‘Millionaire migrants’ flood Aussie property market

Australia has claimed the world’s largest share of cashed-up new arrivals as property prices hit new highs.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Australia’s status as a safe haven has attracted more cashed-up foreign property buyers than any other country globally, while strong population growth was among factors pushing home prices to a new record high.

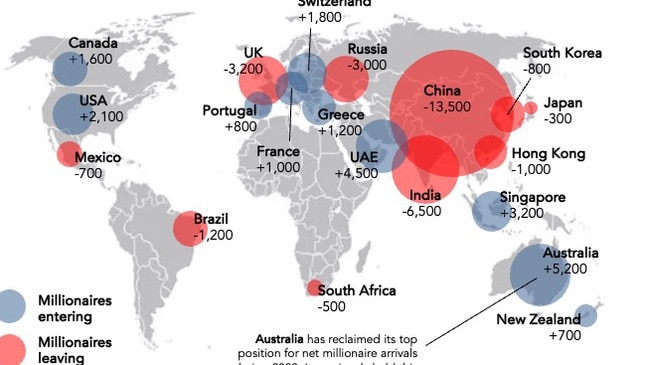

In 2023, Australia reclaimed the top position for net millionaire arrivals, with about 5,200 individuals entering the country, according to a new report by Gold Coast real estate agency Kollosche in collaboration with industry analyst Michael Matusik.

The United Arab Emirates ranked second with 4,500 new millionaires, followed by Singapore with 3,200, and the United States with 2,100 cashed-up migrants in 2023.

It comes as PropTrack’s latest Home Price Index shows values lifted 0.23 per cent nationally to hit a new record in April, with home prices now 6.6 per cent higher than at the same time last year.

Brisbane was one of the top performing capital cities, with the typical home price of $818,000 now 12.82 per cent higher than last year.

The PropTrack report shows home prices in regional Queensland also hit a new peak in April, up 10.03 per cent annually to $659,000.

PropTrack senior economist Eleanor Creagh said a “mismatch” between supply and demand would continue to drive prices higher over the coming months, despite some reent easing in population growth.

“Strong population growth, tight rental markets, low unemployment and home equity gains are stimulating housing demand,” Ms Creagh said.

“Meawhile, the supply side of the housing market has fallen short in responding to substantial demand.

“Building activity is at decade-low levels, exacerbating the housing supply shortage.”

Kollosche’s Property Price Drivers report found foreign demand for Australian housing was greater than ever, with net immigration numbers up by 500,000 in the year to June 2023 — more than twice the intake in 2019.

While many of Australia’s new millionaire migrants settled in either Sydney or Melbourne, the Gold Coast attracted an average of 10 to 15 percent of them each year, according to the report.

Kollosche principal Michael Kollosche said the Gold Coast was “punching above its weight” as a city that makes up just three per cent of the country’s population.

“Australia is seen as a safe haven among our buyers. You can also get a significantly larger house or apartment on the Gold Coast compared to Sydney and Melbourne for the same price, and arguably with a much better climate and lifestyle which certainly plays into it,” Mr Kollosche said.

A foreign buyer snapped up a Southport trophy home for $24.8m in 2023, setting a Queensland auction record.

MORE NEWS

Crucial homebuying strategies in a hot market

Stop blaming international students for the housing crisis

‘Bad boom’: Fears property market set to explode again

Much of the recent overseas demand for Australian property had come from owner-occupiers over investors, with Chinese and Taiwanese buyers most active, Mr Kollosche said.

Offshore buyers accounted for about five per cent of established house sales, while foreigners who do not live in Australia fulltime bought up to 10 percent of all newly built homes sold in 2023, according to a recent survey of the national housing market by National Australia Bank.

“Wealthy expats are really looking for trophy assets to buy with a view to relocating home down the track,” said Mr Kollosche.

“Off-the-plan apartments are also proving very popular with expats and interstate migrants because they can secure something at today’s prices and sit on them for a two to three years while the developments are delivered.”

“Having more affluent people coming into the buyer mix does drive price growth, and in markets like the one we’re currently in you need to have a decent net worth and serviceability to be able to participate.”