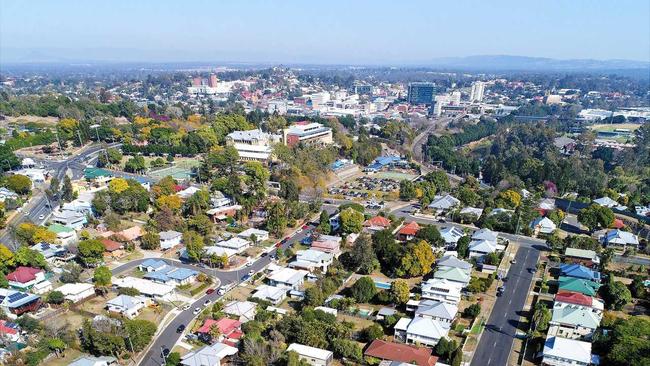

Where you can still buy a house in Qld for under $600k

The number of house suburbs under $600,000 has halved in just four years. Now a report reveals the ‘affordable’ spots to look for first home buyers and investors. INTERACTIVES

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

THE number of suburbs where buyers can score a house in Queensland for under $600,000 has halved in just four years, with units providing the only real hope for first home purchasers in the southeast corner.

New data shows that there are now just 362 suburbs with a house price below $600,000 across the state, down from 630 in March 2020 at the start of the pandemic property boom. Back then, buyers had the choice of suburbs across every Queensland region.

Now there are just five suburbs across Brisbane with median house values below $600,000 - Russell, Lamb, Macleay and Coochiemudlo islands, and Rocklea.

There are no house suburbs under $600,000 remaining on the Sunshine Coast, and just one on the Gold Coast, Stapylton.

But for those able to stretch their budget a bit further, the PropTrack Affordability Hotspots 2024 report has revealed where price-conscious first home buyers and investors should be looking now.

In the Brisbane region, areas to the south and west were the most favourable for cash-strapped buyers, whilst in the regions, buyers should look to the Outback, Townsville, Darling Downs-Maranoa, Cental Queensland and Mackay regions.

“Brisbane features favourable affordability to the south and west of the city,” the report said.

“Three of the most affordable areas are in the southern Logan-Beaudesert broader region – with a median income (in a) Brisbane household able to afford one in five homes in the most affordable Springwood–Kingston region.

“The west of Brisbane, particularly Ipswich, also features favourable affordability.

“Inner Ipswich and the hinterland both remain promising locations for first-home buyers looking to buy a house.”

The median house price in Springwood is now $820,000, up from $540,000 five years ago.

Kingston house values hit $520,000 in March, up 73.5 per cent in five years.

But buyers can still secure a house for under $600,000 in 43 Ipswich suburbs, with prices ranging between $392,500 (Forest Hill) and $592,500 (Flinders View).

Logan-Beaudesert has 10 suburbs with a median house value below $600,000, from Logan Central ($530,000) to Bethania ($600,000).

Outside of Brisbane, outback regions featured some of the best bang for buck in the country, with households able to afford more homes relative to their income.

“Regional centres in Queensland continue to attract residents due to favourable affordability conditions, with places such as Townsville seeing double-digit price growth over the past year,” the PropTrack report revealed.

The median house price in the Townsville LGA is $430,000, while for units it is $280,500.

Other places to get a gong on the PropTrack affordability checklist were the Outback, south and north, which encompasses places such as Cooktown, Longreach and Barcaldine, Biloela in Central Queensland, the Darling Downs-Maranoa region, and, the North Bowen Basin in the Mackay-Isaac-Whitsunday region, which takes in suburbs such as Grasstree Beach, East Mackay, Clermont and Bowen.

Report author and senior economist Paul Ryan said the index looked at the proportion of homes sold between July 2023 to March 2024 that were still affordable to households using just 25 per cent of their pre-tax income on mortgage repayments, below the mortgage serviceability buffer.

He said that the findings showed that “very few regions remain affordable to households earning median incomes (or lower)”.

“This highlights the role existing wealth plays in entering home ownership given the high

level of prices across the country,” he said.

The research found just seven Queensland regions where more than 50 per cent of recent sales would be considered affordable compared to the median household income - all in regional areas.

Meanwhile, there were no sales across 15 locations where a household with a median income of about $107,000 could afford to buy using just 25 per cent of pre-tax income, the research found.

Areas included The Hills District, The Gap-Enogerra, Sunshine Coast Hinterland, Coolangatta, Centenary and Kenmore-Brookfield-Moggill.

The report comes after the most recent PropTrack Home Price Index revealed that Brisbane’s median home price surpassed $800,000 for the first time in history in March.

Dwelling values — houses and units combined — grew another 0.41 per cent, with the median price now 12.9 per cent higher than it was 12 months ago, and only $1000 behind Melbourne at $802,000.

Brisbane home prices have grown by more than 63 per cent since the start of the pandemic

— almost double the growth in Sydney — and the median price of $801,000 is now just over $200,000 less than Australia’s most expensive real estate market.

MORE NEWS: Relief for Townsville tenants

Ultimate motocross, golf course property hits Qld market

Donor gifts $21m to buy cattle station for endangered parrot

The River City’s median house price is now $895,000, while the median unit price grew another 0.6 per cent last month to reach $600,000.

But it is not just the capital that is showing continued price growth, with the median value across regional Queensland now $645,000 – just $152,000 less than Brisbane.

Ray White Group analyst Jemima White said only 55 per cent of Millennials aged between 25 and 39 now owned their home.

“Whereas at the same age, 70 per cent of the Baby Boomers owned their own home in 1991 and 65 per cent of Gen X owned their own home in 2006,” Ms White said.

“This demographic shift in home ownership may be representative of the fact that many young adults today are priced out of their capital city markets.

“In 1991, owning a capital city home was achievable for many young adults as more affordable housing meant many could save up for a deposit by the time they were ready to move out of their parents home and start a family.

“Today, in a much less affordable market and a challenging purchasing environment, many young adults that are ready to buy their first home may be hesitant as they are priced out of the capital-city market they’re living in.”

Ms White said rentvesting, where a buyer purchases an investment elsewhere and continues to rent in their location of choice, had become a popular alternative for young buyers to get into the market.

She said Commonwealth Bank data showed that over 50 per cent of property investment purchases in the past year were made by Millenials and Gen Z.

“The capital gain made on the investment property can ultimately assist with the purchasing power of the young adult when they are in a position to purchase a property in their desired location,” she said.

Meanwhile, a recent Finder survey of 1070 people nationally revealed that 12 per cent of Aussies had turned to shared housing in the past 12 months.

Of those, 5 per cent cited rising rental costs as the reason for the move, while a further 3 per cent said they could no longerafford their mortgage repayments.

“Rents and mortgages have gone through the roof – they are the number-one source of financial stress in Australia and people can no longer cut costs elsewhere to get by,” Finder head of consumer research Graham Cooke said.