Cutting red tape key to building a solution to housing crisis

Global supply and trade shortages resulted in the construction industry being unable to keep up with the building of new dwellings, which ultimately led to a bottleneck of dwellings under construction, and longer completion times.

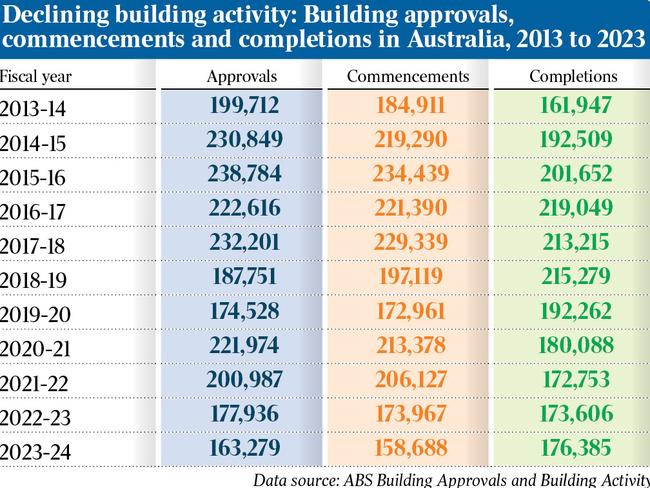

The latest building activity data from the Australian Bureau of Statistics underscores significant delays in approvals, commencements, and completions of residential projects. These challenges are deepening the housing crisis, with affordability and accessibility becoming key issues for both homebuyers and renters.

In the June quarter, dwelling approvals rose by 4.4 per cent to 14,800, showcasing some growth in the sector. Private sector houses led this increase with a 2.2 per cent rise, while multi-unit developments such as apartments grew by 4.7 per cent.

However, despite these promising figures, commencements and completions tell a different story.

During the June quarter, dwelling commencements declined by 1.1 per cent, with multi-unit projects dropping significantly by 7.4 per cent. Single-detached houses fared slightly better, with a modest 1.7 per cent rise in commencements.

These numbers highlight a critical gap between approvals and actual construction activity, limiting the flow of new housing into the market.

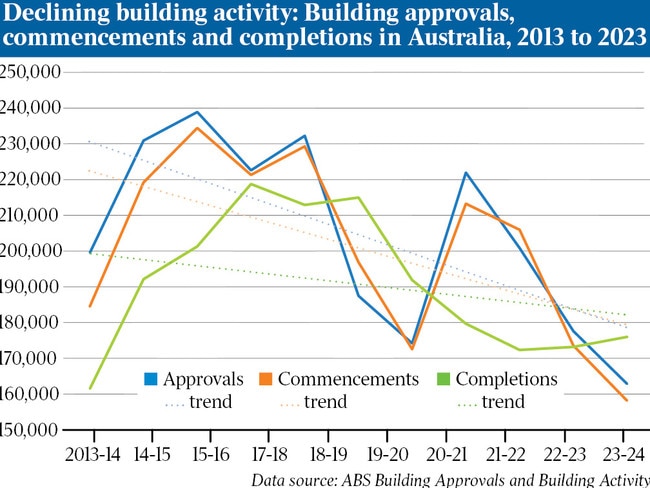

Building approvals and commencements have been trending downwards since the 2013–14 financial year. The 2019–20 fiscal year marked a significant slowdown in approvals and commencements due to the pandemic.

Total approvals dropped to 174,5000, while commencements fell to 173,000 – the lowest since the 2013–14 fiscal year. This decline reflected broader market conditions, including reduced demand and fewer large-scale projects during the time.

A temporary surge in building activity occurred during 2020–21 due to record-low interest rates and government stimulus programs like HomeBuilder. These initiatives targeted new housing construction, leading to a sharp 27 per cent rise in dwelling approvals (222,000) and a 23 per cent increase in commencements (213,400).

Notably, new houses drove this boom, accounting for more than two-thirds of approvals and commencements, while multi-unit developments lagged due to their longer lead times and ineligibility for certain subsidies.

However, since 2020–21, the momentum has faded. The combined pressures of rising interest rates, escalating construction costs, and supply chain disruptions have pushed approvals and commencements to their lowest levels in over a decade.

By 2023–24, dwelling approvals dropped to 163,300, a 6.4 per cent decrease from 2019–20, while commencements fell to 158,700, down 8.2 per cent. These figures mark a return to levels last seen in 2011–12 when approvals were 149,900 and commencements 145,400 dwellings.

This downward trajectory highlights a fragile housing pipeline and underscores the need for co-ordinated government action to address bottlenecks in approvals and support for efficient construction.

