Gold Coast Crime: Glitter Strip’s fraudsters and thieves named and shamed

From a nurse stealing from his patients to a beautician scamming her clients, these are 10 cases where Coast thieves and fraudsters were caught in action.

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

THE Gold Coast is home to many fraudsters and thieves.

From a nurse stealing from his patients, to a mum swindling taxpayers and a beautician scamming her clients – these are the Coast’s fraudsters and thieves named and shamed.

Dodgy engineer

An engineer used fake invoices to siphon more than $174,000 in GST for a Broadbeach tower that did not exist.

Kevin John Barnard did not own the land the tower was to be built on or lodge development applications with council.

The 59-year-old pleaded guilty in the Southport District Court to six counts of obtaining financial advantage by deception and two counts of attempting to gain financial advantage by deception.

Judge Rowan Jackson sentenced him to three years’ prison with immediate release on a $5000 good behaviour order.

The court was told that in 2014 Barnard overstated his non-capital expenses on his BAS statements relating to a tower he was purportedly building in Broadbeach, resulting in GST refunds.

He received more than $147,000 than he was entitled to.

Barnard attempted two more refunds totalling about $76,000 and was refused.

His deception was discovered during an audit by the Australian Taxation Office in which he used fake or unpaid invoices.

Judge Jackson said he did not order Barnard spend time in prison due to serious health concerns.

Woman steals from employer

A former practice manager stole nearly $800,000 from her Gold Coast employer by using her bank account details to accept health fund rebates meant for her boss.

The Southport District Court was told the Kingscliff woman stole the money over a seven-year period and was only caught after her employer, Dr Ibrahim Abdool, retired and new staff discovered the scheme.

Zoe Sandra Mylius, 60, pleaded guilty to fraud, dishonestly cause detriment by employee value of at least $100,000, and fraud, dishonestly cause detriment by employee value of at least $30,000.

The court was told Mylius was the business manager for Dr Abdool’s practice at John Flynn Medical Centre for 17 years and was responsible for the financial management of the business.

Crown prosecutor Kathleen Christopherson said Dr Abdool offered his private patients a no-gap service and was paid by their private health insurer.

Ms Christopherson said in August 2013 Mylius filled out a HCF remittance form and changed the bank account details from Dr Abdool to her own.

“From that point in time these remittances have gone into her bank account and that’s gone on from August 26, 2013 to April 17, 2020,” Ms Christopherson said.

“She tells the complainant from memory she just didn’t know what to do.

“Over a period of approximately six years and eight months hundreds of payments, almost 300, were paid into her account from HCF and that totalled $774,000.”

Ms Christopherson told the court Mylius’s motivation for the crime was greed and she was a “woman living well above her means”.

Mylius was convicted and sentenced to seven-and-a-half years in jail with a parole release date of September 13, 2022.

Fake iPhone racket

A former financial adviser rewound an odometer more than 200,000 kilometres to sell a Mitsubishi Pajero for more than it was worth.

Before the sale Chris Duspara used the same car to sell fake iPhones over Facebook Marketplace.

He made more than $9000 selling “cloned” iPhones to six people.

The 27-year-old pleaded guilty in the Southport Magistrates Court in June to multiple charges, including fraud and forgery.

Magistrate Gary Finger sentenced him to two years’ probation.

The court was told Duspara bought a Mitsubishi Pajero from a private owner in November 2019. It had an odometer reading of about 296,000km.

He wound back the odometer to show the car had travelled about 65,000km.

Duspara sold the car to a Hope Island man on January 29, 2020 for $15,000, the court was told.

After realising the deception, the new owner sold the car for $2400 less than what he paid for it.

In the month before he sold the car Duspara used the vehicle to sell fake or “cloned” iPhones.

The court was told Duspara was advertising on Facebook Marketplace an iPhone 11 Pro Max for sale.

He used aliases including JuanMa Dona, Theo and Philla Deniz.

Between December 19, 2019 and January 22, 2020, Duspara met with six people at various locations across the Gold Coast.

He was driving the Mitsubishi Pajero at the time.

Duspara would insist on the cash and hand over a fake iPhone, the court was told.

