First Republic shares plunge 50 per cent after customers yank $150 billion in deposits

A major US bank could be on the brink of collapse with its shares plunging 50 per cent, after customers yanked nearly $150 billion in deposits.

Markets

Don't miss out on the headlines from Markets. Followed categories will be added to My News.

Wall Street stocks plummeted on Tuesday, as shares of First Republic Bank were battered after an earnings report that showed it lost a large amount of deposits — reviving worries over the financial sector.

Investors have been eyeing the performance of regional lenders since the dramatic failures of Silicon Valley Bank and Signature Bank last month, which sparked fears of contagion.

The beaten-down California lender said on Monday that it lost more than 40 per cent of its deposits in the first quarter this year, intensifying concerns about its long-term prospects.

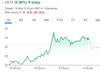

First Republic shares sank nearly 50 per cent as of end-Tuesday.

The Dow Jones Industrial Average slumped 1.0 per cent to 33,530.83, while the broadbased S&P 500 fell 1.6 per cent to 4,071.63.

The tech-heavy Nasdaq Composite Index plunged 2.0 per cent to 11,799.16.

While First Republic had reported quarterly profits of $US269 million ($406 million), that data point was overshadowed by its deposit level of $US104.5 billion ($157.6 billion) at end-March.

This marked a drop of nearly $US72 billion ($109 billion) from the level at end-2022.

The actual flight of cash topped $US100 billion ($151 billion) as First Republic’s holdings were bolstered by a $US30 billion ($45 billion) infusion of funds announced in March from a consortium of 11 US private banks.

Tuesday’s brutal selloff in shares means First Republic has lost more than 90 percent of its value since early March.

On Monday, First Republic also disclosed it was cutting 20-25 per cent of its staff.

The dismal figures have prompted fresh talks among private financiers and Washington bank regulators on another initiative to try to stabilize First Republic, the Financial Times reported on Tuesday.

“We do not see any easy solutions for the bank, and we still see a material probability that there is little left for equity holders once this situation fully plays out,” Morningstar analyst Eric Compton said in a note.

“As we rerun the numbers based on the updated balance sheet, we do not believe First Republic will be profitable on a go-forward basis with its current balance sheet.”

Mr Compton estimated quarterly losses of $US400-$US500 million ($600-$750 million).

Ohhhhh boy 👀 pic.twitter.com/sHFHjHxve3

— ð™ˆð™žð™ 𙚠“Dr. Calm†ð™ƒð™¤â‚¿ð™–ð™§ð™© (@theemikehobart) March 16, 2023

Regional banks have been under pressure since SVB collapsed. Lenders like Comerica and KeyCorp have signaled a weakening profit outlook, though they have not been considered unstable.

Still on Tuesday, KeyCorp, Zions Bancorp and Fifth Third Bancorp all lost more than 5 per cent. Western Alliance Bancorporation dropped 5.6 per cent while PacWest Bancorp slid 8.9 per cent.

“The financial sector is having a bad day,” said Steve Sosnick, chief strategist at Interactive Brokers.

He added that other contributing factors include the disappointing earnings report of logistics giant UPS. UPS shares fell around 10 per cent.

“UPS is essential to the US economy … If their volumes are disappointing that doesn’t bold well,” Mr Sosnick said.

Meanwhile, traders are set to digest the corporate results of tech firms Microsoft and Google parent Alphabet, who reported after the bell.

Originally published as First Republic shares plunge 50 per cent after customers yank $150 billion in deposits