RBA warns double digit fall in property prices likely as rates rise

The Reserve Bank has warned a rise in interest rates could see houses lose a chunk of their value, wiping out 2021’s gains, as three of Australia’s big banks predict hikes will begin Tuesday.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The Reserve Bank has warned a rise in interest rates could trigger a double digit percentage fall in housing prices – with three of the big four banks now expecting hikes to begin Tuesday.

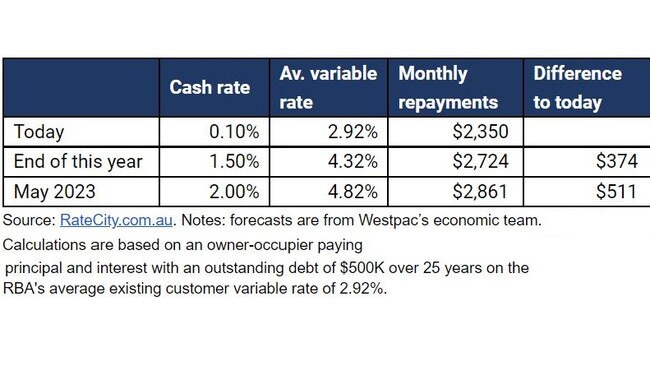

Three of the big four banks are now predicting hikes to begin when the RBA board meets on Tuesday, with analysts expecting the average mortgage holder to pay around $100 more a month in repayments as soon as next month, climbing to as much as $511 a month by this time next year.

MORE: Interest rate pressure builds as inflation hits 13-year high

How to win a $10m beachfront apartment block

Coast tops list of best suburbs for budget buyers below $610,000

In its latest statement on household and business finances, the RBA warned the possibility of swings in housing price growth should be factored into lending and borrowing decisions saying future increases in rates could weigh on housing prices.

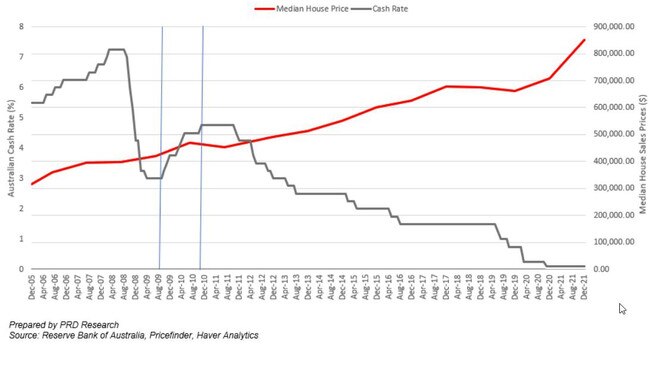

“Estimates using a model of the housing market that takes into account historical relationships between interest rates and both demand and supply factors suggest that a 200 basis point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period,” the RBA paper said.

That would wipe out a big chunk of the record growth achieved in 2021 – when housing prices rose 22 per cent across the country.

RBA said the pace of housing price growth was already moderating in most markets this year, urging lenders and borrowers to “consider the potential for falls in housing prices, particularly for loans at high LVRs”.

Thursday’s shock inflation figures, confirming a 5.1 per cent rise in household costs, has prompted Westpac, NAB and ANZ to bring forward their expectation of a rate hike by RBA – with all three picking Tuesday for the first move of around 0.15 percentage points, with Westpac and ANZ also expecting another in June of 0.25, according to RateCity analysis.

CBA believes the cash rate target will go from the current 0.1 per cent to 1.25 per cent by February 2023, Westpac thinks it will be 2 per cent by May 2023, NAB has pegged 2.5 per cent by August 2024, and ANZ expects it to be 2.25 per cent by this time next year and peak above 3 per cent sometime after 2023.

RateCity analysis found someone with a $500,000 mortgage would pay $39 a month extra if RBA hikes by 0.15 percentage points on Tuesday and $104 extra if the cash rate target also goes up by 0.25 percentage points in June.

It said if the cash rate hit 2 per cent by May next year, the average owner-occupier with a $500,000 balance, and 25 years remaining, could see their repayments rise by $374 a month by the end of this year and $511 by May 2023.

PRD Research chief economist Dr Diaswati MardiasmoIt said the RBA analysis of a double digit fall in prices off a 2 percentage point rise in the cash rate target was interesting, but the current situation was different given the “deep imbalance between demand and supply”.

“There is definitely a lot of fear at the moment in regards to cash rate hikes,” she said. “I think until we actually see it a cash rate hike and how other banks and lenders react (in terms of home loan mortgage products) we won’t truly know the impact.”

She said history showed it took several cash rate hikes, in succession, over a period of roughly 12 months, before it impacted housing prices.

“Our current property market situation differs greatly than 2009/2010,” she said. “The current demand we have is more so local demand, due to a triage of factors: Covid restrictions, federal government homeownership grants, and demographic changes. We are yet to receive the normal pre-pandemic level of international demand for property. We are yet to have the pre-pandemic local and international ‘normal’ type of demand.”

“What’s more, we still have a significant supply issue, with less new ready-to-sell stock coming into the market due to rising construction costs. The deep supply and demand imbalance right now may result in an even longer lag time between when cash rate hike will translate into property prices.”

She said borrowers who were already stretched on variable rates would feel the impact of any coming cash rate hikes.

“As of December 2021, the family income to meet mortgage repayments were at 37 per cent; and most measures will classify 30 per cent or more as heading towards mortgage stress.”

The RBA is counting on APRA’s move in October 2021 to shield borrowers – when it required banks to assess the ability of borrowers to service debt at least 300 basis points higher than the prevailing loan interest rate.

“The increase works to reduce maximum loan sizes, and so reduces the amount of credit extended to riskier borrowers who seek to borrow very close to their maximum borrowing capacity (and as a result are more prone to repayment difficulties if they experience a fall in income or a rise in expenses),” the RBA paper said.

RateCity.com.au research director, Sally Tindall, said a rate hike next week was now “a live possibility” with three of the big four banks predicting RBA will hike.

“While a series of rapid rate hikes are imminent, just how high the cash rate will go remains a point of conjecture,” she said.

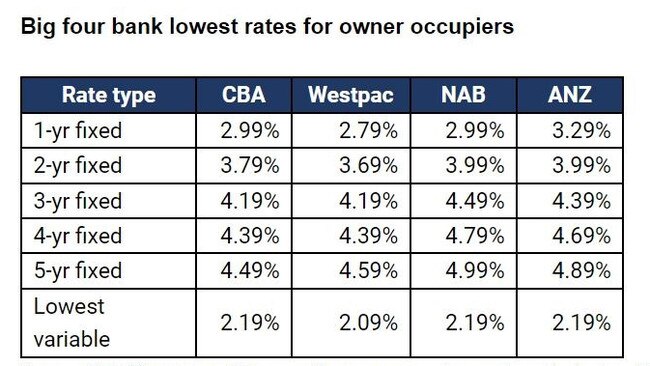

“One thing likely to hold the RBA back is the fact that many Australians up to their necks in housing debt. Many people may now be wondering if it’s worth fixing their home loan, even though ultra-low fixed rates are long gone.”

She said the last thing homeowners should do is panic fix rates without looking at their options.

“If you decide to fix, it’s critically important to shop around. There are still relatively decent fixed rates out there, but they are getting harder to find by the day.”

RateCity was currently showing the lowest two-year fixed rate at 2.45 per cent and the lowest three-year fixed rate at 2.79 per cent.

The RBA board’s monthly monetary policy meeting will be held on Tuesday May 3.