New home buyers drowning in sneaky taxes and charges

New home buyers are being slugged $250,000 in sneaky taxes and charges in Sydney that make up an extraordinary 25 per cent of the cost of an average house.

New home buyers are being slugged $250,000 in sneaky taxes and charges in Sydney that make up an extraordinary 25 per cent of the cost of an average house.

Even first time buyers who qualify for discounts and grants are forced to fork out almost $215,000 for a mountain of extra levies built into the price of a new home, adding a whopping $11,400 to their annual mortgage payments.

Stamp duty is the biggest impost but the stealth taxes also include council fees, water and sewage utilities levies, GST, land tax and state government Section 94 contributions — with even a “biodiversity levy” now proposed for NSW.

The figures are in a report commissioned by the Property Council which found Sydney’s exorbitant direct and indirect taxes outstrip every other capital city and flow through to its median $1 million-plus home price.

Developers and builders must pay “extra” levies on new estates to pay for infrastructure in greenfield sites which then inflates the cost of new homes, but most of the charges don’t apply to building in existing suburbs.

Planning Minister Anthony Roberts says it’s unfair for governments to fund for all new infrastructure and argues developers “are doing quite well” and don’t need to pass all the costs on to buyers.

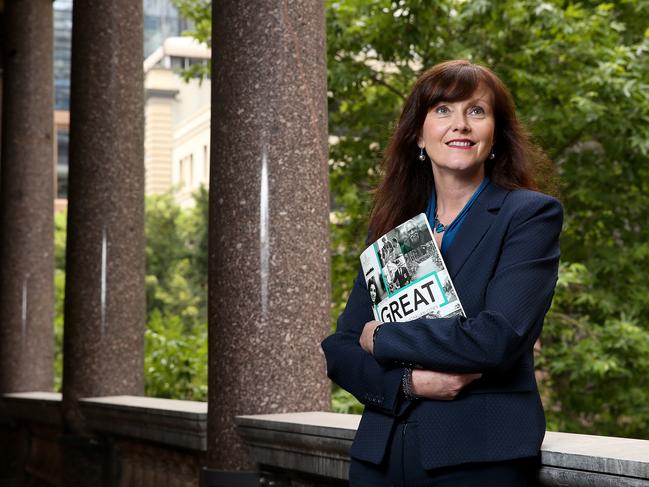

But Property Council executive director Jane Fitzgerald says charges are inevitably passed on in the price of new homes and the system was becoming “a lottery by postcode” with families in new housing estates in Sydney’s west being slugged the most.

“The cumulative spend that you are now making on taxes and charges is the biggest part of the purchase bar the construction cost,” she said.

“That’s crazy. It is a nightmare in Sydney compared to other places.”

MORE NEWS

The top 100 restaurants in NSW revealed

Battle to be Sydney’s top pub baron intensifies

Woollarawarre Bennelong’s final resting place to be preserved

The council’s research showed compared to Sydney’s $250,000 slug, Adelaide buyers paid $97,100 in government taxes and Brisbane buyers $139,000.

Despite living and working in southwest Sydney hairdresser and makeup artist Jessica Gillett, 23, is buying a $290,000 townhouse in Wollongong to get into the market.

“It doesn’t attract developer charges because it’s already built, and there won’t be the massive stamp duty because of the price,” she said.

Urban Development Institute of Australia NSW chief executive Steve Mann called for a brake on any more new government fees on homes, saying “affordability cannot be improved with increased taxes”.

He said a family in Oran Park was paying $149,217 in fees and government charges for a four bedroom home, compared with $135,492 by a family paying for an existing home in Northbridge.

Ms Fitzgerald said stamp duty was a massive impost which should be reviewed because Sydney’s house prices had pushed most home buyers into the top bracket.

“Stamp duty is a real killer,” she said. “Everybody who has bought their first home feels a little sick when they understand how much duty they are going to pay. Because it’s a massive amount. Given that you can’t buy anything in Sydney for under $500,000 you are paying a minimum of $25,000 in stamp duty.”

She said just as income tax “bracket creep” was regularly reviewed, the stamp duty rates should also be revised.

Under a new impost in NSW called the Special Infrastructure Contribution (SIC) scheme, developers will be charged to pay for bridges, roads, schools and health facilities — depending on the suburb.

“It’s not transparent - it’s complex. It’s a lottery for everybody and that really shouldn’t be the case,” Ms Fitzgerald said.

“So we’ve got some outer suburbs not only getting the growth, but paying more for the privilege.”

In response, NSW Planning Minister Anthony Roberts said “the development industry has done very well in Sydney”.

“They continue to provide tens of thousands if not hundreds of thousands of people with jobs. I’m not going to resile from saying to the developers that if you are developing a new suburb or you are building a new building, the taxpayer quite frankly shouldn’t pay for the infrastructure that goes with that.

“Why should somebody living in Penrith pay for the infrastructure of a new suburb through their taxes in Wilton?”

He points out the government continued to contribute about 50 per cent of the cost of infrastructure, including on-going costs.