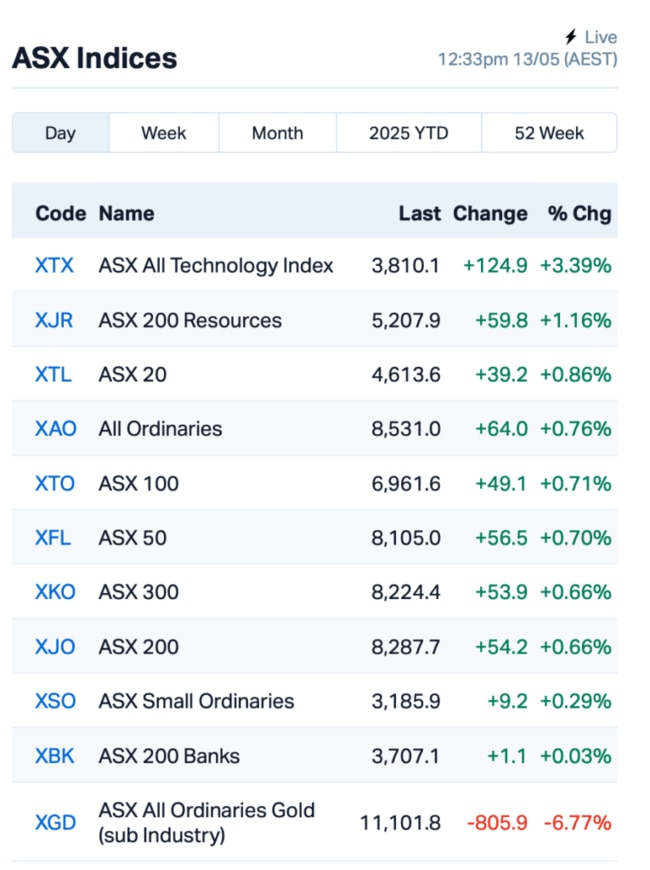

The ASX came charging out of the paddock this morning, up by 0.6% at lunch time AEST, after the US and China finally decided to play nice, at least for now.

President Trump and China agreed to hit the brakes on their trade war, slashing tariffs for the next 90 days.

US tariffs on Chinese exports got chopped down to 30% from a brutal 145%, while China dropped its own duties to 10%.

It’s a ceasefire, not a treaty, but it was enough to get markets popping.

Wall Street was all smiles overnight, with the S&P 500 jumping 3% and the tech-heavy Nasdaq sprinting back into bull territory, up by 4%.

Big Tech came out swinging, with Amazon and Meta ripping 8% higher.

Commodities, though, were the main winners.

Iron ore stormed back above US$100/t for the first time since early April. With tariffs eased, Chinese demand is expected to stabilise, breathing life back into a market that had been gasping for air.

Oil prices climbed 1.5%, with the WTI contract trading now at US$61.83 a barrel. The rally also swept up copper, European natural gas, soybeans, you name it.

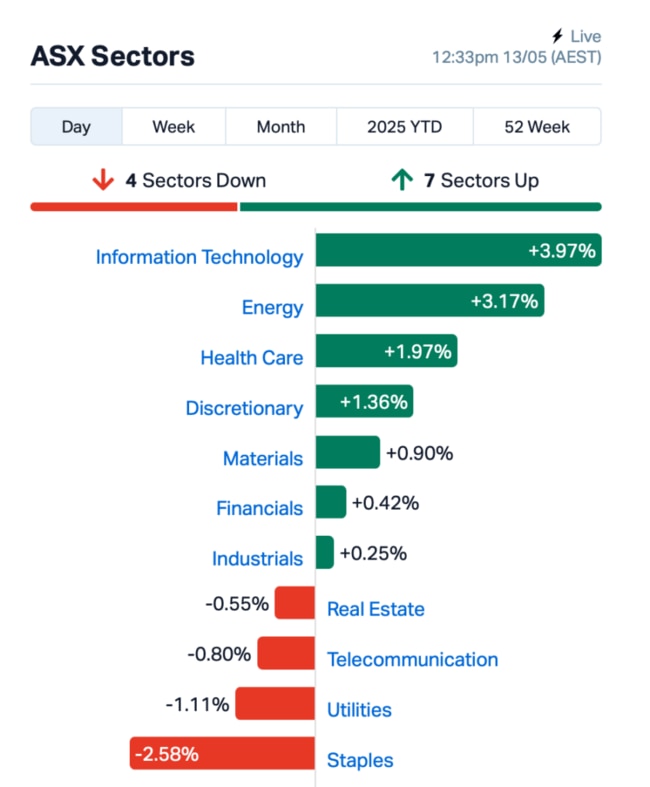

Back to the ASX, tech and energy sectors led from the front.

