Rest Super insurance bungle hits thousands of members

Thousands of Rest Super members wrongly slugged for insurance have been told they need to get in contact if they don’t want to keep paying the fees turned on by ‘accident’ months ago.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

A second Labor-aligned, union-backed superannuation giant is embroiled in a payments scandal, refusing to automatically refund thousands of members wrongly slugged insurance premiums in the latest crisis to rock the $4 trillion retirement industry.

More than 2500 Rest Super members charged for insurance premiums in error since mid-last year will keep paying the added fees unless they opt out, after the $92bn fund chaired by former Victorian Labor deputy premier James Merlino “switched on” its cover by accident more than seven months ago.

Rest is understood to have become aware of the insurance payments error in December but members weren’t notified for another month. Instead of cancelling and refunding the payments, Rest has put the onus on members to opt out, telling those affected they have 35 days to contact the fund if they want to halt the premiums and get their money back.

Federal Labor, which has cracked down on corporate Australia over wage theft, refused to say whether the superannuation operator should automatically hand back refunds from the mistake.

Mr Merlino, who served under Daniel Andrews, failed to respond to requests for an interview.

The blunder is understood to have been made by Rest’s administration provider, MUFG, formerly Link Group, which has been at the centre of scandals and member service failures that have come to light in recent months. The worst of these was the excessive delay in funds paying out thousands of death and disability claims. Cbus chairman, Labor powerbroker Wayne Swan, previously blamed MUFG for the failures and high level of customer complaints – a claim MUFG has rejected. MUFG declined to comment on the latest scandal involving Rest.

A spokeswoman for Financial Services Minister Stephen Jones wouldn’t explicitly say whether the government believed Rest should refund members, when asked about the matter.

“The Albanese government expects all superannuation funds to meet the highest standards of governance and to act in the best financial interest of members,” she said. “The law requires this, and the independent regulators – APRA and ASIC – have the mandate to uphold these standards.

“The government will also be implementing new mandatory and enforceable standards to lift the bar of customer service in superannuation.”

Labor’s mandatory standards will initially focus on more timely handling of death and disability payments, after it was discovered Cbus had on numerous occasions mismanaged such payments.

Super Consumers Australia said there had been a long string of administrative errors across large superannuation funds. “We’re very concerned about how much super funds in general are spending to make sure these kinds of mistakes don’t happen,” said chief its executive Xavier O’Halloran.

“And only giving people 35 days to respond if they’ve been incorrectly charged is totally inappropriate. For anyone who discovers in the future that they’ve been incorrectly charged, (Rest) should be refunding them, including any losses they would have had on their investments as well.”

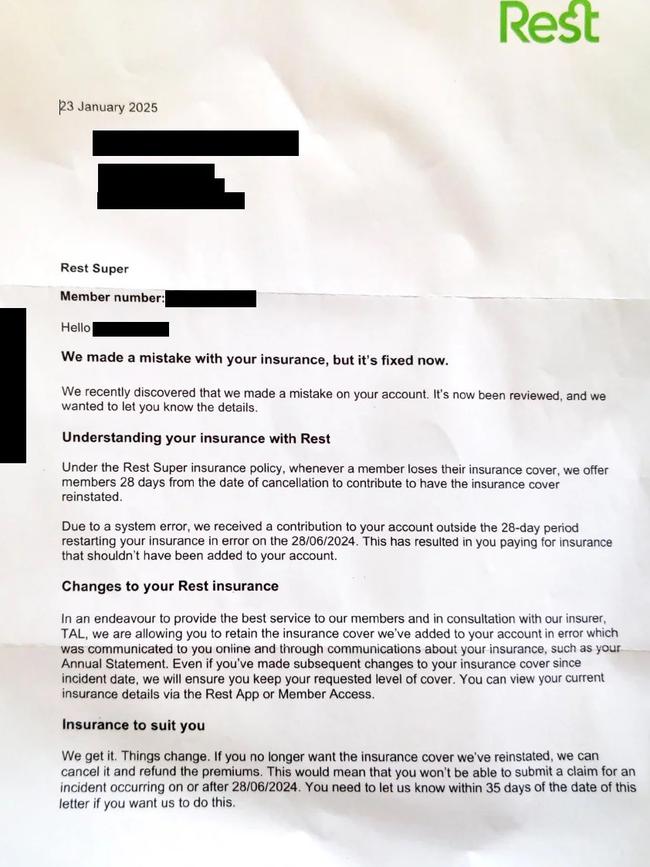

Rest said in a letter sent to members last month: “We made a mistake with your insurance, but it’s fixed now. Under the Rest Super insurance policy, whenever a member loses their insurance cover, we offer members 28 days from the date of cancellation to contribute to have the insurance cover reinstated.

“Due to a system error, we received a contribution to your account outside the 28-day period restarting your insurance in error on the 28/06/2024. This has resulted in you paying for insurance that shouldn’t have been added to your account,” the letter, dated January 23, said.

“In an endeavour to provide the best service to our members and in consultation with our insurer, TAL, we are allowing you to retain the insurance cover we’ve added to your account in error.

“If you no longer want the insurance cover we’ve reinstated, we can cancel it and refund the premiums. You need to let us know within 35 days of the date of this letter if you want us to do this,” the fund wrote.

A Rest spokesperson told The Australian that a small number of uninsured Rest members incorrectly had insurance coverage added to their accounts last year as a result of a system error.

“Once identified, the error was addressed quickly and the impact was limited to less than 2500 members,” the spokesperson said. “Rest wrote to the impacted members to inform them of this mistake, and advised them how to cancel the insurance and have any premiums refunded.

“Rest’s approach is to honour any insurance coverage provided in error for a number of reasons, including in case any claims arise.”

Rest said just over a third or around 700,000 of its members are insured and the remaining 65 per cent or 1.3 million members are without cover.

Wrongly charging insurance premiums is the latest blunder to hit the under-pressure sector that is facing unprecedented scrutiny from regulators.

ASIC is now turning its attention to Cbus’ peers, including the biggest in the market, the $360bn AustralianSuper, for similarly taking too long to pay out death claims.

AustralianSuper in November sought to get ahead of the regulator’s clutches, vowing to pay millions of dollars in compensation to deceased members’ beneficiaries for the delays in processing claims.

ASIC, meanwhile, is part way through a deep dive of super funds’ handling of death benefit claims, with its report due in the coming months.

In the wake of the scandals that have dogged the sector for months, the federal government in January said it would introduce mandatory and enforceable service standards for all large APRA‑regulated superannuation funds.

Opposition financial services spokesman Luke Howarth said Rest should refund its members.

“Rest Super should be refunding these mistaken insurance premiums. If customers want to keep their policy, they should be able to and can choose to pay once they are notified,” he said.

“Superannuation is Australians’ money and these repeated failures from the funds entrusted with billions in retirement savings is totally unacceptable,” Mr Howarth said.

“Labor’s approach to super follows a theme of protecting their union-affiliated industry super funds and donors. After months of bad behaviour from super funds, the government finally announced it would set minimum standards but not until after the election.”

Additional reporting: Giuseppe Tauriello

Originally published as Rest Super insurance bungle hits thousands of members