Lunch Wrap: ASX jumps as US and China break the ice; South32 to get new CEO

The ASX’s off to a flyer with US-China talks sparking some hope. Meanwhile Woolies has slashed prices to claw back market share.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX kicks off strong as US-China talks spark hope

Woolies slashes prices; South32 shakes up the top

Energy and real estate lead the charge

The ASX kicked off the week with a spring in its step, up by 0.3% at lunch time AEST, as traders heard some encouraging news from the US-China trade talks.

US futures set the tone this morning, with the S&P 500 and Nasdaq 100 futures gaining over 1%.

The rally is on the back of what’s being called ‘substantial progress’, where Washington and Beijing finally sat down for a proper chinwag in Geneva.

US Trade Rep and negotiator Jamieson Greer was bullish, saying, “the differences between the two nations were not as large as maybe thought.”

Chinese Vice Commerce Minister Li Chenggang added to the friendly vibes, saying,”As we say back in China, if the dishes are delicious, the timing doesn’t matter.”

Tensions may still simmer under the surface, with US tariffs Chinese goods still towering at 145%.

But the talks laid the groundwork for more wheeling and dealing, with both sides locking in a plan to keep the conversation rolling.

The Aussie dollar and the offshore Chinese yuan edged up this morning on the news, while gold dipped.

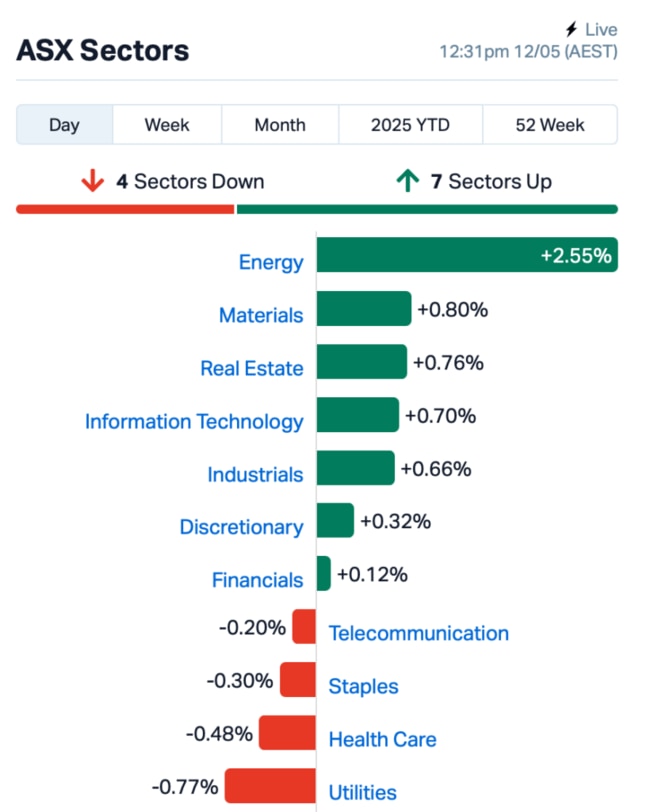

On the ASX, seven out of 11 sectors found themselves flashing green, with energy and real estate leading the charge.

Santos (ASX:STO) climbed 3.3%, while Woodside Energy Group (ASX:WDS) rallied by 2.3%.

Woolworths (ASX:WOW) had a rougher ride, dipping 1% after announcing it would slash prices on nearly 400 popular products by an average of 10%.

It’s a strategic move to claw back market share from Coles and Aldi, said experts.

“This isn’t just a short-term promotion. It’s about lower shelf prices on the products we know customers regularly shop for,” said Woolies’ CEO, Amanda Bardwell.

Still in the large caps space, diversified miner South32 (ASX:S32) also had a bit of news to share. Its long-standing boss, Graham Kerr, is set to step down next year after a decade at the helm.

Stepping up to the plate will be Matthew Daley, who’s currently the Technical and Operations Director over at Anglo American. S32 shares rallied 2%.

