Australia headed for negative interest rates as iron ore, housing market slump

Australia’s two big earners – iron ore and house prices – are showing signs of slumping which means there is one move the RBA has to make.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

The Australian economy is a simple machine that runs on two motors. The two engines are commodities and household debt. We might call these miners and banks. Or, iron ore and house prices.

The machine is fuelled by commodity income derived offshore. This is then leveraged up in global markets via bank borrowing. The debt is channelled into rising house prices that drive consumption.

At least, that’s how it used to work. Since the pandemic began, the machine has instead leveraged commodity income via bank borrowing from the Reserve Bank of Australia

Like a twin-engine aircraft, the Australian economy can soar when both of its engines roar in unison. The last year is an example.

It can also hold its altitude on only one engine. Like the post-GFC period when mining boomed and house prices fell. Or, the reverse, during the mining bust of 2015 when house prices launched.

But when both engines fail, a crash is imminent. This is where the Australian economy finds itself today.

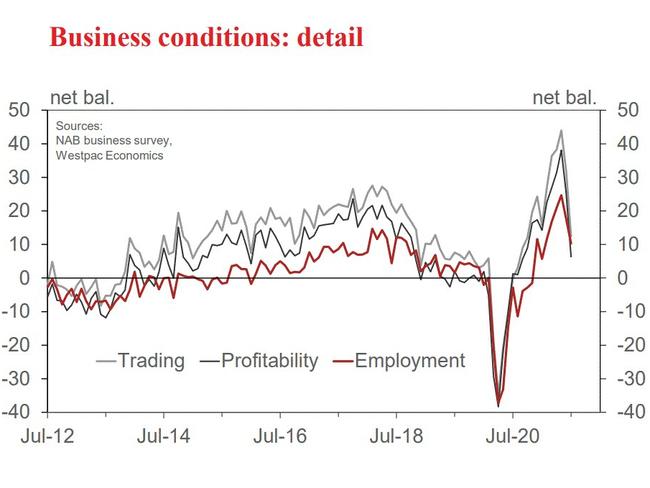

The first jet to flame out is households. Delta lockdowns have hammered confidence and spending. Business is slowing fast and future investment plans are being shelved.

RELATED: China’s plan to crush Aussie iron ore

The lockdowns are likely to run until November, and even afterwards there will be serious interstate restrictions, meaning no rebound of substance is possible.

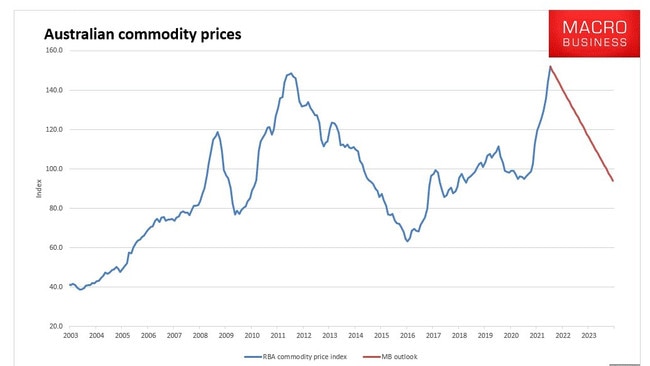

The second jet to flame out is our huge commodity price gains. China launched out of the Covid-19 lockdowns with huge commodity demand but is now slowing very fast. Iron ore is tumbling and coal is next:

RELATED: Move that could see house prices skyrocket

As our two economic motors sputter, unemployment will begin to rise, wages will weaken and inflation will disappear.

How can Australia react?

Policymakers have two throttles to toggle in response.

First, governments can spend more – and they will. But, unlike 2020/21, as mining profits bust not boom this time, the tax take will get smashed so they’ll want to be more conservative.

The larger deficits will be more to absorb the falling revenues that come from the mining income crash. Actual spending increases will be much more difficult.

That will mean the second throttle, the RBA, will have to carry more of the load. Australia will need a lower currency to help offset collapsing export income so the RBA will be forced to increase its money printing and bond purchases as a matter of course.

More interesting is what it will do for domestic demand. The likelihood is that the mining income engine will be shut off throughout 2022. The RBA will therefore need to rev its other engine, the housing market.

But how can it do that when interest rates are already at effective zero and prices high?

It is possible. Either the RBA will have to cut its cash rate negative. Or, it will have to print more money for the banks offered up on negative yields.

The European Central Bank has been doing both of these things for many years. The European cash rate is -0.5 per cent and it provides money to banks to lend for as low as -1 per cent.

The RBA says it will never do these things. But it always says that.

When the master alarm goes off in its economic cockpit and the ominous voice declares “pull up terrain”, it will have no choice.

David Llewellyn-Smith is chief strategist at the MB Fund and MB Super. He is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. David is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Originally published as Australia headed for negative interest rates as iron ore, housing market slump