James Packer takes a big hit as Crown Resorts holds dividends

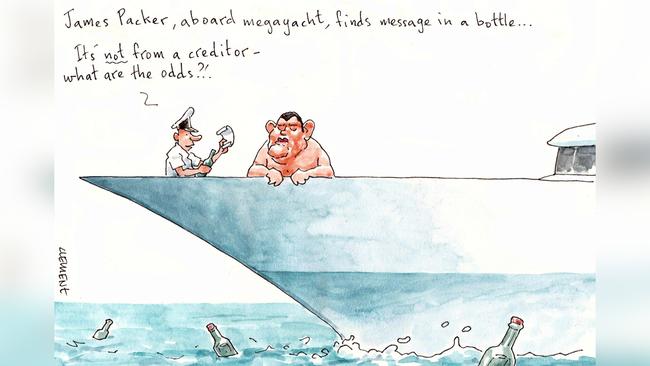

While local shareholders rejoice in the record $38bn of dividends being shelled out in the current reporting season, spare a thought for billionaire James Packer whose dividend drought continues thanks to ongoing scrutiny of his gaming group.

Packer, who has historically relied on dividends from his 37 per cent stake in Crown, was a mere onlooker as new chief Steve McCann handed down a $261m full-year loss on Monday, the group’s first dip into the red in a decade.

McCann said Crown was suspending dividends for at least the next year in an attempt to appease its creditors, putting an end to the long run of easy money for Packer.

The 53-year-old, along with the rest of the company’s register, hasn’t had a payout since the 30c interim dividend in early 2020, which was worth $73m to him at the time.

Up until then, let’s call it pre-Patricia Bergin’s casino inquiry, 30c dividends per half had been the norm for the group, even a special dividend after the sale of Crown’s Melco stake in 2017, all providing plenty of cashflow for the billionaire and his expensive hobbies.

To top it all off, Crown noted on Monday it had ceased any talk with Oaktree over a potential deal to buy Packer’s stake – enough there for a bad day, even if you’re sailing the seas off the Turkish coast, where his IJE megayacht was last spotted.

Is it any wonder then that Packer is still yet to settle on his new $60m luxury pad in the top levels of Sydney’s One Barangaroo tower?

Worse still, Packer’s precarious position also sets the stage for elder sister Gretel Packer to catch up to her brother in the wealth stakes.

In recent years, the Sydney-based Packer has steadily grown her wealth, thought to be in the realm of $2bn, thanks in large part to investment advice from Caledonia’s Will Vicars which she juggles alongside plenty of philanthropic interests.

With the results of multiple state probes, and action pending from the national anti-money laundering regulator, still pending, the younger Packer would be well-served to take his sister’s lead.

Still, there’s plenty cashing in on the increasing levels of regulation. Crown reported legal and consulting fees of $111.6m for FY21, expected to remain elevated in the year ahead too.

Quite the change from Packer’s usual cash splashing.

–

Late mail

Despite the rush for Australia Post to appoint its new chief Paul Graham, there sure hasn’t been much urgency to get him in the door.

Recall Post chairman Lucio Di Bartolomeo announced the appointment of the Woolies logistics boss to lead the postal service just a day before the start of an inquiry into the circumstances surrounding the exit of his predecessor Christine Holgate.

A joint media release at the time, signed off by Finance Minister Simon Birmingham and Communications Minister Paul Fletcher, noted Graham’s credentials and that he would start in the role by September.

Margin Call reliably hears that date is looking more like the end of the month, with Graham slated to join no sooner than September 27.

That leaves interim chief Rodney Boys to hand down his first annual results as boss on Tuesday, expected to be buoyed by pandemic parcel deliveries as states grapple with wide-ranging lockdowns.

Those same conditions will make for a rough start to the job for the Sydney-based Graham, who jumps straight from juggling groceries to overseeing letters and parcels without any break. Such are the perils of managing two of the most in-demand industries during a pandemic.

NSW Premier Gladys Berejiklian’s lockdown across most of the state hardly makes for much of a warm welcome either.

