James Packer and Crown Resorts investors lose out as casino holds dividends

Crown Resorts has reached a deal with its bankers to suspend dividend payments until at least halfway through the financial year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Crown Resorts has reached a deal with its bankers to suspend dividend payments until at least halfway through the financial year, after the under-fire casino group unveiled a huge full-year loss due to the impacts of Covid and the scrutiny of two state royal commissions.

It means the group’s 37 per cent shareholder, James Packer, will go without a payout for another year, and potentially longer if the Victorian or West Australian royal commissions into the group follow NSW in revoking Crown’s casino licences in their respective states over money-laundering concerns.

Mr Packer’s ability to sell off his shareholding in Crown has also hit another roadblock, with the company confirming it had ceased discussions with US private equity giant Oaktree about funding a $3bn buyout of his shareholding.

But incoming Crown CEO and former Lendlease boss Steve McCann – taking the reins following executive chairman Helen Coonan’s resignation last week – said the group would not rule out future takeover offers.

That is despite Crown knocking back an $8bn takeover bid from Blackstone and a $12bn merger proposal from Star Entertainment earlier this year.

“We will consider all options to maximise shareholder value in the context of however the regulatory environment plays out, and what the constraints might be that come from that,” Mr McCann said.

“There are a range of possible options. As I said, Crown’s got three of the best integrated resorts in the world. It’s very attractive from that perspective – I’m sure there will be people looking really interested in how things play out.”

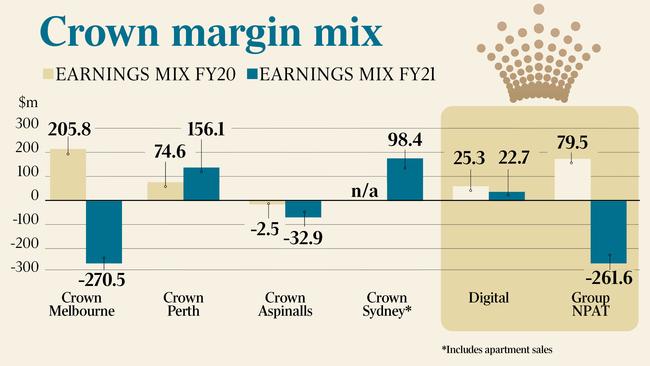

Crown dived to a full-year loss of $261.6m after it battled Covid shutdowns that cost the company’s bottom line $120.6m.

Group revenue fell 31 per cent to $1.53bn, but some relief came in the form of a $179.6m JobKeeper wage subsidy from the Morrison government.

Aside from the Covid impacts, the burden of the NSW inquiry and two royal commissions more than doubled corporate costs to $111.6m as legal bills mounted and insurance premiums shot up.

Chief financial officer Alan McGregor told shareholders this cost may never revert to historical levels of less than $50m.

“We may not get back to that post the current challenges depending on what the embedded costs are in the business,” he said.

Mr McCann said Crown’s cost base would increase as it increased its efforts to save its casino licences, but said higher responsible gaming spending and money-laundering controls would soon be a feature of the industry in Australia.

“There will be a change to the way we operate, but I will suggest that there will be a change to the way the industry operates. There will be a level playing field, ultimately,” he said.

Crown had previously warned that if the Victorian royal commission revoked the licence to its flagship Melbourne casino, it would be in danger of defaulting on its $892m of net debt.

But on Monday Crown said that, in return for a waiver of certain events of default that would “otherwise arise” if its licence was lost, or if any of its licences were revoked in the future, it would withhold dividend payments for the next half year.

“As part of these arrangements, Crown has agreed not to declare or pay dividends in respect of the half year ending December 31, or where a review event is triggered as a result of a cancellation or suspension of any of Crown’s Australian casino licences,” Crown said.

Mr McCann said beyond that point, Crown should return to paying dividends if it retained its casino licences and lockdowns lifted for good.

“We have pretty low levels of debt and high cashflow. So, you would expect that we would get back to a position of being able to pay dividends fairly shortly after being back at full operating activity,” he said.

Analysts were unsurprised by Crown’s results, having priced in a loss due to Covid disruption. They remained concerned with the outcome of the Victorian royal commission, due in October, and the WA commission, due in March.

“While we place the loss of a casino licence as a low risk, these outcomes will shape Crown Resorts’ future,” analysts at Macquarie said.

Covid disruptions resulted in Crown Melbourne being closed for 160 days of the financial year, with revenue more than halving to $582.5m, resulting in a $100.6m reported earnings before interest, tax, depreciation and amortisation (EBITDA) loss.

Mr McCann said current Covid restrictions in Victoria had a weekly negative $7m EBITDA impact.

But in relatively Covid-free WA, Crown’s Perth casino remained mostly open, lifting revenue 21.1 per cent to $742.8m, resulting in a positive reported EBITDA result of $231.8m.

Crown’s boutique Aspinalls business in London reported an EBITDA loss of $28.4m. Mr McCann said Crown was kicking off a comprehensive review of the segment.

Crown Sydney, which has not been permitted to open its gaming floors after the NSW Bergin inquiry revoked Crown’s casino licence in February, booked an operating loss but achieved a positive $123m reported EBITDA on the back of apartment sales in the complex.

Mr McCann said Crown was still working with the NSW Independent Liquor and Gaming Authority and its independent monitor to achieve probity and set an opening date for the casino floor.

With former Telstra boss Ziggy Switkowski set to replace Ms Coonan as chairman of the board, Mr McCann said Crown’s new management team would be able to thread the needle of maximising shareholder value while keeping regulators onside.

“We are a public company, we’ve got to meet our community obligations and government and regulatory obligations, but we’re going to do that also with an eye on how to maximise shareholder value,” he said. “It takes a fair bit of commercial acumen and experience to be able to bring those things together, so I am looking forward to Ziggy’s input.”

Crown’s shares closed at $9.31, down 0.11 per cent.

Originally published as James Packer and Crown Resorts investors lose out as casino holds dividends