WiseTech Global (ASX:WTC) shot up 7%, while Woodside Energy Group (ASX:WDS) climbed more than 4%, building on Monday’s gains.

But it wasn’t pretty for ASX gold stocks today after spot gold tumbled over US$100 to US$3,224.65.

The large cap standout this morning was Life360 (ASX:360), which skyrocketed 16% after a blowout in new monthly users sent its Q1 revenue soaring 32%. The stock was the top performer on the ASX200 index.

Ampol has sold off its retail electricity business in NZ to Meridian (ASX:MEZ), and offloaded its Australian assets to AGL Energy (ASX:AGL).

Ampol expects to receive pre-tax proceeds of approximately $65 million from these transactions. The company said it was all part of its push into EV charging and renewables. Ampol shares rose 1%.

Pharma stocks, meanwhile, rebounded this morning after Trump yesterday hinted at an executive order to cut US prescription prices.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 13 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AMS | Atomos | 0.01 | 50% | 511,865 | $4,860,074 |

| JAV | Javelin Minerals Ltd | 0.00 | 50% | 3,888,015 | $12,092,298 |

| GGE | Grand Gulf Energy | 0.00 | 33% | 25,506,730 | $8,401,161 |

| ENV | Enova Mining Limited | 0.01 | 29% | 4,367,887 | $9,894,505 |

| PHO | Phosco Ltd | 0.08 | 26% | 712,692 | $28,929,216 |

| BKT | Black Rock Mining | 0.03 | 25% | 5,878,305 | $35,266,557 |

| IAM | Income Asset | 0.03 | 24% | 486,919 | $19,548,287 |

| IFG | Infocusgroup Hldltd | 0.01 | 20% | 911,395 | $1,312,134 |

| VRC | Volt Resources Ltd | 0.01 | 20% | 125,608 | $23,423,890 |

| AUA | Audeara | 0.03 | 19% | 245,617 | $4,678,294 |

| WWG | Wisewaygroupltd | 0.17 | 18% | 92,326 | $23,429,447 |

| SRK | Strike Resources | 0.04 | 18% | 1,082,808 | $9,647,500 |

| WNX | Wellnex Life Ltd | 0.31 | 17% | 58,791 | $17,452,598 |

| NIM | Nimyresourceslimited | 0.10 | 17% | 3,871,059 | $16,858,356 |

| AHK | Ark Mines Limited | 0.25 | 17% | 211,109 | $13,893,747 |

| BNL | Blue Star Helium Ltd | 0.01 | 17% | 983,882 | $16,169,312 |

| OVT | Ovanti Limited | 0.00 | 17% | 766,699 | $8,380,545 |

| BCC | Beam Communications | 0.12 | 15% | 31,189 | $8,642,192 |

| AAU | Antilles Gold Ltd | 0.00 | 14% | 3,034,907 | $7,442,287 |

| ADR | Adherium Ltd | 0.01 | 14% | 10,000 | $5,307,296 |

| AEV | Avenira Limited | 0.01 | 14% | 5,000 | $22,243,508 |

| PIM | Pinnacleminerals | 0.04 | 14% | 5,728 | $1,591,216 |

| ORP | Orpheus Uranium Ltd | 0.03 | 13% | 22,967 | $8,458,114 |

| CP8 | Canphosphateltd | 0.02 | 13% | 401,197 | $4,908,168 |

Grand Gulf Energy (ASX:GGE) has struck a deal with Sage Potash to team up on exploring the Red Helium project in Utah. The two signed a non-binding MoU to share the costs of a 3D seismic survey targeting helium and potash. The partnership is set to speed up development at the Red Helium site, where Grand Gulf’s Jesse-1A well has already shown promising helium reserves.

