China will likely succeed in crashing Australia’s iron ore price

Australia’s economy relies on one thing from China but recent figures show that demand has fallen dramatically – and it won’t be temporary.

You could be mistaken for thinking that it’s a good time to buy iron ore. After all, Australia’s magic dust has gone down a quarter in price in the past month. Isn’t the idea to buy low (and sell high?)

Yes, it is. The problem is that iron ore is still not low. In fact, it is still incredibly high.

Moreover, the conditions that support those high prices have collapsed. Raising the uncomfortable possibility that although iron ore has corrected, this is only an overture for a stomach-churning crash.

What are these underlying conditions? There are three that matter.

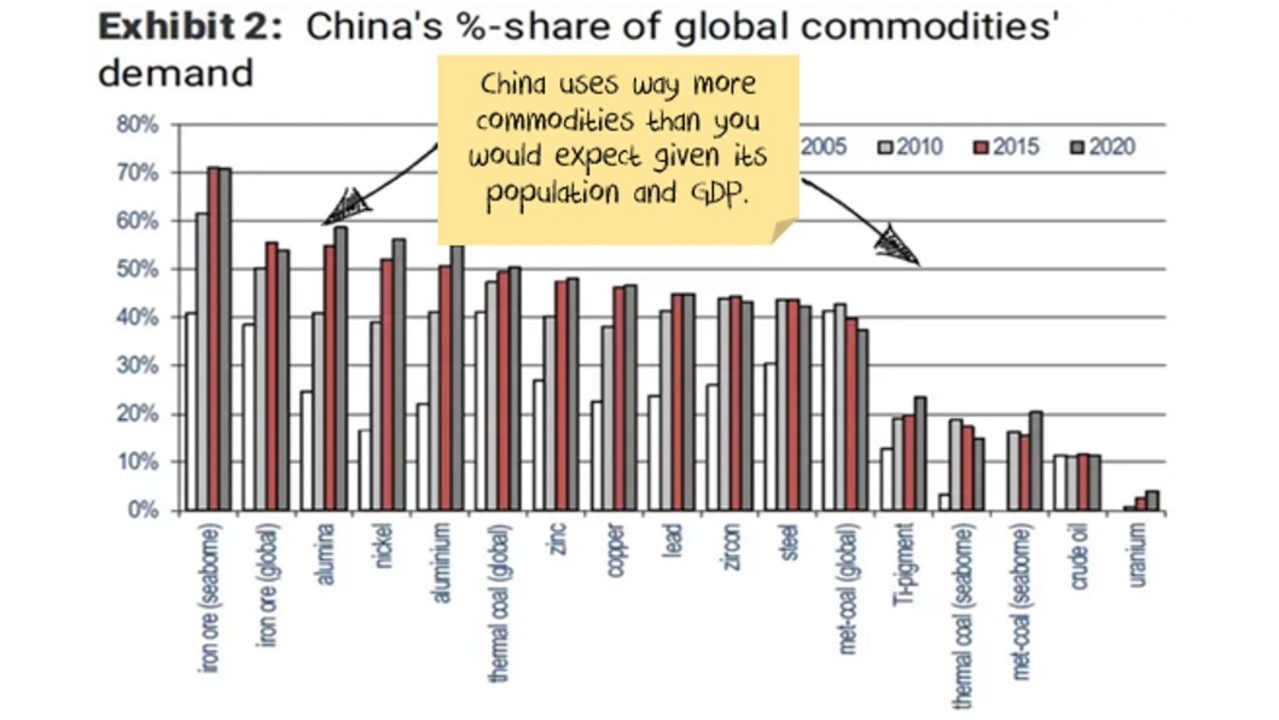

The first is Chinese demand. A number of investment banks have recently argued that China no longer matters to commodities prices. They argue that developed market stimulus is now the key driver. This is rubbish as the below chart shows.

RELATED: Australia starting to feel China pressure

So, Chinese demand decides the iron ore price. Currently, the picture on that front is getting worse daily.

China has been tightening credit to the steel-intensive sectors of its economy, property and infrastructure, all year and they are slowing fast. So much so, in fact, that household names like Evergrande, China’s formerly largest property developer, are tottering on the verge of bankruptcy.

Chinese property and infrastructure alone constitute 70 per cent of iron ore demand in China and half of all global seaborne demand.