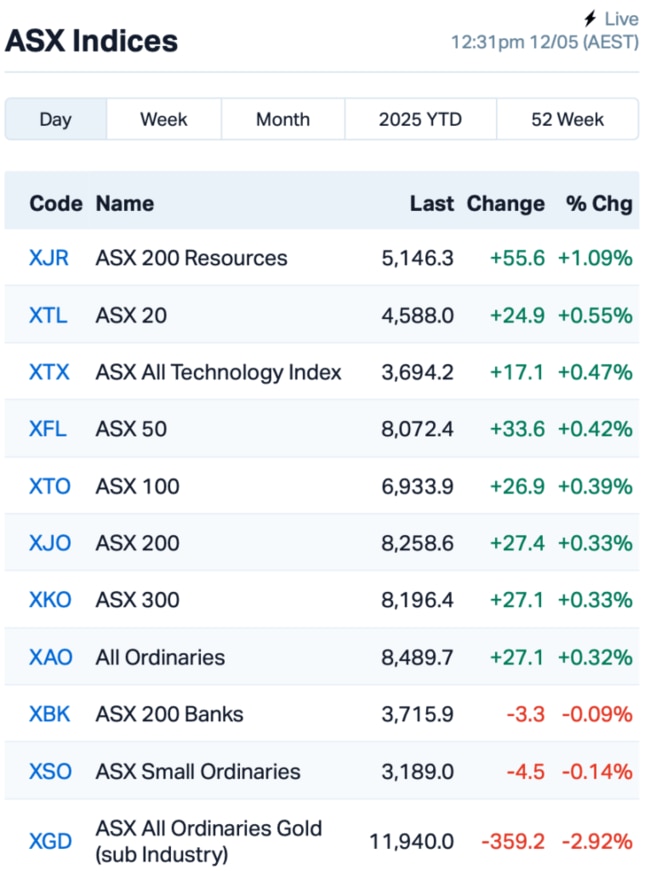

This is where the ASX stood at around 12:30pm AEST:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 12 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.029 | 71% | 37,590,441 | $3,993,281 |

| QXR | Qx Resources Limited | 0.005 | 43% | 3,839,576 | $4,586,151 |

| CRR | Critical Resources | 0.004 | 33% | 3,150,111 | $7,842,664 |

| ADG | Adelong Gold Limited | 0.009 | 21% | 49,300,342 | $9,782,403 |

| KRR | King River Resources | 0.009 | 21% | 563,868 | $10,697,545 |

| EVS | Envirosuite Ltd | 0.086 | 21% | 23,731,500 | $102,857,962 |

| PKD | Parkd Ltd | 0.035 | 21% | 56,416 | $3,016,403 |

| ATH | Alterity Therap Ltd | 0.012 | 20% | 19,807,854 | $91,273,707 |

| BKT | Black Rock Mining | 0.024 | 20% | 6,857,220 | $29,388,798 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 2,000,000 | $12,497,745 |

| EM2 | Eagle Mountain | 0.006 | 20% | 417,945 | $5,675,186 |

| MSG | Mcs Services Limited | 0.006 | 20% | 2,314,474 | $990,498 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 216,666 | $23,423,890 |

| WBE | Whitebark Energy | 0.006 | 20% | 419,150 | $1,999,534 |

| G88 | Golden Mile Res Ltd | 0.013 | 18% | 4,930,183 | $5,986,726 |

| VR1 | Vection Technologies | 0.018 | 17% | 10,726,410 | $26,508,328 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 979,048 | $16,169,312 |

| CUF | Cufe Ltd | 0.007 | 17% | 2,699,879 | $8,079,449 |

| DTM | Dart Mining NL | 0.004 | 17% | 121 | $3,594,167 |

| FBR | FBR Ltd | 0.007 | 17% | 7,002,553 | $33,813,791 |

| HHR | Hartshead Resources | 0.007 | 17% | 900,000 | $16,852,093 |

| IPT | Impact Minerals | 0.007 | 17% | 2,584,469 | $22,215,980 |

| OVT | Ovanti Limited | 0.004 | 17% | 1,334,496 | $8,380,545 |

| HCT | Holista CollTech Ltd | 0.050 | 16% | 963,815 | $12,287,969 |

Manhattan Corp (ASX:MHC) said it was snapping up the Hook Lake project in Nunavut, Canada, home to the high-grade Turquetil Lake gold deposit and a bunch of other promising gold and VMS (volcanogenic massive sulphide) prospects. The project hasn’t been touched since 1988, when a “foreign” estimate (not JORC-compliant) clocked in at 3.4 million tonnes grading 2.38g/t for around 285,000 ounces of gold. The project’s sitting in a prime spot in Nunavut’s Greenstone Belt, not far from Agnico Eagle’s massive Meladine Mine.

