‘None of us are immune’: Higher rate hike for investors abandoned

A peak real estate body warns the rental crisis continues to deepen across Queensland, welcoming a council decision to abandon plans to slug investors with higher rates than others.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A peak real estate body warns the rental crisis continues to deepen across Queensland, welcoming a council decision to abandon plans to slug investors with higher rates than others.

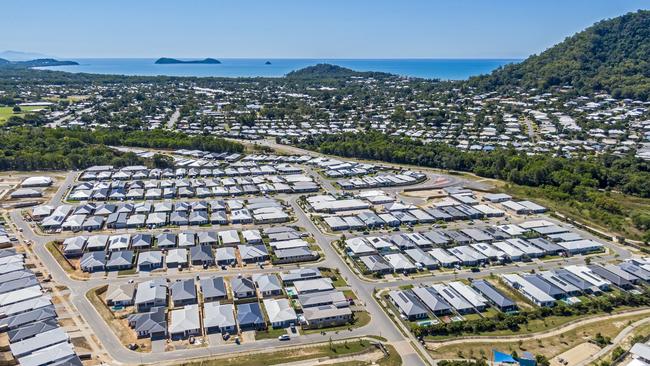

Real Estate Institute of Queensland head Antonia Mercorella said a decision by Cairns Regional Council to drop a plan to charge higher rates for investment properties was “a win for commonsense” which she hoped other local governments would take note of.

No comment could be obtained from the Cairns Regional Council which reportedly backtracked on a decision made last year to single out investors with higher rates from 2023/2024.

MORE: Dogs, cats, get almost $600,000 windfall off Qlder’s dying wish

Mango farm with surprising slices of NQ history listed for sale

Ms Mercorella said “rather than new fees, what we need is more investors to bring rental properties to the long-term market”.

“Given the immediate need of the crisis, it’s time for the government to try taking a carrot approach rather than continually coming at investors with the stick.”

She said “from the outset, our local Zone Chair for Cairns Tom Quaid highlighted that it was a very delicate spot to be poking and property investors would not take this quietly”.

“We continually caution all levels of government about the dangers of overregulation and the increasing fees and taxes that everyday mum and dad investors are being hit with.”

“None of us are immune to the rising cost of living pressures such as rising interest rates, local government rates, and repairs and maintenance.”

Property investors across Cairns had earlier received an “unwelcome surprise” in the form of a letter flagging higher rates from the 2023/4 financial year for non-principal place of residence properties, she said.

The higher rates were to be determined as part of the 2023/24 council budget process.

“While the rental crisis is being experienced Queensland-wide, it’s our regional markets that are feeling the squeeze most of all,” Ms Mercorella said.

“The latest REIQ Residential Vacancy Rate Report showed Cairns is sitting at a mere 0.7 per cent vacancy rate in the December 2023 quarter.”

“This rate has not risen above 0.8 per cent over the past two years – which is considered a very tight market and well below the 2.6-3.5 per cent range that the REIQ classifies as ‘healthy’.”

“These numbers tell a story about how challenging it is for people looking for a place to live in Cairns and indicates how vital rental stock is to the region.”

FOLLOW SOPHIE FOSTER ON TWITTER