Gold Coast businessman Phil Sullivan and colleagues lose $70m Federal appeal in City Pacific case

THE Gold Coast businessmen behind a failed mortgage fund that left more than 11,000 investors out of pocket will be forced to shell out more than $65 million after losing a Federal Court appeal.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

THE Gold Coast businessmen behind a failed mortgage fund that left more than 11,000 investors out of pocket will be forced to shell out more than $65 million after losing a Federal Court appeal.

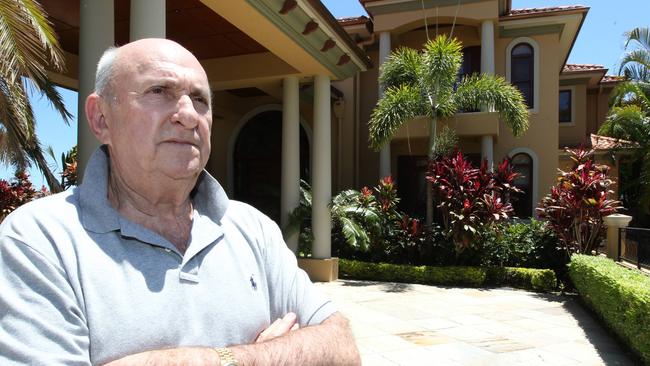

Phil Sullivan and three of his former colleagues appealed a 2015 court ruling that ordered them to repay the mostly senior investors in City Pacific, which collapsed in 2009 and is now known as Pacific First Mortgage Fund.

The fund loaned millions of dollars for property developments, mostly based on the Gold Coast, and was once valued at $700 million.

The court found that Sullivan and three of his associates improperly loaned failed businessman Craig Gore nearly $60 million for a proposed development at Canungra.

The fund has been frozen since 2009, devastating its mostly-elderly investors.

In his ruling, Federal Court judge Wigney savaged South Africa-born Sullivan, 73, as “a man prepared to lie about his knowledge of, and involvement in, key events so as to extricate himself from blame’’.

He ordered Sullivan and his colleague Stephen McCormick pay $62.95 million plus costs, with Thomas Swan and Ian Donaldson ordered to pay $10.57 million plus costs.

On Monday, the Federal Court dismissed their appeal and found in favour of Trilogy Funds Management, as responsible entity of the Pacific First Mortgage Fund, granting it the right to recover the funds from Sullivan and the other unsuccessful defendants.

Property records show Sullivan sold his Broadbeach Waters home for $2.7 million to his son Grant in 2013.

MORE IN TOMORROW’S GOLD COAST BULLETIN