First Republic Bank saved after 11 banks deposit $45 billion, stock price rises

A US bank that was teetering on the brink of collapse has been shored up after some of its rivals made deposits worth billions of dollars.

Banking

Don't miss out on the headlines from Banking. Followed categories will be added to My News.

A US bank that was teetering on the brink of collapse has been shored up after some of its rivals made deposits worth billions of dollars.

In the past week, three American banks have collapsed – Silvergate Capital, Silicon Valley Bank (SVB) and Signature – sending the market into meltdown as faith in the banking sector has been shattered.

On Tuesday, news.com.au reported that another bank, First Republic Bank, appeared on shaky ground, with its shares tanking drastically, amid revelations that it had needed to draw on some cash reserves to prop itself up.

Its shares fell by 61.8 per cent in a single day on Tuesday.

However, a major development heralds good news for the embattled First Republic Bank.

Some of the biggest banks in the US are determined to keep the regional bank alive, reportedly depositing $US30 billion ($A45 billion) into First Republic Bank to help its liquidity crunch.

Federal US regulators and the Treasury Department said in a joint statement that 11 banks had stepped in to aid the flailing First Republic Bank.

Those banks included JPMorgan Chase & Co, Citigroup Inc, Bank of America Corp, Wells Fargo & Co, Goldman Sachs Group Inc, Morgan Stanley, US Bancorp, PNC Financial Services Group Inc and Truist Financial Corp.

“This show of support by a group of large banks is most welcome and demonstrates the resilience of the banking system,” federal regulators said.

JPMorgan Chase & Co, Citigroup Inc, Bank of America Corp and Wells Fargo & Co are reportedly in talks to deposit $US5 billion ($A7.5 billion) each into First Republic Bank, according to Dow Jones.

The smaller banks, like Morgan Stanley and Goldman Sachs Group Inc., as well as regional banks US Bancorp, PNC Financial Services Group Inc and Truist Financial Corp, are putting in smaller amounts.

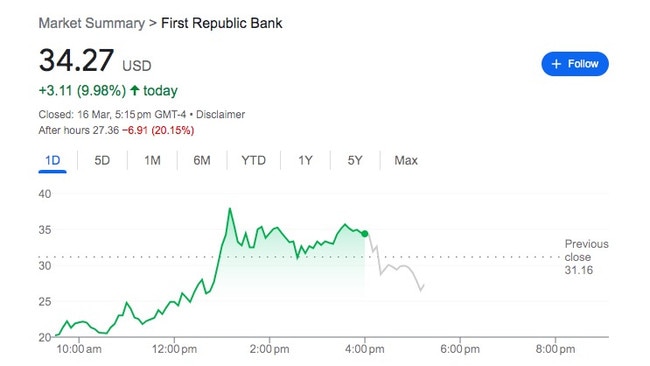

First Republic Bank’s stock price is now in the green, and the company is up almost 10 per cent compared to the previous day, as the announcement buoyed investors’ hopes.

US Treasury Secretary Janet Yellen assured parliament that the banking system is strong and resilient when she gave a testimony on Thursday.

Meanwhile, it continued to be a bloodbath for banks on the stock market late into the week.

It comes at the same time that a European investment bank, Credit Suisse, was also feared to be on the brink of disaster.

Shares in major investment bank Credit Suisse plunged by 24 per cent overnight as the financial institution teetered on the brink.

Trading in Credit Suisse, the world’s seventh largest investment bank, was suspended several times as the stock plummeted, sparking a worrying ripple effect as shares in other European banks also plunged.

Stocks in the Swiss bank fell to 1.68 Swiss francs ($A2.71) – the lowest price in its history.

The banking ‘contagion’ is in part because of cumulative interest rate rises, which has drastically reduced the yields on treasury bonds, bringing many banks to their knees. Banks like Credit Suisse were forced to sell bonds at a loss.

However, there are rumours that Credit Suisse is now in talks and is considering being bought out by another banking entity, American multinational investment bank UBS.

They both see a takeover as a last resort, as UBS does not want to absorb Credit Suisse’s debts, according to Bloomberg.

Overnight, Credit Suisse announced it had the capacity to borrow up to 50 billion Swiss francs ($A80 billion) from the Swiss National Bank.

This was a lifeline the country’s central bank offered the flagging investment firm.

Credit Suisse also said it would buy back some of its own debt.

Originally published as First Republic Bank saved after 11 banks deposit $45 billion, stock price rises