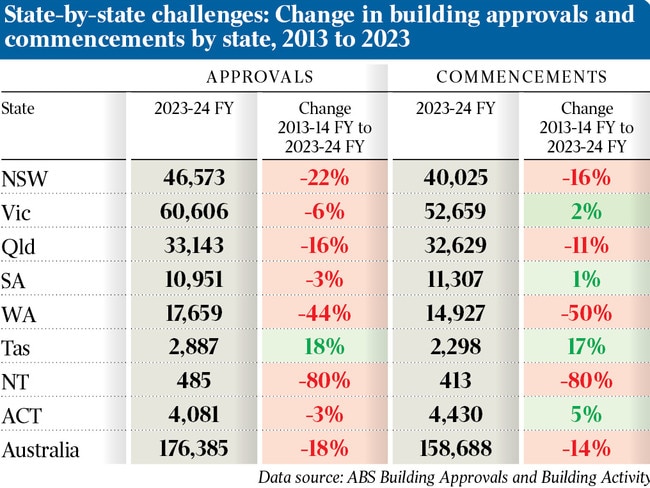

In the last 10 fiscal years to 2023-24, building approvals in NSW fell by 22 per cent and building commencements fell by 16 per cent.

One of the primary issues lies in the varied processing times for building approvals across states. In NSW, restrictive zoning laws and detailed environmental reviews contribute to some of the country’s longest approval times. These hurdles slow the progression of projects from planning to construction. The average turnaround time for residential building approvals in NSW is about 90-120-plus days. This further fuels the issue.

During the same time, Victoria’s building approvals fell by 6 per cent while building commencements increased by 2 per cent.

Northern building activities slowed down more than the other states, with the Northern Territory recording an 80 per cent decrease in both building approvals and commencements. In WA, approvals fell by 44 per cent and commencements by 50 per cent.

WA benefits from more streamlined processes, with faster turnaround times for approvals between 30 to 90 days. Despite this, building activities remained lower than the 2013 levels.

Similarly in Queensland, building approvals fell by 16 per cent and commencements by 11 per cent.

Tasmania was the only state to record an increase in both building approvals and commencements at 18 per cent and 17 per cent respectively.

Between 2013 and 2023, Tasmania experienced growth in building approvals and commencements due to factors such as increased population driven by interstate migration, heightened demand for affordable housing, and government initiatives. Programs like land-release schemes and investments in social and affordable housing contributed significantly to boosting construction activities.

Similarly, SA and the ACT had small decreases in building approvals by 3 per cent and recorded an increase in commencements by 1 per cent and 5 per cent compared to the 2013-14 financial year.

All states face broader industry challenges, such as labour shortages and rising material costs, which delay construction timelines. The combination of bureaucratic and industry-specific constraints significantly affects the pace at which new housing becomes available.

Delays in housing approvals and construction exacerbate affordability pressures. Australia’s population growth has heightened demand for housing, especially in urban centres. Yet, the slow rate of completions limits supply, driving up property prices and rental costs.

For low- and middle-income families, these trends make finding affordable housing increasingly challenging. Renters are particularly vulnerable, facing higher rents and limited options. The ripple effects of this housing crunch extend into the broader economy, affecting workforce mobility and productivity as people struggle to find homes close to their jobs.

The housing sector faces numerous policy and industry-related obstacles. Restrictive zoning laws, particularly in major cities, limit the availability of developable land. Complex approval processes further delay projects, especially those involving high-density housing, which is critical for urban areas.

Additionally, supply chain disruptions and rising construction costs add another layer of complexity. The cost of essential materials such as timber and steel has surged, while labour shortages in the construction industry hinder progress. These challenges are compounded by financing difficulties, with high interest rates and tighter lending criteria discouraging developers from taking on new projects.

Other global cities and countries facing similar challenges have implemented innovative solutions that Australia could learn from.

Tokyo, for example, has managed to keep housing supply in line with demand by adopting permissive zoning laws. These laws encourage high-density developments and reduce bureaucratic barriers for developers. As a result, Tokyo has avoided the severe housing shortages seen in other major cities.

Singapore stands out for its government-led housing initiatives. Through robust public-private collaboration, the city-state has developed high-quality public housing that caters to most of its residents. Its strong focus on planning and execution ensures timely delivery of projects and mitigates housing shortages.

Germany offers another model, with its use of land banking and pre-planned infrastructure development. By acquiring land in advance and ensuring it is ready for housing projects, German municipalities can fast-track construction and address community concerns early in the process.

To address its housing crisis, Australia must focus on both policy reform and industry innovation. Simplifying zoning regulations, particularly in urban areas, could unlock land for development and reduce delays. Introducing expedited approval processes for pre-certified projects would also help fast-track construction.

Investments in infrastructure are crucial to align housing developments with community needs. Improved transport, utilities, and public amenities can reduce resistance to new projects and make them more attractive to residents.

Addressing labour shortages in the construction industry is equally important. This could involve targeted migration policies to attract skilled workers, as well as upskilling initiatives to expand the local workforce.

Embracing construction technologies like modular building and prefabrication could further reduce costs and accelerate timelines.

Hari Hara Priya Kannan is data scientist at The Demographics Group

Australia’s housing market faces a persistent supply-demand mismatch, driven by population growth and limited construction activity.