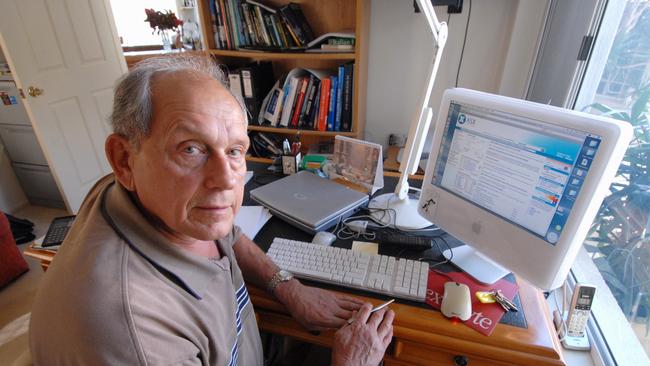

HIS is a face of heartbreak and lost opportunities — and Ray LeGassick’s story is just one of 11,000 heartbreaks in the wake of a billion-dollar company downfall which is unresolved after a decade.

Investors stung by Gold Coast investment company City Pacific are still waiting for their money, as former CEO Phil Sullivan fights numerous court orders to avoid repaying $70 million over a loan to failed developer Craig Gore.

The fund controlled by City Pacific loaned hundreds of millions of investor dollars to developers who were unable to pay them and also financed its own related companies and borrowed heavily from the Commonwealth Bank.

Remarkably, despite evidence of unusual transactions, pleas from the liquidator and allegations of illegal activities, the government’s corporate regulator, ASIC, has never investigated.

As the developer loans defaulted, the fund took possession of about 40 assets, many of them now the subject of high-profile projects and proposals, including Jewel, the Songcheng theme park at Nerang and Mariners Cove.

As City Pacific imploded, new fund manager Balmain Trilogy took over and has since sold all the assets, returning some of the proceeds to investors — although this week it wouldn’t say how much.

The fund was once worth almost $1 billion but now it’s under $20 million and being slowly eroded by management fees and unrelenting legal actions.

When City Pacific failed, the mortgage fund was worth $630 million, of which $140 million has been divided among the 11,000 investors.

The company’s former CEO Phil Sullivan says he can’t pay the $70m he’s twice been ordered by courts to cough up — but he can afford to drive luxury cars and live in a mansion, own and race horses and donate to politicians.

Today, we examine a decade of drama, accusations and pain cause by the collapse of City Pacific.

The investors:

RAY LeGassick and his family worked seven-day weeks for more than 20 years, building their Broadbeach service station into a thriving family business.

In 2008, when he was 67 and working on cars had become too much for him, Mr LeGassick sold the business, netting enough to ensure he and his wife Judy could live comfortably in retirement.

The mechanic is still proud of how his family built it into a successful business with loyal customers — including Mr Sullivan, who had an account with them.

“We were one of the last on the Gold Coast to give driveway service.

“By the time I retired, I’d worked 40 years for BP.

“It was a seven-day a week job and we lived around the corner from the service station, so we never really left the place.

“My body said `that’s enough, get out of here or you’ll kark it’.”

Before karking it, the LeGassicks hoped to travel and enjoy their twilight years after a long lifetime’s work.

Seduced by a flashy office and breathtaking sales pitch, the family trusted the $1.4 million proceeds of the sale to City Pacific.

It was a decision that saw them lose almost everything, sending them into the Centrelink office, with Mr LeGassick forced to keep working odd jobs on cars in people’s garages to keep food on the table.

They put the family’s home on the market, which was still depressed by the GFC, and while they waited to sell, they had no income and were knocked back for financial assistance.

“When it crashed, I had to go and look for a job — but I was too old.

“The only thing that saved us was that I never had a debt on the house.

“It nearly broke our 40-year marriage — we ended up in a great mess.”

Mr LeGassick, now 77, said he felt like he’d been robbed of 10 precious years of his life.

“We worked that service station pretty hard my wife and I, and my eldest daughter — it was a real family affair and a great service station.

“My wife’s not too good now, healthwise. I think it would have been different if we had been free and easy.

“The best outcome I would think is to get (Mr Sullivan’s) assets and sell them and divide them among all the investors.”

“There are some terrible stories of some investors — it would have killed some of them,” Mr LeGassick said.

