Crown Resorts’ future in Ray Finkelstein’s hands as profits plummet

At stake is the licence to operate for the jewel in the business, Crown Melbourne.

Incoming CEO Steve McCann had a short answer to how much communication there had been about results or the appointment of new chairman Ziggy Switkowski with Crown’s 37 per cent shareholder James Packer’s CPH. “Zero,” he said.

A meeting was offered by Crown, but CPH – who now communicates through advisers to Crown – declined. After the Bergin inquiry which crushed Crown’s Sydney dream of a restricted licence to be open for business, Both CPH and Crown know that the historically toxic connection between the two needs no more oxygen.

A Perth royal commission into Crown looms in March next year. The combination of Covid shutdowns cruelling cashflow and ongoing costs of three inquiries is laid bare in the annual results: revenue down 31.3 per cent to $1.537bn and a net loss of $262m.

In some ways, it’s surprising the result was not worse. The full cost of Crown’s cumulative misdemeanours are translating into hundreds of millions of lost dollars for shareholders, including a $112m hit in corporate costs of legal, consulting, compliance and insurance, with about the same expected in 2022. Potential penalties for two ongoing Austrac enforcement investigations in Melbourne and Perth are unclear.

The loss of Melbourne’s casino licence as an ongoing operation, however, would require a radical rethink and it is not out of the question. Ray Finkelstein’s recent commentary signalled that he thought Crown would not be paying a hefty enough price if it merely righted a few wrongs, including unpaid taxes in Melbourne.

Steve McCann’s comments around results were considered and reverent. They needed to be if Crown is to earn back confidence and trust of both the public and regulators.

The traditionally low-profile former CEO of Lendlease was also pretty frank. The sheer scale of reform and remediation at Crown is breathtaking: changes to board and management, a new anti-money laundering program, risk management issues, stopping the junkets and a major cultural review as part of remediation. The financial crimes and compliance group has doubled to 110 people.

Each of the three casinos have different issues to solve. As McCann says, they haven’t taken a bet yet in Sydney, so no historical transgressions there. They must show that processes, systems and culture are in good enough shape to open.

In Melbourne, Crown cannot rule out regulatory reform. There is work on remediation on many fronts, including a forensic auditing of Crown patrons’ banking accounts. Some 250 of the 1800 top end customers in Melbourne and Perth have seen a withdrawal of their licence.

A huge cultural shift is needed over responsible gaming, which McCann readily accepts is an important part of any social licence to operate.

In peak times there are 700 staff walking the floor. “My intention is that the entire organisation culturally takes a view around customer care, patron care, employee care which includes responsible gaming, so my expectation is that all 700 of those people will have that mindset and that’s a significant shift,” McCann says.

Incoming Crown chair Ziggy Switkowski lends a weight of experience operating in a regulatory environment. He chairs NBN Co and was a former CEO of Telstra.

“It’s an environment where a very experienced level head is very important addition to our board,” McCann says. “We are a public company. We’ve got to meet our community, government and regulatory obligations but we’ve got to do that with an eye on how do you maximise shareholder value. It takes a fair bit of commercial acumen to bring those things together.”

The impact on revenues on change at Crown is muddied by lockdowns but McCann is not prepared to accept that Crown will not be as profitable as in the past. He wants to reposition the premium international market to replace junkets and post-Covid in 2023 he sees pent-up demand in Sydney, as there was in Perth, with tourism driven by the high-end offering.

Crown management have renegotiated with its bankers to extend funding and waive some financial covenants while committing not to pay dividends for the December half-year.

Enough to keep their investment rating and keep takeover interest from groups like Oaktree capital at bay.

And while it will be costly to make changes, in the end he sees a level playing field. “Our objective is to set a standard that is very high and that our competitors will need to meet,” McCann says.

For now, the highest priority is to retain the licence to operate. Much rests on Finkelstein and the Andrews government response.

–

Green dream

If the strategy works, Fortescue’s $400m to $600m investment into hydrogen this year will bring even lower costs to its iron ore production and turn Fortescue green for 2030.

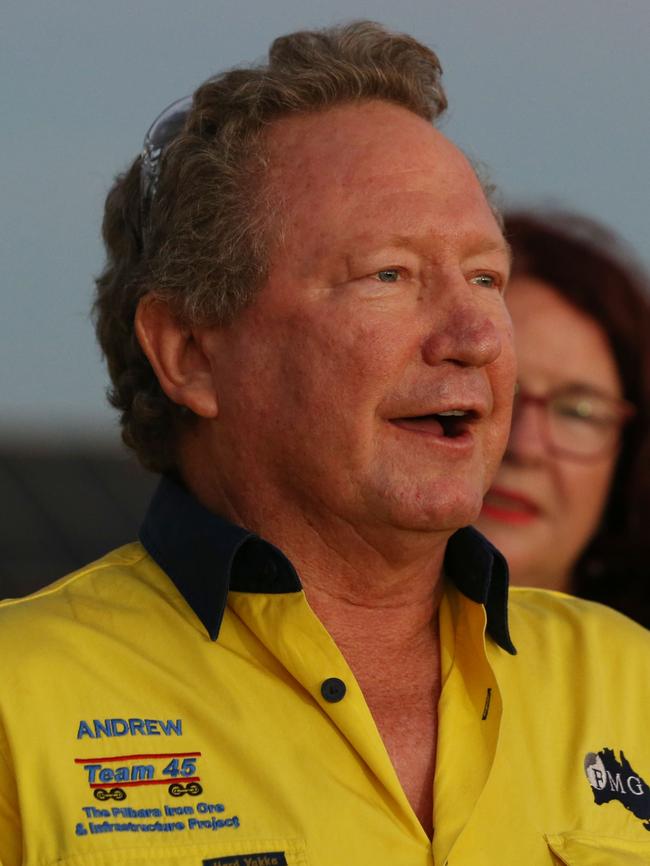

A second year of record performance for Andrew Forrest and his chief executive Elizabeth Gaines delivered $10.3bn in net profit for the miner. With a commitment to allocate 10 per cent of net profit to the company’s Fortescue Future Industries, this year’s hydrogen play is comfortably within limits.

Forrest’s energetic sell to investors and the media painted visions of a green haulage fleet bellowing nothing but steam. With big decisions on the haul truck fleet within the next three to four years, Gaines wants to be at the forefront of next-gen mining equipment.

A quarter of the FFI investment will go to the fleet, and another 25 per cent in research into new technologies with a CSIRO tie-up. The remainder goes to taking the project opportunities through to study stage in both Australia and internationally.

FFI will have Fortescue as a customer and look to export hydrogen. Gaines says green iron ore and potentially green iron from that ore, produced by 100 per cent renewable energy, will create a new price premium and is the cornerstone of Fortescue’s aggressive commitment to be carbon-neutral by 2030.

“If we are producing over 180 million tonnes of iron ore every year and it is done with no emissions, we will be the first iron ore producer to be truly green,” she said. “Energy costs will go up for fossil fuels so we will start to see the introduction of renewable energy that will see our costs continue to reduce.”

For that to happen the research, development and commercialisation all needs to deliver in nine years.

If any business has the capacity to be quick to fail and then succeed, as Andrew Forrest likes to put it, it is the miner that can pay its hydrogen-fixated No.1 shareholder $2.4bn and throw another $2.8bn to $3.2bn at iron ore production growth.

Fortescue shares romped up over 6 per cent on the day.

Monday’s sobering annual result for Crown Resort was pitched most importantly at one man: Ray Finkelstein QC, who will deliver his conclusions from Victoria’s royal commission on October 15.