The phones looked like the Apple product but were loaded with non-Apple software which does not work in Australia.

During one of the transactions, Duspara asked the buyer to get in his car so they could go around the corner away from a bank, the court was told.

When the buyer declined, Duspara asked to count the money, handed the buyer a fake phone, slammed the door and drove off.

Duspara made $9290 selling the fake phones.

Outside of court, defence lawyer Jason Grant, of Grant Lawyers, said Duspara was remorseful for his actions and happy to pay restitution to his victims.

Billabong bungle

Ex-Billabong boss Matthew Perrin made headlines for all the wrong reasons when it emerged he had forged loan documents.

Perrin, 47, was sentenced to eight years jail after a jury convicted him of forging his ex-wife Nicole Bricknell’s signature in order to pocket a $13.5 million loan secured against his wife’s Cronin Island home on the Gold Coast, which he used to invest in a speculative and ultimately disastrous Chinese supermarket business.

In a Court of Appeal decision delivered in September 2017, Perrin’s parole eligibility date was listed as being this year.

Casino chip cheat

A high-end retail worker was busted on CCTV camera trying to bluff the Star Casino out of almost $20,000.

Winnie Huang was part of a high-stakes scam that involved hiding betting chips on the card table and only alerting the dealer to the bet when the hand won.

The single mum placed a $10,000 plaque in the betting area behind the card shoe and out of the dealer’s sight while gambling at the Star Casino at Broadbeach on June 7, 2017.

When the hand lost, Huang, 28, left the chip on the table instead of surrendering it to the dealer. She played a number of hands with the plaque hidden on the table.

Her deceit totalled up to $19,500.

She pleaded guilty in September 2019 to fraud.

Magistrate Joan White sentenced her to 12 months jail, to be wholly suspended for two years.

Mum’s Centrelink fraud

A Gold Coast mother of three was ordered to pay back the $12,000 she swindled from taxpayers while working at two government agencies.

Sandra Dorne Colbert, 46, received welfare payments for 13 months while working part-time at the Australian Taxation Office and later Centrelink.

She was employed at Centrelink to advise others how to declare payments correctly.

She failed to declare to Centrelink that she was employed and later did not update any change in circumstances after transferring roles.

In January 2020 she pleaded guilty to obtaining financial advantage for one’s self, 14 counts of making a false document and 14 counts of using forged documents.

Colbert was sentenced to nine months’ prison, with immediate release, and was ordered to serve a two-year $800 good behaviour bond.

Beauty betrayer

A Gold Coast beautician scammed the credit card details from a client while she had her eyes closed for eyelash extensions.

Casey Jade Leather then went on a spending spree, splashing out $6600 over six days in 2019 on an Apple Watch, Xbox, Samsung sound bar, MIMCO handbags and wallets, Ugg boots, clothes and kids play sets.

Leather pleaded guilty in the Southport Magistrates Court in September 2019 to 19 fraud charges and one count of possessing dangerous drugs.

A woman was having her eyelashes done and unable to open her eyes when Leather stole the cards.

After taking down the details, Leather then returned the cards to the woman’s wallet.

Magistrate Jane Bentley sentenced Leather to six months in prison, to be wholly suspended for 12 months.

She ordered Leather pay $3808 in restitution.

From Russia with love

A Wealthy Russian mum was getting Centrelink family benefits while she secretly transferred $750,000 from offshore accounts to avoid being taxed.

Nadezda Bek transferred $8000-9500 from Russian credit cards to two Australian accounts more than 70 times between July 2014 and February 2019.

Under federal law any cash amount more than $10,000 transferred into Australia from a foreign country is reportable and taxable. Taking steps to deliberately avoid the reporting threshold is an offence.

Bek grinned as she left the Southport District Court, avoiding spending any time in prison.

Judge Catherine Muir sentenced Bek to four months in prison with immediate release on a 12-month, $1000 good behaviour bond.

The 35-year-old pleaded guilty to one count of conducting transactions to avoid reporting requirements relating to threshold transactions.