Good thing Graham is already familiar with a few faces, namely Post’s head of people and culture Sue Davies.

Graham sits alongside her on the board of industry mental health peak body Healthy Heads in Trucks and Sheds, the same group that counts Lindsay Fox as patron.

He’ll likely have a warmer reception from staff compared to Holgate’s first days at chief at rival Global Express this week, which coincided with industrial action and a 24-hour driver strike.

Australia Post on Monday signed off on a fresh enterprise agreement with its 30,000-odd award employees for a 9 per cent pay increase over the next three years.

If only he could get that same pay rise written into his $1.46m fixed pay, though the potential to double that in bonuses should suffice.

–

Corporate creed

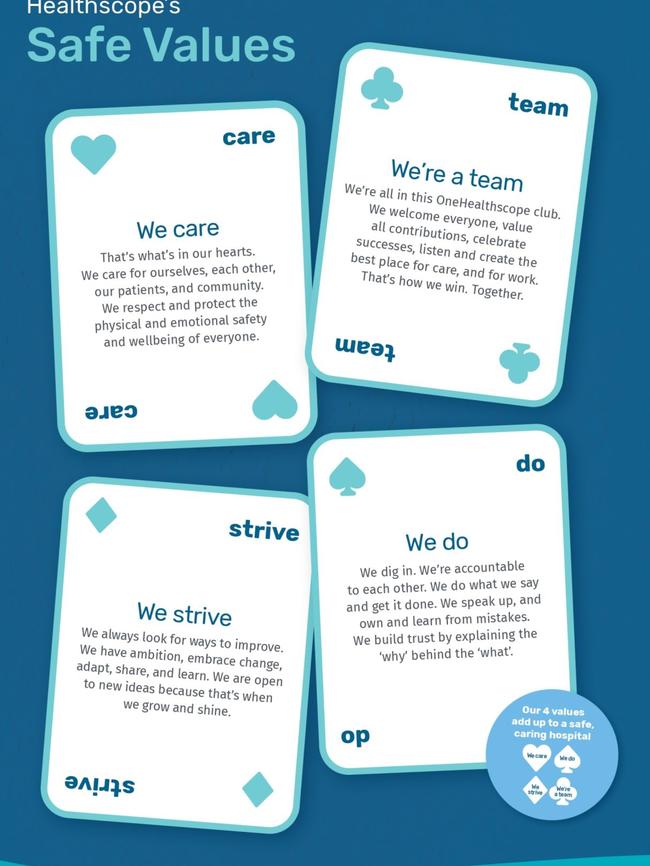

Company values have become a big business – ask any corporate affairs supremo.

The hours involved in coming up with a list of inspiring slogans detailing a company’s mission to motivate workers, can well … end up uninspiring.

It is hard to match the simplicity and perfection of the likes of the Olympic motto: Citius, Altius, Fortius – Communiter (faster, higher, stronger – together).

But with the Tokyo games still fresh, we have to give Australia’s second-biggest private hospital operator – the silver medallist in healthcare – Healthscope and its chief Steven Rubic, some points for trying.

Healthscope’s corporate affairs team has indeed gone above and beyond – coming up with four safe values: we care, we’re a team, we strive, we do. At Margin Call, we applaud. Their creativity anyway.

You see, each of the values are set on the suit of a playing card – hearts, clubs, diamonds and spades. We’re not sure what this has to do with healthcare, and indeed some Healthscope workers are said to be equally mystified.

The only connection we can think of is subliminal – ‘‘don’t gamble your safety’’ or ‘‘values you can bet on’’. Gambling has been on the brain in Melbourne with Ray Finkelstein’s Victorian royal commission into James Packer’s Crown Resorts after all.

Hopefully, for the Len Chersky-chaired group, the whole house of cards doesn’t come tumbling down.

Then again, this was from the team that won not one but two International Association of Business Communicator Gold Quill Awards this year, one of which was for ‘‘overcoming adversity, innovating through crisis’’.

Gold performance indeed.