Regional Qld property values remain strong despite downturn

Dwelling values in regional Queensland are proving to be more resilient than those in the once overheated southeast market, with three regions only now reaching their price peaks.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Dwelling values outside of southeast Queensland are proving more resilient than those in the capital, with values down just 1.89 per cent since their peak compared to 2.77 per cent in Brisbane.

The latest PropTrack Market Insights Report shows that demand for more affordable regions and larger homes continues to support regional values, with three regions hitting peaks in October – Toowoomba, up 12.96 per cent year-on-year, Townsville up 6.41 per cent and Mackay-Isaac-Whitsunday up 7.28 per cent.

But those same regions could still be rising, PropTrack senior economist and report author Eleanor Creagh said, adding that the ‘regional renaissance’ that lead to regional home prices booming throughout the pandemic had seen prices outside of the capitals holding up stronger.

Cairns values were down 0.2 per cent in October.

MORE NEWS: Beach apartment block for price of average home in southeast Qld

Qld rental crisis: ‘Virtually nowhere to go’

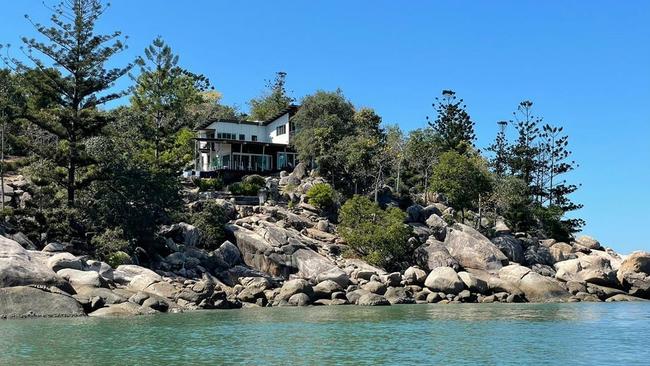

Heritage-listed WWII site in Qld hits the market

“Regional home prices have increased 6.49 per cent in the past year, compared to a 2.08 per cent decline in the capitals,” she said.

“Home price falls in regional Australia are also not as widespread as metro areas.

“Out of the 42 regional areas classified by the Australian Bureau of Statistics as SA4s, 28 have seen prices fall from their peak, while 41 of the 46 metro regions have seen home prices slip from peak levels.”

Ray White’s Julie Mahoney said Townsville hadn’t seen the “out-of-control” price growth that some southern regions had, with the garrison city only now just “on par” with its previous housing price boom.

But Ms Mahoney said rising rates and reduced borrowing costs were having some impacts on budgets in outer suburbs.

“Even if we are at the peak, I suspect it will remain a steady peak,” she said.

“We are seeing our population increase, people are still relocating here, our vacancy rate is less than 0.5 per cent, there is not enough stock to meet the demand.

“We have what I call parkers, people buying anything instead of renting and then waiting out for their dream home.

“You can’t generalise Townsville in terms of peaks as places like the inner-city, which is tightly held anyway, is strong.”

At the other end of the spectrum is the Sunshine Coast and Gold Coast, arguably two of he hottest regions for interstate migration during the pandemic migration.

Both have seen values falling the fastest on the back of interest rate hikes, with Sunshine Coast values dipping 5.1 per cent from their peak and the Gold Coast down 2.2 per cent, according to the report.

Harcourts Coastal Group director Dane Atherton said the minor decline in values was not surprising but had hardly been noticed in the market.

“It is a minor speed bump,” he said. “Buyer activity is still high and stock is still low.

“Compared to places like Sydney and Melbourne, the Gold Coast is holding up way better.

“It is like the rest of the country has decided to park their money here.”

Meanwhile in a recent blog post, Tom Offermann of Tom Offermann Real Estate said the Sunshine Coast market was “resilient yes, unaffected, no” by market conditions.

“A tiny bit of the sparkle has come off certain sectors of the market, with prices being achieved around 5 to 10 per cent less than their peaks in late 2021,” the blog said.

“When you consider that prices rose in 2021 by around 25 per cent after a similar amount the preceding year, today’s prices are still fantastic for sellers who moved on their price a little to achieve a sale.”

But Mr Offermann said the current conditions also presented a reprieve for buyers after a tough three years.

“Thinking less about the current price and more about what it will be worth in the future is a good strategy,” the blog said.

Looking at all of the combined regional areas, regional Victoria and regional NSW have recorded the biggest falls from their peaks, down 2.45 and 2.24 per cent respectively.

Regional Queensland is down 1.89 per cent from its peak and down 0.05 per cent in October.

But that comes after combined price growth of 8.6 per cent over the year and a whopping 48.1 per cent since March 2020.

But while demand for the more affordable regions has supported values, conditions remain tough for regional buyers due to the number of listings well below pre-pandemic levels, according to the report.

“More expensive regions – particularly those that were in high demand in the pandemic – have seen home prices falling fastest as higher interest rates are affecting higher-priced regions most,” Ms Creagh said.

The economist said that while the regions were outperforming capital cities, as interest rates continued to rise and borrowing capacities continued to fall, values in some area may also tumble further.

“Although, it’s likely that the regions where supply remains limited will still see stronger competition and exhibit a lesser pace of price falls as a result,” she said.