Super funds wage war on bid to use member balances for first home deposit

First time buyers hoping to follow New Zealand’s lead to use super to help fund their home loan deposit have been dealt a blow by a powerful superannuation group that’s lobbying against it.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A war of words has erupted after a superannuation lobby group claimed allowing members using their own super balances for first home deposits would increase housing prices by $75,000.

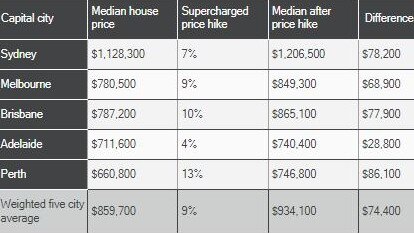

This after the Super Member’s Council – which represents superannuation funds that have $1.4 trillion in members funds to invest as they choose – released a report claiming that allowing Australians to access money in their super accounts to buy a first home would inflate house prices by an average of $75,000 across the country’s five largest capital cities.

MORE: Desperate bid to fix ‘silver tsunami’ of empty homes

Hot auctions: 449sqm block of land sells for $845,000

‘Ruthless’: How two in 5 Aussies will buy a home in next 5 years

SMC said their modelling found “pouring retirement savings into housing would inflame an already-inflated property market – pushing up the major capital city median price by an estimated 9 per cent”.

The modelling was based on allowing first home buyers to take $50,000 from their super savings for a deposit.

SMC CEO Misha Schubert said “using retirement savings for house deposits would just unleash a huge price hike”.

“That would mean higher and longer mortgages for Australians – and would quickly make capital cities even less affordable for new home buyers struggling to get into the market.”

“We all desperately want more Australians to own their own home, but this idea won’t achieve that – it would just make that goal even harder for first home buyers by making house prices even more expensive.”

According to SMC analysis, a 30-year-old couple who withdrew $35,000 each from their super could retire with about $195,000 less in today’s dollars.

“An academic review of the New Zealand super scheme, Kiwisaver, that allows withdrawals for housing, found balances were far lower partly due to the country’s first home deposit withdrawal scheme. New Zealand also has a lower rate of home ownership than Australia.”

But Brisbane-based Australian Institute for Progress executive director Graham Young said in a statement that the SMC modelling was “rebutted by the facts”.

“It’s predictable a superannuation fund lobby group would be opposed to a policy which reduced superannuation funds under management, even temporarily, but they are not doing any favours to the 10 million Australians who have $1.4 trillion in accounts with their members,” he said. “These Australians deserve the best chance at security during the whole of their working life, as well as in retirement.”

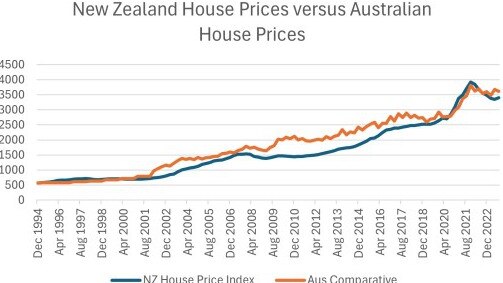

He said “the Member’s Council references New Zealand where first home buyers have been able to access their Kiwisaver accounts for a deposit for a first home since 2007, but the Kiwi figures show their model to be wrong.”

“New Zealanders were first able to borrow for a deposit from Kiwisaver in 2007, yet prices went down immediately afterwards, and in fact were lower than Australia’s until 2020. The real world data say there is something drastically wrong with the SMC model.”

He said “before the Kiwisaver policy New Zealand started with lower home ownership than Australia by 2.4 percentage points (66.9pc versus 69.3pc in 2006) but in 2018, the last year we have New Zealand data the gap had shrunk to only 1.7 percentage points”.

See the latest PropTrack Home Price Index

He said Australia needed a retirement policy, not a superannuation policy.

“While the SMC would no doubt like to manage more money, the truth is that the biggest indicator of financial distress in retirement is not owning your own home, irrespective of your superannuation balance. We need to deal with the savings of Australians equitably. It is their money that the superannuation firms have been made the custodians of, but they have a right to use it to their best advantage.”

He said the financial returns of housing over time were far superior to superannuation.

“The leverage involved in most house purchases gives a great return on the capital employed, when the property is sold it is exempt from capital gains tax, and the owner gets the benefit of not having to pay rent, freeing up resources for other needs.”