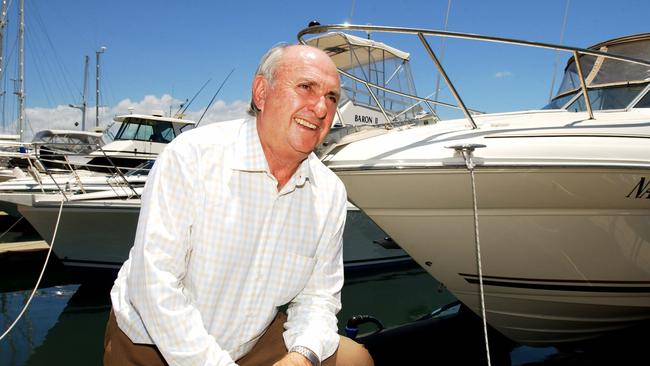

Ex-City Pacific boss Phil Sullivan declares bankruptcy

GOLD Coast businessman, who once headed up a fund worth $1 billion, has declared bankruptcy. The fund still owes money to 11,000 unit holders, many elderly investors looking for retirement income.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

GOLD Coast businessman Phil Sullivan — the founder of collapsed property developer City Pacific — has declared himself bankrupt with debts of $78 million.

The National Personal Insolvency Index lists Mr Sullivan’s date of bankruptcy as June 18, with David Clout appointed as trustee.

Mr Sullivan headed up City Pacific, which, at its peak, had a market capitalisation of nearly $1 billion.

His own personal wealth was once valued at more than $300 million, making him one of Queensland’s richest men.

The fund, with 11,000 unit holders — many of them elderly investors looking for retirement income — loaned millions to property developments on the Gold Coast including Mariner’s Cove and the Surfers Paradise site where Jewel is being built.

It collapsed in 2009 in the wake of the Global Financial Crisis, shortly after funds management company Balmain Trilogy wrested control from City Pacific.

Balmain has since pursued Mr Sullivan in the courts over management of the funds.

Balmain Trilogy won a major court judgment against Mr Sullivan almost three years ago but appeals played out until the High Court rejected an application to hear the case in February.

Balmain Trilogy then threatened to chase Mr Sullivan and other former executives of City Pacific into bankruptcy if they did not pay more than $70 million owed to investors.

Mr Sullivan yesterday told News Corp that $37.5m of the $73.5m owed was due to losses on an advance to Gold Coast developer and former tycoon Craig Gore, for a development site at Canungra.

GET FULL DIGITAL ACCESS FOR 50C A DAY

The balance of the money, some $37.5 million, was interest accrued on the Gore loan incurred since City Pacific collapsed.

He said a further $4.5m is owed to entities associated with Mr Sullivan’s wife, Tuija, incurred through legal costs fighting Balmain Trilogy’s claim against the businessman.

Mr Sullivan said he has $13,777.50 in cash held in three bank accounts with Westpac.

He is also the registered owner of a property in Broadbeach Waters valued at $785,000, and is the owner of more than 10 million units in the mortgage fund now worth just $214,521. He listed his golf clubs as worth $250, fishing gear worth $250 and a $5000 wristwatch as assets.

Mr Sullivan also has a stable of racehorses, including Blue Book, which won $229,575 in his first three starts at Doomben.

Mr Sullivan lashed out at the returns that unit holders received from Balmain Trilogy.

“It beggars belief that the former City Pacific directors are found responsible to compensate the Pacific First Mortgage Fund for $73.5m on a single loan (asset) while the replacement responsible entity, Trilogy Funds Management, is permitted to repay unit holders less than an average $3.45m on sale of each loan over the entire 40 loan portfolio,” Mr Sullivan said yesterday.

Trilogy deputy executive chairman Rodger Bacon said the final outcome for unit holders is not yet clear.

“Our only duty in that regard is to act in the interest of the unit holders. This must be taken to a logical end and hopefully that is not too far away now.”