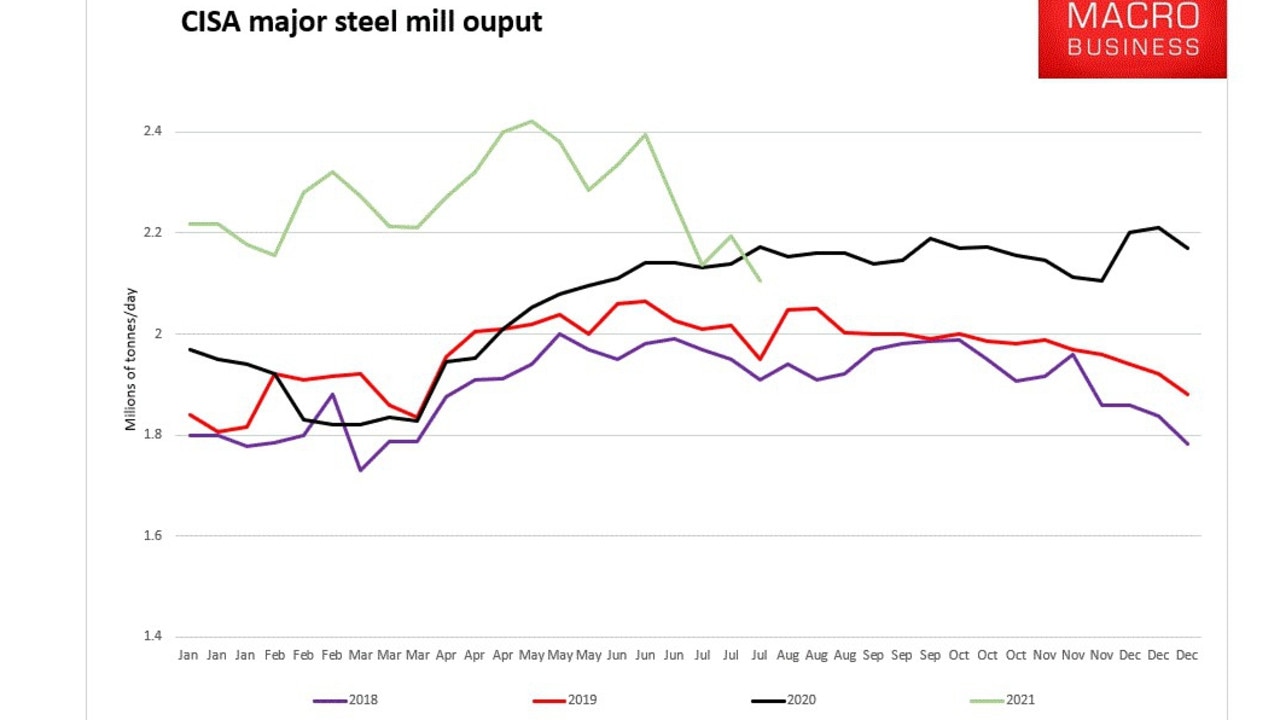

To ensure this slowdown is translated as quickly as possible into lower iron ore prices, Chinese authorities have demanded unprecedented levels of output cuts from their sprawling steel mills. This has lifted the price of steel as supply falls but they obviously need less iron ore as well.

RELATED: Australia’s fate in hands of China

Rising iron ore supplies

Sadly for Australia, this demand crunch is coinciding with the second reason for collapsing underlying conditions for high iron ore prices: rising supply.

In recent company reports, the world’s two largest iron ore producers, Vale and Rio Tinto, both confirmed their production guidance for the second half of this year.

Because both have had weak first halves owing to bad weather and other difficulties, they will need to significantly accelerate output run rates in the second half to reach the targets. This is in the realms of an annualised 60-70 million tonnes more than was available in the first half of 2021.

And that brings us to the last reason that iron ore is in such a hot mess.

Less demand and more supply mean a surplus of iron ore. When any commodity market turns to abundance, one thing happens ahead and above all others. The price of that commodity falls to the highest cost marginal producer.

That is, the price falls to a point where the miner or farmer that has the highest production costs in that commodity starts to feel the pinch and so cuts output, helping stabilise prices.

Because this iron ore boom has been so fast, under heavy covid pressures and distortions, there are no new high-cost iron ore producers in the market.

The highest marginal cost producer in iron ore is still below $100, exactly where it was before covid changed our world.

So, for the market to reflect the emerging surplus of iron ore, and start to work it off, that is exactly where the price has to go back to. With a bullet.

The lockdown effect

Finally, there is one more factor to consider which might make things worse or better. Delta lockdowns are spreading in China, exacerbating the slowdown already underway.

For now, it is making the Chinese commodity demand slump worse. But, if it gets out of hand, it could trigger another panicked stimulus in the very sectors currently under pressure and that would short-circuit any iron ore crash.

Thus, oddly, a Delta shock is the iron price’s best hope of staving off a crash to $100 by Christmas.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. He is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.