Collapsed Bensons Property could have been insolvent as far back as July 2023

Famous for its glistening Gold Coast towers, the failed Bensons Property Group might have been insolvent as far back as 2023, a new report says.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Collapsed developer Bensons Property Group, which failed just after Christmas with 1300 apartments in the pipeline across property projects worth $1.5bn, may have shown indications of insolvency as early as July 2023, according to a new KordaMentha report.

The collapse of the high-profile apartment builder came after property sales for key projects dried up, debt mushroomed and its cash on hand dwindled.

Costs quickly accelerated. In 2019 they represented 88 per cent of revenues, but by 2024 the number expanded to a crippling 247 per cent of group revenue. By the eve of its collapse a few days after Christmas, costs as a proportion of revenue reached 363 per cent.

The developer was also forced to write down tens of millions of dollars in costs related to its Liberty One apartment project in Melbourne as a result of accelerating pressures, operational and timing delays and its own builder going into administration.

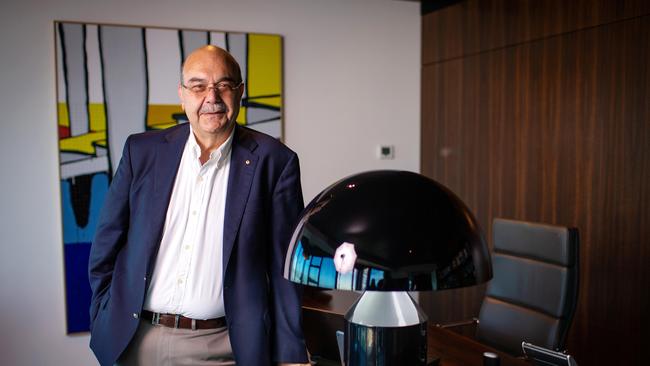

If it can be proved the directors of Bensons, including its multi-millionaire developer founder and winery owner Elias Jreissati, did not act with care and diligence when heading into possible insolvency, they could be in breach of section 180 of the Corporations Act, a report issued by administrators KordaMentha on Friday revealed.

However, Bensons directors sought “safe harbour” protection in 2023 as the spectre of insolvency emerged, potentially giving them protection. The KordaMentha report says its preliminary view is that the directors will probably be able to rely on the protection of safe harbour provisions for the period September 29, 2023 to December 20, 2024.

Bensons collapsed two days after Christmas in one of the largest property developer failures in decades, with estimated total liabilities and money owed to creditors of $813.24m.

Its creditors include builders, tradies, investors, state government revenue offices and the Jreissati family and businesses owned by the family, such as their winery in Victoria’s Yarra Valley.

Mr Jreissati, an immigrant from Lebanon who built up Bensons from scratch, is a well-known philanthropist, art collector and winery investor who made a name for himself building luxurious apartment towers.

Bensons has suffered significant financial losses since 2022 and had a working capital deficiency at each financial year-end between 2020 and 2024.

Its cash almost completely disappeared, with cash of $19.9m in 2019 diving to $700,000 in December 2024 just before its collapse into administration. At the same time, its borrowings expanded from $60.8m in 2019 to $352.6m on the eve of its failure.

The KordaMentha report – which recommends creditors vote in favour of a deed of company arrangement (DOCA) to save the developer from a painful liquidation that would wipe out most creditors – reveals Bensons only made a net operating profit in three of the past seven years.

This raised the likelihood of insolvency, which was becoming a real risk by 2023.

The company’s $1.5bn development pipeline includes a 41-level residential tower in Chevron Island, Queensland, worth $485m, and 740 apartments across suburban Melbourne, collectively valued at $452m on completion.

The directors entered safe harbour in July 2023, a form of protection under the Corporations Act which may be invoked by directors who believe their company is insolvent or at risk of insolvency.

“Our preliminary investigations suggest the company (Bensons) exhibited indicators of insolvency, and may have been insolvent, as early as 1 July 2023 and as late as 30 June 2024,” the KordaMentha report concludes.

“If this is the case, then it may be found that the directors did not act with care and diligence (a breach of Section 180 of the Corporations Act). A liquidator, if appointed, will undertake investigations in this regard. However, … directors may be able to rely on the protection of the safe harbour provisions.”

The administrators are recommending creditors support the DOCA put forward by the Jreissati family, stating that it will result in a better return to all creditors.

The DOCA includes a commitment from the founder’s family interests of more than $477m over the next three years for the recapitalisation of Bensons, including assumption of $413m in outstanding liabilities to continuing creditors, a cash component of $16.6m and procurement of key agreements for ongoing projects, including $48m from landholding counterparties.

The proposed return to creditors under the DOCA would be $414.25m, compared to the expected return in a liquidation of the company of only $625,772.81 to employee creditors only. It will also keep building workers employed and help Bensons complete its projects.

It is believed a large pool of creditors support the DOCA and will vote in favour of the deal in a week.

Meanwhile, KordaMentha has also investigated related party transactions between the Jreissati family’s Levantine Hill winery in the Yarra Valley – which is not part of the voluntary administration – and his collapsed property group, but found no evidence of uncommercial or unusual business transactions.

The Levantine Hill winery was used for boutique sales events for wealthy clients and potential apartment purchases, with each Bensons property development having a wine and hospitality budget.

Three years ago Levantine Hill released a limited edition $800 bottle of wine called Optume which, at the time, was the most expensive red wine produced in Victoria. It was part of a push by Mr Jreissati to elevate Levantine Hill to a luxury wine producer.

The KordaMentha report says Bensons’ management team believe the winery and gifts of wine were a valuable marketing strategy that generated $359m of gross residential property sales in calendar 2024. The cost of these wine gift purchases and hosting events at the winery was included in the sales and marketing budgets for each Bensons property development project. According to the report, Levantine Hill remains a creditor of the collapsed Bensons group with an outstanding invoice for wine stock of $519,760.

Other wine and hospitality businesses owned and controlled by the Jreissati family are also listed as creditors. The receivers report noted, upon investigation, it was concluded these wine and hospitality deals were done on commercial terms.

The 151-page KordaMentha report shows company revenue of $243.3m in 2019 had shrunk to only $45.1m in 2021, $11.8m in 2023 and just $4.6m by December 2024.

This saw Bensons’ net operating losses widen from $10.8m in 2019 to $11.8m in 2022 before blowing out to $53.7m in 2024 and $108.2m by December 2024.

A spokesman for Bensons on Friday said the developer and its people were committed to working with all stakeholders.

“We acknowledge the challenges this period has posed, particularly for our employees and trade creditors, who have had to deal with significant uncertainty. Bensons Property Group is optimistic and hopeful that creditors, including compromised creditors, will support the DOCA, enabling it to continue to provide opportunities and facilitating the completion of hundreds of homes across Australia – outcomes that we believe serve the best interests of each and every stakeholder.”

Creditors will meet on February 7 to vote on the DOCA.

More Coverage

Originally published as Collapsed Bensons Property could have been insolvent as far back as July 2023