Sign interest rate hikes could see house prices nose dive

Rising interest rates in two similar countries to Australia have seen their house prices drop by worrying amounts.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

In the month since the RBA raised interest rates for the first time in 11 years, the sentiment within many of the nation’s property markets has shifted significantly.

In Sydney and Melbourne, where just last year prospective buyers had a very real fear of missing out (FOMO), that has been replaced by a far more measured and circumspect approach to the market.

In some areas where price falls have already begun, some Australians are facing a very different psychological phenomenon to FOMO which present within elements of the market FOOP or fear of over paying.

In some Canadian and New Zealand housing markets, FOOP has well and truly replaced FOMO as the driving psychological force behind market sentiment, as some of their biggest and most expensive markets already face large falls in home prices.

While there are naturally differences between Canada, New Zealand and Australia, the three nations arguably share the most similarities in terms of their respective housing markets relative to the rest of the world.

All three nations have seen runaway price growth above already elevated price levels since the pandemic began and all three have high levels of household debt relative to the rest of the world.

New Zealand

In October, the Reserve Bank of New Zealand became the first central bank in the Anglosphere to raise interest rates, taking its official cash rate to 0.5 per cent. Since then it has continued to raise interest rates at every rate meeting. At its last two rate decisions it elected to raise rates by 0.5 per cent, taking the Kiwi cash rate to 2 per cent, a world away from the 0.35 per cent cash rate we currently have in Australia.

It didn’t take long for rising rates to be felt within the New Zealand property market, with housing prices in Wellington peaking just a few weeks later and prices in Auckland and nationally peaking the following month.

Since then the Kiwi housing market has diverged significantly, with prices falling in Auckland by 10.2 per cent, by 11.2 per cent in Wellington and 3.4 per cent nationally excluding Auckland.

In the last month in particular price falls have accelerated significantly, dropping by 1.4 per cent nationally excluding Auckland, by 3.0 per cent in Wellington and by 2.7 per cent in Auckland.

Canada

Canada on the other hand raised interest rates quite a bit later. The Bank of Canada pulled the trigger on its first rate rise in February and raises rates by an outsized 0.5 per cent in April. It’s expected that Canada will follow New Zealand’s example and raise rates by a further 0.5 per cent when the Bank of Canada meets next.

At a national level the moves within the Canadian property market have been relatively minimal, with prices for existing homes down 0.6 per cent in April, with some markets performing much more strongly than others.

Despite the impact of rate rises still being very fresh on Canada’s property market, one city is experiencing much greater price falls than the others.

That city is Canada’s most populous, the city of Toronto.

Since the end of February, the median home price in Greater Toronto has fallen by 8.9 per cent. In neighbouring Dufferin County around 65km from the Toronto CBD, prices have fallen by 22.9 per cent.

Greater Toronto housing prices between February and the end of April down 8.9%.

— Avid Commentator 🇦🇺 (@AvidCommentator) June 2, 2022

Chart: Reuters pic.twitter.com/g361Qzl6g6

This comes on the back of meteoric price growth in Greater Toronto and outlying areas like Dufferin County, which rose to prominence as the work from home way of life became the norm during the pandemic. Between February 2020 and February 2022, housing prices in the Greater Toronto area rose by 54.5 per cent and in outlying rural areas such as Dufferin County by up to 82 per cent.

Australia

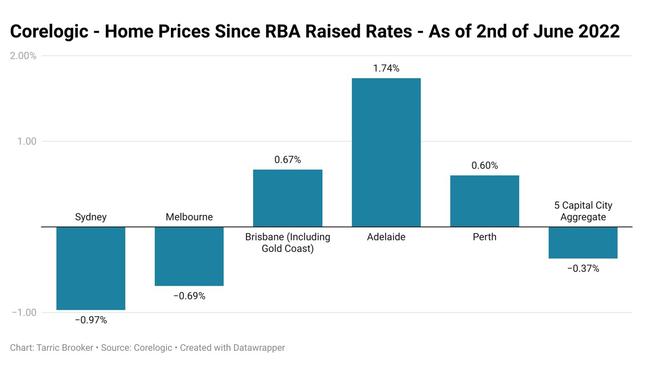

It’s only been a little over four weeks since the RBA raised interest rates, so the data we have on the impact on home prices is relatively limited. According to housing price data provider CoreLogic, since the RBA raised rates prices have fallen by 0.97 per cent in Sydney, by 0.69 per cent in Melbourne, risen by 0.67 per cent in Brisbane, rose by 1.74 per cent in Adelaide and gained 0.6 per cent in Perth.

This experience of smaller and generally lower price markets outperforming the larger more expensive ones is consistent with what we’ve seen in Canada and New Zealand, but naturally it’s early days.

Even if Australia’s property market was to follow the path taken by New Zealand’s, it will be months before a major impact is felt outside the nation’s two biggest cities. But Australia following the same course as the Kiwi’s is far from certain.

Across the Tasman the RBNZ is absolutely committed to raising interest rates, with Governor Adrian Orr recently stating the cash rate could rise to 3.95 per cent and warned that the RBNZ wanted to avoid doing “too little too late”.

On the other hand the RBA is far more circumspect and if the predictions of the Commonwealth Bank are correct, much less likely to pursue as an aggressive interest rate hiking cycle due to concerns about high levels of household debt.

Ultimately, the course of interest rates is in the hands of central bankers, who may or may not be committed to fighting inflation if they are confronted with the potential of a housing crash and the economic hit that would follow.

Tarric Brooker is a freelance journalist and social commentator. | @AvidCommentator

Originally published as Sign interest rate hikes could see house prices nose dive