Winners and losers: Rise in ‘relistings’ in Qld post property boom

Dozens of Queensland homeowners have lost hundreds of thousands reselling homes they bought at the peak of the boom, but others have turned a profit.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Dozens of Queensland homeowners have lost hundreds of thousands of dollars reselling homes they bought at the peak of the pandemic property boom in what could be the first signs of a rise in stressed sales.

Exclusive analysis by Suburbtrends has revealed that 1849 properties bought between January 2020 and the end of December last year have been relisted within the past three months, with 4 per cent of those properties – 71 dwellings – recording sales losses.

MORE NEWS: How your rent horror story could be in Slumlord video game

Warning: Brace for at least four more interest rate rises ahead

EOI for Aussie actors home and theatre in North Qld now closed

And the majority of the biggest losers were buyers who bought towards the top of the market.

A house at Burleigh Heads that was bought for $1.77m in February last year, sold for $1.35m in November – a staggering $420,000 drop in nine months.

The owners of a Currumbin Waters house also took a substantial hit, selling for $1.75m after purchasing for $2.05m just 12 months ago.

A unit in the Brisbane CBD that sold for $735,000 in October changed hands again for just $350,000 in December – a $385,000 drop in just two months.

Losses were recorded right across the state, from units in Bentley Park and Brisbane to houses in Townsville, the Gold Coast and Sunshine Coast.

A house in Buderim re-sold for $121,000 less just eight months later, while up north, a house at Alligator Creek, which sold for $740,000 in June last year sold again for $595,000 just six months later – a $145,000 drop.

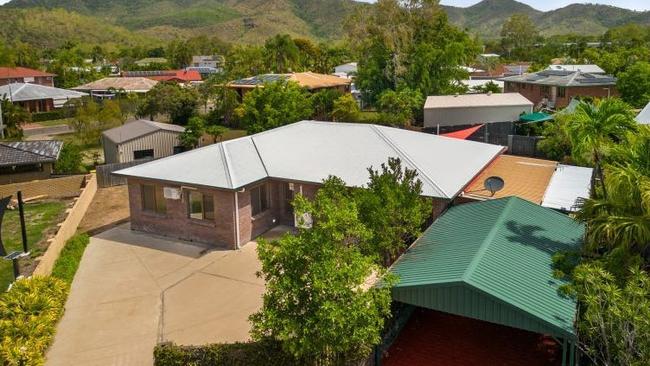

In Cairns, a house in Andergrove that was bought in January last year for $875,000 sold again in November for $680,000 – a $195,000 loss.

Suburbtrends founder Kent Lardner said there were many reasons why relistings were on the rise – from cost of living pressures to homesickness and lack of job opportunities.

“Many home buyers who are already feeling the pinch financially may be deciding to sell up,” he said.

“This might remove the stress associated with larger mortgage repayments, however many of the top regions for resellers are also some of the worst rental markets in the country.

“Many home buyers in the top reseller regions are people who moved away from the city during the Covid-19 pandemic and some may now regret their decision and choose to move back to the city.”

But for every loser, there have also been plenty of winners, and move-in ready homes are commanding top dollar.

A house at Hope Island that was purchased for $1.555m in October 2020 sold for $2.35m in November last year, a $795,000 profit.

On the Sunshine Coast, the owners of a property at Maleny walked away with a windfall of $740,000 just 20 months after buying it in March 2021.

A house in Clayfield earned its owners $200,000 profit when it sold for $1.7m in November – 18 months after they bought it.

Up north, the owner of a house at Idalia in Townsville pocketed $105,000 above their original purchase price in just 14 months, while a house at Kewarra Beach sold for $770,000 in November – $390,000 above what the vendors paid in September 2020.

And it is a trend that Mr Lardner expects to continue, with the property data analyst tipping more relistings to come.

He said that listing volumes across the country were rising and the proportion of relistings (properties sold within the last 3 years and resold recently) in Queensland was 33 per cent.

“This is a significant over representation for the state which throughout 2022 represented around 25 per cent of total property sales nationally,” Mr Lardner said.

“The Gold Coast (8%), Sunshine Coast (4%) and Wide Bay (3%) represent the top 3 most highly represented regions for relistings in Australia currently.”

Harcourts Coastal sales director Rob Forde said he was aware of a number of relistings in recent months.

“I know of a few who moved to the Gold Coast as they could work remotely, but they have had to sell as they have been recalled back to offices in Sydney and Melbourne,” he said.

“But I don’t know of any that took any big hits, some got out without making any money.

“And I would say there might be more (relistings) in coming months and it will be more challenging for those who bought at the peak, but if they don’t have to sell, our rental market is still tight with good returns.”

Mr Forde said that while interstate migration had slowed, it was still occurring.

The latest REA Market Trends report for February shows that median house values have fallen in 209 Queensland suburbs in the past three months, dropping between 0.1 per cent (Margate, North Lakes, Railway Estate) and 27 per cent (Banyo, Surfers Paradise).

But PropTrack economist Angus Moore said real estate was typically a long game and people should not panic.

“Most people don’t buy and sell in six months so what happens on a month-to-month basis should not affect many people,” he said.

“Prices are down 3.8 per cent since the peak in Brisbane and we do expect to see further falls in house prices but we are not seeing the pace of falls that we saw last year, they aren’t falling as quickly.”