Critical Resources (ASX:CRR) has appointed Tim Wither as its new CEO, starting May 14. With over 20 years in the mining game, Wither has been at the helm of projects across Australia, India, Africa, and South America, even leading Maximus Resources through a $31 million takeover by Astral Resources.

Alterity Therapeutics (ASX:ATH) took the stage at the 2025 International MSA Congress, highlighting its progress in fighting Multiple System Atrophy (MSA). Its Phase 2 trial of ATH434 has shown strong results, cutting disease severity and improving key symptoms. Alterity also introduced the MSA Atrophy Index (MSAai), a new imaging tool to better track brain volume changes in MSA patients.

Black Rock Mining (ASX:BKT) has signed two big agreements with Tanzania’s TANESCO for its Mahenge graphite project. Faru, its 84%-owned subsidiary, will build a new 220kV power line connecting Mahenge to hydro-powered electricity. Faru will get back the construction costs from TANESCO over four years of mine production. On top of that, the Tanzanian Mining Commission has lifted a default notice on Mahenge’s licence, clearing the way for Black Rock to get things moving.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 12 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LSR | Lodestar Minerals | 0.010 | -44% | 15,092,841 | $5,731,629 |

| SRH | Saferoads Holdings | 0.110 | -37% | 288,257 | $7,648,446 |

| ANR | Anatara Ls Ltd | 0.004 | -33% | 1,658,032 | $1,280,302 |

| VML | Vital Metals Limited | 0.002 | -33% | 30,000 | $17,685,201 |

| FGH | Foresta Group | 0.008 | -27% | 1,913,741 | $29,181,971 |

| DY6 | Dy6Metalsltd | 0.100 | -26% | 1,613,762 | $7,902,337 |

| 1AD | Adalta Limited | 0.003 | -25% | 313,019 | $2,572,891 |

| GGE | Grand Gulf Energy | 0.003 | -25% | 1,923,593 | $11,201,549 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 1,026,089 | $9,591,960 |

| ENV | Enova Mining Limited | 0.007 | -22% | 10,040,286 | $12,721,507 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 2,436,170 | $4,349,768 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 113,145 | $9,086,764 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 31,642,241 | $15,115,373 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1,038,000 | $1,946,223 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 511,000 | $7,480,156 |

| TASDA | Tasman Resources Ltd | 0.016 | -20% | 20,003 | $3,220,998 |

| VHM | Vhmlimited | 0.265 | -18% | 685,804 | $71,223,734 |

| AUG | Augustus Minerals | 0.027 | -18% | 1,374,054 | $3,933,317 |

| ERL | Empire Resources | 0.005 | -17% | 557,132 | $8,903,479 |

| MEM | Memphasys Ltd | 0.005 | -17% | 333,923 | $11,901,589 |

| MTB | Mount Burgess Mining | 0.003 | -17% | 324,577 | $1,055,108 |

| BOT | Botanix Pharma Ltd | 0.390 | -16% | 16,593,009 | $908,582,315 |

| PLN | Pioneer Lithium | 0.110 | -15% | 1 | $5,533,019 |

| ASE | Astute Metals NL | 0.023 | -15% | 100,000 | $16,689,787 |

IN CASE YOU MISSED IT

Maronan Metals (ASX:MMA) has tapped mining engineer Matthew Hine as non-executive director, effective today. Hine has 20 years’ operational and technical experience spanning underground and open pit operations across Australia, New Zealand and Europe.

He’s previously held senior roles as chief operating officer at Adriatic Metals (ASX:ADT), general manager for OceanaGold (ASX:OGC) Waihi and Macraes operations and manager mining at Evolution Mining (ASX:EVN) Mungari operation.

In the path to mine approval for the Tumblegum South gold project in WA, Star Minerals (ASX:SMS) has appointed ResourcesWA as a consultant. They will assist with all aspects of the mine approval process, including environmental.

“At this time of robust gold prices, it is fantastic to have a resource on granted mining tenure that we can progress toward production,” Star Minerals MD Ashley Jones said. “Star Minerals’ goal is to transition to gold producer in early 2026, generating cash flows.”

At Stockhead, we tell it like it is. While Maronan Metals and Star Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX jumps as US and China break the ice; South32 to get new CEO