Cases where no convictions were recorded:

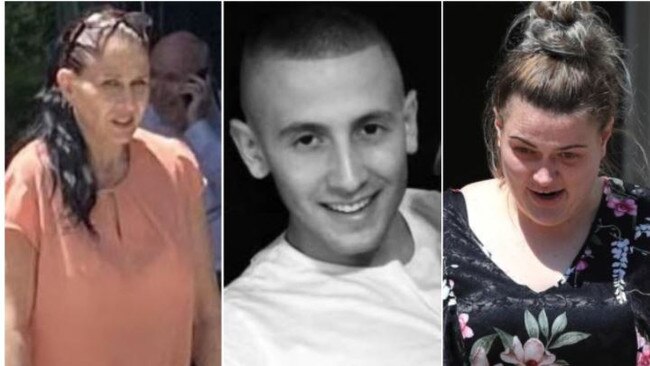

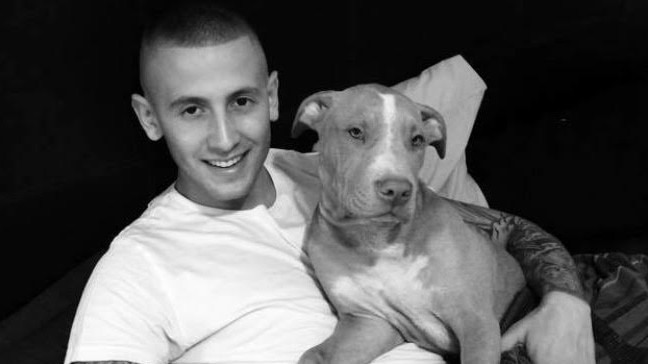

Nurse stole from patients

A Gold Coast nurse who stole credit cards from the bedside of seven patients has been banned from health care for five years.

Nathaniel Scott McAndrew spent more than $2000 of patients’ money.

His ban may be lifted early if he can prove to the Nursing and Midwifery Board of Australia he is fit to practice.

The Queensland Civil and Administrative Tribunal (QCAT) cancelled his registration after a hearing this month.

McAndrew was working at the John Flynn Private Hospital’s coronary care unit when he took the credit cards from the patients’ bedside drawers in December 2017 and January 2018.

He then used the cards to make multiple purchases under $100.

Police raided his home on January 31, 2018 and found steroids and tadalafil – a drug used to treat erectile dysfunction – which he did not have prescriptions for.

He was fined $3000 and had no convictions recorded when he pleaded guilty in Coolangatta Magistrates Court on December 13, 2019 to seven counts of stealing, eight counts of fraud, possessing dangerous drugs and possessing restricted drugs.

WAG steals phone

An AFL wag whose barely there bikinis have been worn by Kylie Jenner and Rhianna has been ordered to pay $860 for stealing an iPhone from a car wash six years ago.

Rebecca Jane Klodinsky, the former girlfriend of convicted killer Dione Lacey and partner now of Geelong Cats player Lachie Henderson, pleaded guilty in February to stealing in the Southport Magistrates Court.

She was arrested on a warrant relating to a charge from 2015. The court was told Klodinsky stole a mobile phone from a car wash manager after claiming staff scratched her black Porsche coup while cleaning it.

Police prosecutor Sergeant Reece Forte said the 30-year-old refused to pay for the service and the pair got into an argument.

Sgt Forte said the car wash manager took Klodinsky’s car keys, only handing them back once she had paid for the service.

“The defendant has then grabbed the mobile phone from the counter and said, ‘I’ll take the phone for the damage’,” Sgt Forte said.

He said it took police nearly six years to find Klodinsky because she was living in Melbourne for “some time”.

Klodinsky founded Frankii Swim, now called IIXIIST in 2013, and became a global swimwear sensation after famous fans including Kim Kardashian, Kris Jenner, Kylie Jenner, Bella Hadid and Rihanna were spotted wearing her swimwear.

Defence lawyer Claudia Arbon said her client was a single mother whose business was operating at a loss due to Covid and relied on JobKeeper but was willing to pay restitution.

Klodinsky was sentenced to a $500 good behaviour bond for six months and ordered to pay $860 restitution. No conviction was recorded.

More Coverage

Originally published as Gold Coast Crime: Glitter Strip’s fraudsters and thieves named and shamed