Where Qld buyers can shop now following borrowing capacity cuts

Queensland buyers have seen as much as $511,000 wiped from their borrowing capacity since last April. See where you can buy now.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

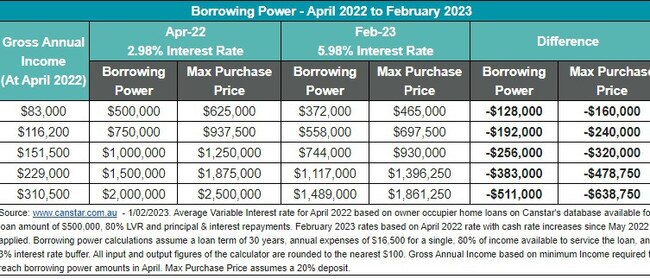

Queensland buyers have seen as much as $511,000 wiped from their borrowing capacity since April last year, with first-home buyers and families taking the biggest hit to their budgets.

Analysis by Canstar and News Corp Australia has revealed that first-home buyers with a borrowing capacity of $500,000 and a maximum purchase price of $625,000 just 10 months ago, can now only borrow $372,000 and spend up to $465,000.

Ten months ago, those same first home buyers could shop for a house in 157 suburbs across Greater Brisbane, but that number has shrunk to just 34 suburbs, analysis of the latest REA Market Trends report shows.

Even traditionally affordable suburbs such as Caboolture and Deception Bay in the Moreton Bay region, and Ellen Grove and Darra in Ipswich are largely out of reach for many young house buyers.

And it even harder on the Gold Coast and Sunshine Coast, with the median house price in just two suburbs coming under their new maximum budget of $465,000 – Stapylton and South Stradbroke.

The Sunshine Coast’s cheapest suburb – Nambour at $610,000 – is now $145,000 over budget due to rapidly declining borrowing capacities.

First home buyers who have seen their borrowing capacity plummet by $128,000 should now be looking to suburbs like Gleneagle, Kairabah and Kooralbyn (Logan), Cooloola Cove and Tin Can Bay (Wide Bay), Bluewater Park and Annandale (Townsville) and Laidley Heights or Walloon (Ipswich).

MORE NEWS: Expert tips: Where to buy to make money in Qld in 2023

Qld island paradise could be yours for $2

Millenial moguls: Where to invest now to make $1m in 10 years

And it is not much easier for families who, with a borrowing capacity of $750,000 and maximum purchase price of $937,500 just 10 months ago, have taken a $192,000 hit to their budgets.

Now those same buyers can borrow $558,000 and spend up to $697,500, according to Canstar.

There are 536 suburbs across Queensland where those buyers can now purchase a house, down from 877 in April 2022.

Just 10 months ago, a family could buy in Peregian Springs, Port Douglas, Tamborine or Upper Kedron.

Now they can shop in Nikenbah (Wide Bay), Bannockburn (Logan-Beaudesert), Yungaburra (Cairns), Nambour (Sunshine Coast) and Fitzgibbon (Brisbane).

But even those with heftier budgets have taken a walloping, with a borrowing capacity of $1 million (maximum purchase price of $1.25m) shrinking by $256,000.

Borrowing capacities of $1.5 million (max purchase price of $1.875m) and $2 million (max $2.5m) have fallen by $383,000 and $511,000 respectively.

A buyer with a maximum purchase price of $2.5 million last year is now locked out of five suburbs – Teneriffe, Mermaid Beach, New Farm, Surfers Paradise and Sunshine Beach – compared to just two suburbs (Sunshine Beach and Surfers Paradise) just 10 months ago.

To put that $511,000 into perspective, the median house price in Collingwood Park, Wongaling Beach, South Toowoomba and Black River is roughly the same.

And those declining borrowing capacities are having a flow-on effect to contracts, with over 70 properties across Queensland having been relisted after an existing contract “crashed”, often on finance, and they range from acreage properties to beachside units.

Canstar’s Steve Mickenbecker said the interest rate rises were having a “severe” effect on borrowers who bought near the top of the boom market, with big loans and no time to build up a buffer.

“However, interest rates don’t discriminate on the basis of income when it comes to diminution of borrowing power, with borrowers at all income levels now finding that they can no longer afford the loan size they expected,” he said.

“There has been a price correction and the decline in purchasing power has no doubt contributed, but the price fall is nowhere near the 25.5 per cent fall in purchasing power.”

Mr Mickenbecker said the result could see buyers “chasing each other down the price ladder rung by rung”, with first home buyers and low income earners likely to find themselves crowded out again.

RE/MAX Bayside Properties agent Sam Neilson recently relisted a Wellington Point property after its previous contract crashed on finance.

“I have had a few clients declined on finance in recent months,” she said. “They were pre-approved for an amount that just didn’t stack up when they went for the contract.

“It is exceptionally tough for buyers, and while vendors have softened a bit, they aren’t panicked as they realise the market is holding up quite well.”

First National Real Estate Moreton agent Mark Cheney said interest rates were still historically low, and prices in his area had come back around 10 per cent.

“I have no shortage of buyers but I do have a shortage of stock,” he said.

“I reckon there will be plenty of properties on the market in 6-12 months when fixed rates come off.”

Ray White chief economist Nerida Conisbee said the changes would be hardest felt in first home buyers suburbs and potentially new home estates.

“We have also seen new home loan approvals drop dramatically because stock is low but capacity has just dropped considerably,” she said.

Mr Mickebecker said that while it was tough, buyers could counter some of the pain by accessing lower interest rate loans.

“Banks have started to reserve their best rates for those with generous equity in their house, loan size that doesn’t test the limits of affordability and a track record of being ahead with their repayments,” he said.

“Unfortunately, first-home buyers and low-income earners don’t have that luxury and are less likely to tick these boxes.”