High-rise apartment developer Bensons Property Group placed in voluntary administration

High-rise apartment developer Bensons Property Group is the latest victim of the nationwide crisis dogging the construction sector, entering voluntary administration on Friday.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The nationwide crisis of failing construction companies has claimed one of its biggest victims after apartment builder Bensons Property Group was placed into voluntary administration late on Friday, threatening to derail a development pipeline of more than 1300 homes across $1.5bn of property projects.

The demise of Bensons, a well-known builder for 30 years, will cast a new cloud over the sickly home construction sector that has witnessed a string of collapses in the last two years.

At a board meeting on Friday, Bensons appointed Craig Shepard and Sebastian Hams of Korda Mentha as voluntary administrators, while Keith Crawford and Matthew Caddy of McGrath Nicol have been appointed as receivers and managers to oversee the ongoing operation of the Melbourne-based apartment builder. It is intended that Bensons will continue to trade during and beyond the administration and receivership period.

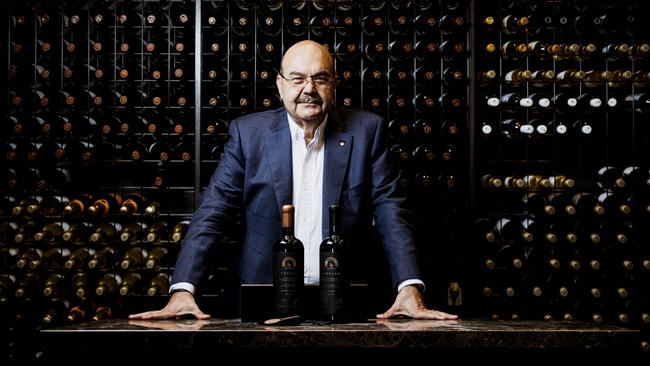

Founded by Lebanese immigrant, philanthropist and art collector Elias Jreissati in 1994, Bensons is currently working on 1337 homes – all apartments – across Tasmania, Victoria and Queensland. Of these homes some are still under construction, others have been completed and are being sold and a portion have planning approval but are awaiting a sales process before construction can begin.

Bensons’ high-profile projects include the construction of a 41-level residential tower in Chevron Island, Queensland, worth $485m, that at the time of its planning contained the largest and most expensive penthouse to feature on the Gold Coast with a ticket price of $22m. Bensons is also overseeing 740 apartments across suburban Melbourne, collectively valued at $452m on completion.

Typical of the mushrooming costs of building in Australia – which have played a role in sinking Bensons and many other builders recently – a residential project in Melbourne that Bensons was working on before Covid-19 was largely pre-sold on a construction quote of $22m, but then later hiked to $37m in a new construction quote. Some construction costs have gone up close to 70 per cent over the last three years, although property players have more recently seen a moderation in cost growth.

The Jreissati family, which separately also owns the upmarket Levantine Hill Estate winery in Victoria’s Yarra Valley, is hopeful for a deal to be put to Bensons’ creditors next month that will see tradies continue to be paid, properties completed and handed over to buyers whose deposits will be protected, The Australian has learned. This would allow Bensons to complete its pipeline of more than 1300 homes.

However, that creditors’ deal is not a certainty and if the vote on a deed of company arrangement (DOCA) is lost it could pull the rug from under the projects, put jobs in jeopardy across half a dozen developments, as well as threaten the completion of the homes themselves.

Bensons Property Group chief executive Rick Curtis said the developer needed the “reset” of the voluntary administration to ensure it can continue to deliver its homes to buyers.

“This was not an easy decision, however, I want to assure our people that there are no plans for redundancies. I also want to assure the hundreds of Australians who have purchased apartments in projects that we are managing, that we are taking this action to help protect their interests and the interests of Bensons Property Group,” Mr Curtis said.

“We currently have a development pipeline worth well over $1.5bn, and I am confident that we will get through this period and come out of it as an even stronger business.”

The strains of Covid-19 and the current economic malaise on the property sector, and in particular Bensons, were showing for a number of years. The collapse of high-rise builder ABD Group during development of a Bensons project – its 25-level Liberty One tower in inner-western Melbourne – in turn resulted in delayed completion, lost settlements, and significant cost increases associated with having to kickstart a build that had stopped midway, as well as increased interest and holding costs.

It has been a horror two years for the construction industry amid a spate of failures. Last year one of the nation’s largest residential home builders, Porter Davis, lurched into administration in the middle of building more than 1500 homes that at the time left many owners who had paid deposits without a finished house to move into.

Other construction collapses have included Lloyd Group, PBS Building, EQ Constructions, Hamlen Homes, Hallbury Homes and LDC.*

On Friday The Australian reported that senior property executives were seeing cost inflation moderating within the home building industry but that expensive labour and energy prices were still a major cost headache for the sector.

Meanwhile, the failure of Bensons will be especially felt by founder Mr Jreissati and his family. Mr Jreissati, who just before Covid-19 was battling pancreatic cancer, immigrated to Australia from Zahle, Lebanon, when he was only 18, and after first buying a sandwich shop in Melbourne’s CBD, moved on to small suburban property deals and eventually shimmering residential towers from Hobart to the Gold Coast.

He has recounted the story that when aged 15 he knelt down in his local Catholic church in Lebanon to pray to his patron saint, St Elias, making a deal that in return for a successful life, he would build a church in St Elias’ honour.

After quickly becoming a millionaire in his early 20s Mr Jreissati lost it all in the “recession we had to have” when the Labor government crashed the economy, but he soon rebuilt his fortunes and Bensons.

The shaky economic foundations of the construction industry has been made all the worse by the dour economy, stubbornly high inflation, a pull back by investors that typically lend to property developers and the string of interest rate hikes by the Reserve Bank.

Bensons’ business is also funded through a combination of equity, institutional lending and through the participation of some external investors who came to the developer via the now-scrapped Significant Investor Visa (SIV) investment program for wealthy investors.

It is believed that Bensons had as many as 35 foreign investors that had collectively invested more than $150m with the developer, but that a small number of these overseas investors were seeking to have their capital returned.

Under the DOCA proposal to be voted on next month these SIV investors will be treated equally and in accordance with the risk profile they accepted at the time of making their investments, insiders told The Australian. As part of that Bensons is hoping to gain support for a pathway to recouping their capital, but without disrupting Bensons’ business.

This includes, under a proposal to be put to creditors, Bensons to continue trading, complete each of its projects, protect all jobs, and provide opportunities for its investors. If accepted, this proposal will ensure employees and trade creditors will be unaffected. Compromised creditors will also have the opportunity to invest in a new fund, which will facilitate new property projects.

*Clarification: Earlier online and print versions of this story incorrectly said Hamlan Homes, rather than Hamlen Homes, had collapsed.

More Coverage

Originally published as High-rise apartment developer Bensons Property Group placed in voluntary administration