“When we lived at Broadbeach, we used to see him all the time — they drove the best cars, drank the best wine, bought the best horses — nothing’s altered with him.”

The projects:

THE tendrils of City Pacific were curled around some of the Gold Coast’s best-known developments — many of which have since become the most lucrative in the city’s history.

They include the land where the $900m Jewel project is now under way.

The land, with its 116m of stunning beachfront, was sold by the new fund managers to Ridong for $81 million in August 2009.

Ridong then sold a 55 per cent share to Wanda for more than what they’d paid for the entire site, clearing their debt while retaining almost half the upside.

It was a similar show with the same players at Carrara, where a site on Nerang-Broadbeach Rd was bought by the Wanda-Ridong joint venture for $20m, and onsold to Chinese company Songcheng two years for $55 million.

Investors have watched as the massive gains rolled to Ridong, stung also by the fact both sales were financed by the Pacific First Mortgage Fund — aka their money.

Those were two of 40 assets owned by the fund, managed by City Pacific and sold by Balmain Trilogy over six years to 2015.

Other sites included Mariners Cove, now owned by Sunland; a mammoth Townsville Ocean Terminal and Breakwater Cove project; the Gold Coast International Hotel and Paradise Resort and housing estates at Hope Island and Pimpama.

Also on the books were a $120m high-rise at Labrador; and the Greenmount Beach Resort — also now being developed by Sunland.

In Victoria, City Pacific was developing the $630 million Martha Cove project, on the Mornington Peninsula at Safety Beach, before it went into receivership.

The former boss:

CITY Pacific was founded in 1997 by former bankrupt Philip Keith Sullivan, whose Gold Coast development company collapsed in the 1980s.

City Pacific managed the Pacific First Mortgage Fund, which loaned money from everyday investors to property developers.

Its value grew swiftly to $920 million by 2007, when City Pacific was top of the town — sponsoring high-profile horse races at Doomben and Moonee Valley, co-sponsoring golf’s Queensland Open at Gainsborough Greens and enjoying a sharemarket capitalisation of $580 million.

But by 2009, the value of the fund controlled by Mr Sullivan’s company had fallen to $630 million.

Unit holder funds — mostly from elderly investors — had been frozen a year earlier as developers, including fellow former rich lister Craig Gore, defaulted on repayments.

City Pacific was declared illiquid in 2008 and placed into receivership.

Two courts have found Mr Sullivan and former colleagues liable for the loss on the Gore loan and interest accrued since for a total of $70 million — but the men are now seeking a high court challenge to avoid paying it.

The 74-year-old told the Gold Coast Bulletin he can’t afford to pay — but he has been able to afford upkeep of a number of race horses and was able to donate $2000 to the LNP last September.

His family has also managed a high-end property buying spree, purchasing 11 properties worth $11.7 million in the past eight months.

Their assets are spread across a wide range of companies — most directed by Mr Sullivan’s son Grant, who lives with his parents in the mansion.

The court battles:

PROLONGING the pain for investors, and whittling away at the remaining funds, has been a volley of court actions, one of which has made its way to the highest court in the country.

The case was first brought by Balmain Trilogy over the loan to Mr Gore, who defaulted in 2008.

If he is not granted an appeal, Mr Sullivan plans a new action against BT, alleging the new fund manager has questions to answer over the disposal of fund assets and the proportion of proceeds returned to investors.

Professional companies who worked for City Pacific have also wound up in court, and have been forced to pay for their roles in the mess.

SUBSCRIBE TO THE GOLD COAST BULLETIN

Among them was the Gold Coast office of law firm Minter Ellison, which BT successfully sued for $13.5 million over a loss-making loan for the purchase of Mariner’s Cove — a property which has made the headlines more recently under the ownership of Sunland Group.

In 2010, three entities related to a company named Kosho Pty Ltd started Supreme Court proceedings against the new fund managers, chasing up to $81 million and claiming they’d breached a finance facility. The proceedings and all subsequent appeals were dismissed.

BT also launched action against accounting firm KPMG, who audited financial statements for the mortgage fund.

In March last year they won a settlement on behalf of investors that was deemed confidential,

but the fund’s financial statements reveal $5.5 million income from legal settlements.

The fund manager:

In 2009, a joint venture of the Balmain and Trilogy investment groups won control of the fund, then worth about $630 million, and became its new managers.