Health and wellness company Wellnex Life (ASX:WNX) posted a solid trading update for the first four months of 2025, with revenue soaring 46% to $8 million compared to the pcp. Gross margins also climbed 55%. April alone saw a massive 75% surge in revenue. Wellnex says its outlook is bright, with plans to expand its brands across Australia and push into the UK and Europe by FY26.

Beam Communications (ASX:BCC) is set to pocket an extra $4.1 million from its settlement with Roadpost, separate from the sale of its 50% stake in Zoleo Inc. The payout includes $3.9 million for early royalty payments and $238k for selling remaining ZOLEO devices. Beam has been in a joint venture with Roadpost for Zoleo Inc, a company known for its satellite communication devices.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 13 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.00 | -50% | 1,017,042 | $8,219,762 |

| EEL | Enrg Elements Ltd | 0.00 | -33% | 5,002,500 | $4,880,668 |

| VML | Vital Metals Limited | 0.00 | -33% | 53,126 | $17,685,201 |

| BTN | Butn Limited | 0.11 | -25% | 41,910 | $39,108,240 |

| CMG | Criticalmineralgrp | 0.10 | -23% | 49,787 | $9,364,861 |

| GLA | Gladiator Resources | 0.01 | -22% | 41,886 | $6,824,671 |

| CCM | Cadoux Limited | 0.04 | -22% | 231,763 | $16,691,292 |

| FBR | FBR Ltd | 0.01 | -21% | 7,130,448 | $39,826,165 |

| RGT | Argent Biopharma Ltd | 0.12 | -20% | 9,725 | $10,827,473 |

| ASR | Asra Minerals Ltd | 0.00 | -20% | 7,493,499 | $6,765,117 |

| CAV | Carnavale Resources | 0.00 | -20% | 426,448 | $20,451,092 |

| SHP | South Harz Potash | 0.00 | -20% | 3,507,546 | $5,412,894 |

| TFL | Tasfoods Ltd | 0.00 | -20% | 100,000 | $2,185,478 |

| AAJ | Aruma Resources Ltd | 0.01 | -18% | 2,176,561 | $3,053,300 |

| WEC | White Energy Company | 0.03 | -18% | 17,741 | $10,595,077 |

| LKY | Locksleyresources | 0.03 | -17% | 6,310,260 | $6,013,333 |

| EAT | Entertainment | 0.01 | -17% | 156,419 | $7,852,716 |

| SHE | Stonehorse Energy Lt | 0.01 | -17% | 72,500 | $4,106,610 |

| MIO | Macarthur Minerals | 0.02 | -15% | 139,623 | $3,993,310 |

| AJL | AJ Lucas Group | 0.01 | -14% | 794,631 | $9,630,107 |

| ARV | Artemis Resources | 0.01 | -14% | 9,771,716 | $17,699,705 |

| GLL | Galilee Energy Ltd | 0.01 | -14% | 300,000 | $4,833,683 |

| HHR | Hartshead Resources | 0.01 | -14% | 487,804 | $19,660,775 |

| LMG | Latrobe Magnesium | 0.01 | -14% | 4,871,100 | $36,744,541 |

IN CASE YOU MISSED IT

DY6 Metals (ASX:DY6) has netted just over $261,000 in a research and development tax rebate from the ATO. DY6 now has about $1.95m in the bank, which will drive exploration at its Machinga heavy rare earth and Tundulu rare earth and phosphate projects.

Impact Minerals (ASX:IPT) raised another $881,000 under a shortfall offer for a recent renounceable rights issue, and received a final payment of $350,000 from the sale of its subsidiary Blackridge Exploration Pty Ltd, which holds the Blackridge project in Queensland. Impact recently acquired a 50% stake in Alluminous, owner of HiPurA, with assets and intellectual property IPT considers a bolt-on opportunity for its Lake Hope high purity alumina project.

Legacy Minerals (ASX:LGM) has applied for an exploration licence over one of Australia’s largest nickel deposits. Watch StockTake for more.

At Stockhead, we tell it like it is. While DY6 Metals and are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Bulls back in control after US-China truce; tech, commodities rally