First Republic Bank shares plunge days after three other US banks collapse

Another bank is teetering on the edge of ruin just days after three massive banking institutions fell like dominoes, sending shockwaves across the world.

Customers and investors appear to have lost faith in another US bank, just days after three banks sensationally collapsed in a move that sent shockwaves around the world.

Overnight, fears mounted for a regional bank based in San Francisco, First Republic Bank, with its shares tanking drastically.

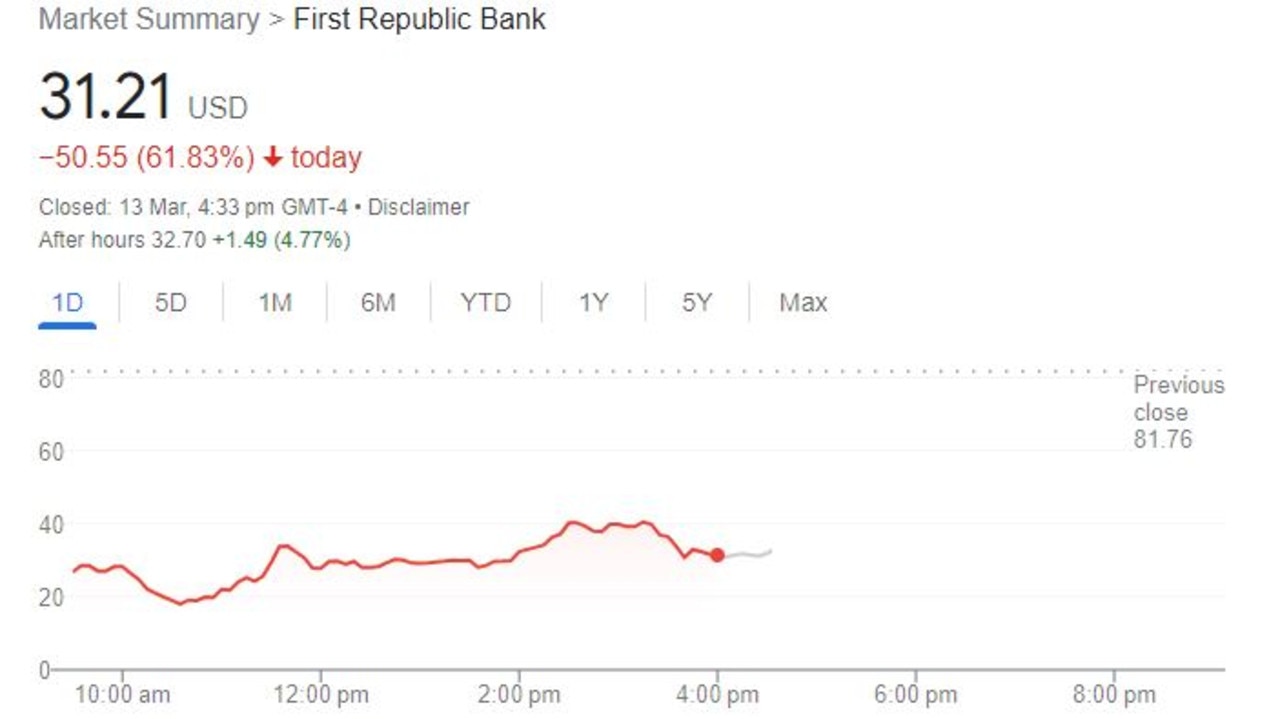

First Republic Bank’s shares fell by 61.8 per cent on Monday, local time. The week before, its shares had been down 33 per cent.

At the time of writing, the bank had recovered slightly, down 50.55 per cent in the past 24 hours, currently trading at $US31.21 ($A46.81) per share, according to the New York Stock Exchange.

It follows a similar pattern of several other failed banks in recent days, with stocks plunging, leading to a liquidity crunch, sending the market into a meltdown.

Investors and customers are also panicked because a whopping 70 per cent of the deposits held with First Republic Bank are uninsured.

That’s above the industry norm, with medium-sized banks usually having around 55 per cent uninsured, Bank of America said in a note.

On Sunday, local time (Monday AEDT), First Republic revealed it had needed a helping hand, announcing it had received more cash reserves from the Federal Reserve, the US Central bank, and investment firm JPMorgan Chase.

This action moved First Republic’s available funds to draw from to $US70 billion ($A105 billion).

The news did little to stop the share price from sliding to alarming lows the following day.

Founded in 1985, First Republic reportedly has $US212 billion ($A318 billion) in assets while it has $US176.4 billion ($A264 billion) in deposits, according to its annual report from last year.

Since Friday, three banks have collapsed, either going into liquidation or being appointed to receivers, amid turbulent market conditions that saw their liabilities outstrip their assets.

Just before the weekend, Australian time, Californian-based Silvergate Capital announced it had gone into voluntary liquidation, after racking up $US1 billion ($A1.5 billion) losses in the past quarter, as well as its shares being down 67 per cent.

Less than 24 hours later, Silicon Valley Bank (SVB) went into receivership.

The bank was the 18th largest in the country and had a market capitalisation of around $A40 billion as well as assets of more than $A300 billion.

It was the second-biggest bank failure in US history.

Then on Monday, New York-based Signature Bank collapsed after its share price fell 22.87 per cent, prompting state authorities to intervene and take over and shut down the bank.

The US regulator agreed to prop up all deposit holders of SVB and Signature Bank, and even opened up a fund to provide additional support to other troubled financial institutions for the future, called the Bank Term Funding Program.

The banking ‘contagion’ is in part because of cumulative interest rate rises, which has drastically reduced the yields on treasury bonds, bringing many banks to their knees.

On top of that, a drawn-out crypto winter has also impacted banks dabbling in digital assets and lending to crypto exchanges – something Silvergate Capital and Signature Bank were both doing.

It’s been dubbed the worst crisis since the 2008 Global Financial Crisis.

Other regional banks across the US also plunged on the stock market.

PacWest Bancorp dropped 45 per cent, Western Alliance Bancorp tanked 47 per cent, Zions Bancorporation lost around 26 per cent and KeyCorp plummeted 27 per cent.

Stock exchanges even had to call trading halts multiple times throughout Monday amid volatile trading conditions.

Some of the biggest financial institutions in the country – Bank of America and Charles Schwab – fell 5.8 per cent and 11 per cent respectively, in a sign that even the bigger ones cannot weather the storm hitting the sector.

The KBW regional banking index fell 5.4 per cent while the S&P 500 banking index dropped by 6 per cent.

Two wealth management funds have made an incredibly bad bet in light of the USA’s current banking crisis.

Norway’s sovereign wealth fund and Sweden’s largest pension fund both invested in SVB, Signature and the troubled First Republic Bank and had stakes worth hundreds of millions of dollars prior to the events of the past few days.