Want to be a property investor? Ask these 10 questions first

Investing in real estate is a cornerstone of wealth for a majority of Aussies, but before getting started you should ask yourself this.

Investing in real estate is a cornerstone of wealth for a majority of Aussies, but before getting started you should ask yourself this.

Chemist Warehouse is dominating the nation’s pharmacy sector, with average monthly spend at its stores more than 50 per cent higher than at other chemist chains, new research from Macquarie has revealed.

Tech investors pile in despite Trump’s tech exemptions confusion. Property, health stocks also strong gainers.

Come in spinner – the new owner of The Star wants to bring back two-up has vowed to turn the Sydney casino’s focus from Asian whales to Aussie locals.

Latest travel figures show just how far America has slumped on the list of destinations Australians book for international trips.

Melbourne’s Park Hyatt Hotel is close to being sold for $200m in the largest commercial deal in the city in 12 months.

After the asbestos scandal, building materials giant James Hardie is in hot water again, this time with shareholders who have been frozen out of a controversial takeover of US rival Azek.

Bally’s boss Soo Kim is exploring options to remain involved in Star’s prized Queen’s Wharf casino precinct as either owner or operator.

The Kiwi carrier has unveiled its first redesign in 14 years as Qantas continues the hunt for a designer for its new uniforms.

MST Access says securing a $75m debt financing facility with Merricks Capital will enable Andromeda to make a Great White investment decision.

Cannindah Resources has reported grades of up to 96.86g/t gold at its Mt Cannindah copper-gold project in Queensland.

ASX jumps on tariff relief, Wall Street ends strongly despite “Sell America” talk and Neuren and GGE take off.

Trump’s tariffs have sent stocks tumbling, but history favours the patient investor. Here’s why staying the course beats panic-selling, according to Barefoot Investor.

He’s only a kid but Barefoot Investor Scott Pape’s son had some choice words for Treasurer Jim Chalmers about the gaping holes in his budget.

Barefoot’s week-long cash-only experiment turned into a battle with fast-food workers, bureaucrats, and the Royal Australian Mint – revealing just how fragile our financial freedoms really are.

It’s the end of an era as legendary business columnist Terry McCrann looks back at the past 46 years as he signs off on his last regular column.

Brad Banducci should feel pretty satisfied with the latest result at Woolies – his final mark on a stellar turnaround at Australia’s biggest supermarket group.

BHP and its multi-billion profits are still all based on China. Today it’s iron ore tomorrow it will be copper.

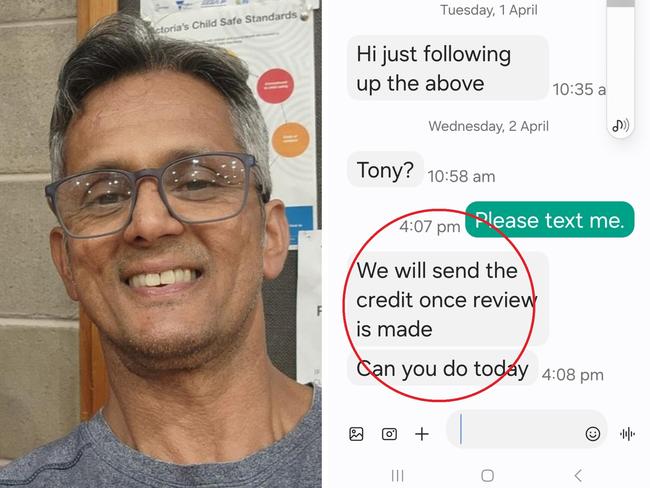

Tony Griffs paid more than $13,000 to this company to help his business, for little benefit. He finally cut ties — then came another request.

The new tariffs being introduced by Donald Trump could lead to more of our meat being shipped offshore, pushing up local prices.

The RBA has just delivered a stark warning that Donald Trump’s trade war could trigger disorder in the global economy and hammer Australians.

Shopping hurts hip pockets more than ever but supermarkets are not price gouging. Here’s what you can do.

The worst stock market fall since Covid is worrying investors and superannuation savers, so what should you do?

Cricket great Bill Lawry’s exclamation “it’s all happening” applies to real estate investors today, so don’t miss out on tax deductions.

When there was mass euphoria and talk of ‘once in a lifetime’ gains around Bitcoin late last year, ASX Trader knew it was time to exit. Here’s the danger signs he saw.

Some of Australia’s savviest business people planted the roots of their empires in Western Sydney. Here are the companies that experienced skyrocketing success.

Sanjeev Gupta’s InfraBuild has struck two key agreements which should avoid a possible default on its debts but the $US150m in new debt at the heart of the deal is not yet settled.

The domino effect from Donald Trump’s tariffs is likely to be felt far and wide and we may look back on this week not as the start of a trade war but a market reset, writes ASX Trader.

Australians are facing a widespread hit from Trump’s tariffs, including farmers, winemakers and manufacturers. SEE THEIR STORIES

NSW pulled the pin on Star’s much-needed financing deal leaving Star boss Steve McCann with limited options. This is what comes next.

Pallas Group is seeking financial backing for its latest property project, even though it’s opposed by the City of Sydney.

Australia’s central bank is trying to war game how tariffs will impact inflation and global growth. The real answer is it doesn’t know.

Sanjeev Gupta’s InfraBuild could default on $880m in debt imminently according to ratings agency Fitch, while cheap steel imports will put further pressure on profitability.

A golden run for the popular precious metal has sent it soaring to record highs, and investors seeking a slice have several options.

The BlackRock boss has put forward a defence for globalisation as he argues markets hold the key to creating more evenly distributed wealth.

A China-linked Northern Minerals investor, which for months ignored federal government demands to sell its shares in the rare earths hopeful, has finally sold up.

A new Qantas chairman is quietly rebuilding a board dogged by scandal. The tech billionaire should take notice.

Telstra, Woolworths, Coles and Origin Energy are among the companies that may be worth a closer look as share markets struggle.

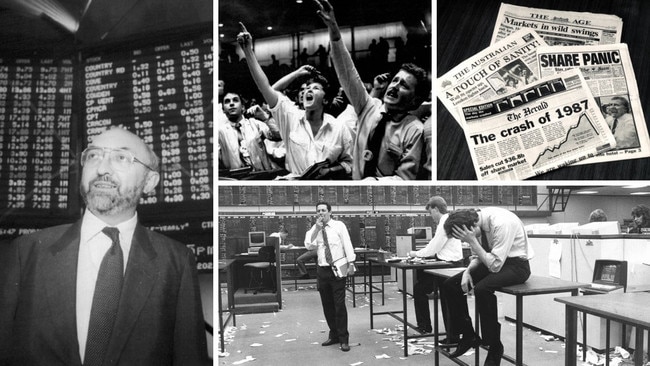

This rare market signal that’s appeared before six of the biggest stock market crashes in history is back and it’s sounding the alarm, writes ASX Trader.

Original URL: https://www.dailytelegraph.com.au/business/nsw-business