In November of that year the fund was worth $521.1 million — down 46 per cent from $969.7 million the previous year.

Another $108.9 million in writedowns took the total amount of diminished value to $448.9 million over the year to June 30, 2010.

The managers faced repeated attempts by Mr Sullivan to regain control of the fund, which had launched legal action against the former CEO and others. The attempts were all unsuccessful.

By December 31, 2012 the fund had $114.48 million left in total assets and in June 2013 they were $97.83 million.

As of June 30 last year, the scheme’s assets totalled $19.11 million.

A report to unit holders said BT hoped to distribute the remaining net funds to investors once the legal actions had ceased.

Balmain Trilogy initially pledged to repay $295 million to investors by October 2012, and to split another $35 million pro rata payment between them in October 2010.

They appear to have delivered less than half that — although they declined to comment this week.

The fund declined to say whether they’d delivered on the pledge, or the total income the fund had received from selling the 40 assets.

Company representatives were unavailable by phone and responded to 10 emailed questions about their handling of the funds by directing the Gold Coast Bulletin to their blog page.

“It’s Trilogy Fund’s view that your questions below can all be covered in the information publicly available on the website,” head of marketing Elizabeth Flynn said in an email.

The financial statements available on the site show the 11,000 investors had shared $140.6 million in capital payments in the five financial years from 2011-16, but received no payments last financial year as legal actions continued.

The regulator:

IN 2009, an auditor’s report by KPMG identified alleged breaches of the Corporations Act and the fund’s compliance plan by City Pacific. It was reported at the time that ASIC had been alerted to a related party getting a benefit from a transaction and City Pacific’s failure to maintain sufficient capital.

In 2010, City Pacific’s liquidators uncovered a raft of unusual transactions within the group, including an $11m transfer to a Queensland property developer.

Liquidator Andrew Wily applied to ASIC for an investigation — but it was denied.

“We were only seeking $50,000 to $100,000 to fund an investigation, which is peanuts when you look at the hundreds of thousands of investors’ funds that have been lost,” he told The Australian at the time.

“ASIC told us in writing it doesn’t think the issue is of sufficient public significance to warrant an investigation as it doesn’t offer enough `deterrent value’. I find that amazing”.

ASIC acknowledged receiving 10 questions from the Bulletin on Wednesday, but then stopped replying to emails and phone calls about City Pacific.

Quizzed this month, Mr Sullivan confirmed he had been questioned by the regulator, but would not reveal the nature of the questions.

“They gave me a letter saying they’re not taking any action and that’s all you need to know,” he said.

The bank:

THE Commonwealth Bank loaned $240 million to City Pacific — mostly secured against developments that were also managed by City Pacific or related companies, so the investors’ fund was left to service the debt when that company went into receivership.

Because the bank held first priority mortgages to the assets, the bank was paid before the investors — many of whom had no prior knowledge of any bank loan.

In November 2009, the bank made $5.6 million from the sale of City Pacific’s headquarters to listed oil and gas explorer Icon Energy, and Trilogy announced the bank debt had been trimmed to $82.3m.

In January 2010, the CBA extended the $82 million loan until June 30, 2010 — renewable every year if the bank remained comfortable with the fund’s performance.

By June 2012, the debt was down to $19 million, and by that December it was $10 million.

In March 2013, the debt was $6.6 million. It was repaid in full in July that year.

Investor Ray LeGassick said he’d never have invested with City Pacific if he’d known they were in debt to a bank.

“Had they said at the time they’d borrowed $240 million from the Commonwealth Bank, I’d have back-pedalled,” he said.

“All the investors’ money went back into CBA.

“I’ve never been able to work out how the Commonwealth Bank did that — I never signed anything with the Commonwealth Bank and neither did any of the other investors.”

Add your comment to this story

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout

‘Good luck with that’: Legendary developer’s stark warning

More than $5bn worth of developments are coming for the Gold Coast – but experts say it’s just a drop in the ocean of what’s needed. Read our special report on the city’s deepening housing crisis.

Why locking up damaged kids just won’t work

“Children are being placed back into abusive environments with no advocacy, ending up on the streets in sexploitation, criminal gangs, and juvenile justice systems because they do not have a voice,” writes Dr Cher McGillivray