Home loans Australia: ‘Unfair’ rule threatening Aussies’ homes

Urgent calls are being made to change an out-of-date rule seriously threatening homeowners’ ability to pay their mortgages and even hold onto their homes.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Borrowers are “becoming mortgage prisoners”, struggling yet unable to refinance home loans because of a bank measure put in two years ago, a survey by Australia’s peak broker body warns.

The Finance Brokers Association of Australia (FBAA) warned of the growing problem, and called for a 3 per cent serviceability buffer enforced by lenders since October 2021 to now be cut back to between 1.5 to 2 per cent.

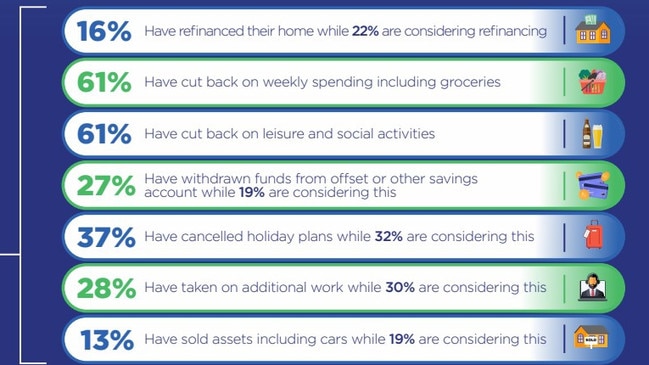

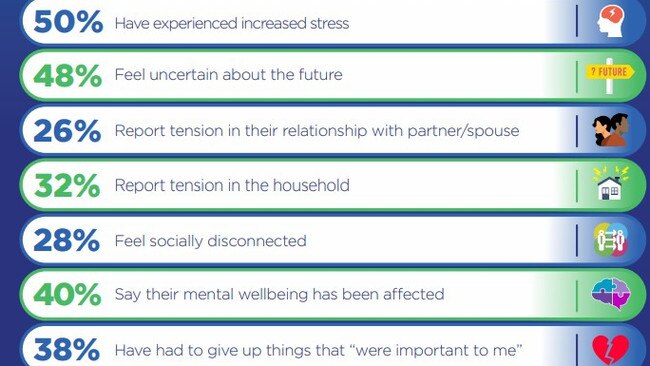

This as FBAA released its 2023 ‘Australian mortgage and rental affordability survey’, conducted by researchers McCrindle, which found large percentages of renters and mortgage holders were struggling since interest rate rises began, cancelling holidays, selling assets, taking on additional work, cutting back on groceries and social activities, depleting savings and moving to cheaper accommodation.

MORE: ‘We’re past the worst for housing prices’: ANZ Bank

Rate cut: 32 lenders slash home loan interest ahead of RBA move

Inside the Brisbane house that’s become Australia’s hottest home

The survey, out Tuesday, warned that 50 per cent of those with a mortgage had experienced greater stress amid high rates while more than a quarter reported tension in their relationship with their partner or spouse, with almost half uncertain about the future.

FBAA managing director Peter White warned “the current serviceability buffer makes it harder for mortgage holders to refinance and negotiate a better rate”.

“The buffer – which is added to a lender’s interest rate for loan assessment purposes – means that many borrowers who can afford the interest rate of the day or even a little higher, are being unfairly prevented from refinancing.”

“More borrowers are becoming ‘mortgage prisoners’, locked into a situation where they can’t access a better deal because they don’t meet the inflated assessment rate.”

Mr White said “we would like to see the Australian Prudential Regulation Authority (APRA) reassess its decision to continue with a 3 per cent loan serviceability buffer for mortgages, as interest rates rise”.

He said the three per cent serviceability buffer “was appropriate in the past because interest rates were at an all-time low and were always going to rise significantly, and this protected both the banks and the borrowers”.

“But,” he said, “we can’t live in the past and a buffer of 1.5 to 2 per cent is far more appropriate today and in the near future.”

The serviceability buffer has been in place for almost a decade, and sat at 2 per cent in early 2019, before APRA proposed it be raised to 2.5 per cent in May 2019, and then 3 per cent two years later.

On February 27 this year, APRA announced it would keep the serviceability buffer at 3 per cent above the loan rate.

“This buffer was increased to this level in late 2021, in an environment of heightened risks for the financial system,” an APRA statement said. “While lending at high debt-to-income ratios has reduced, a key concern at the time, heightened risks to serviceability remain: there is the potential for further interest rate rises, high inflation and risks in the labour market. It is important that all banks maintain prudent lending in the current environment of competitive pressure on standards.”

Mr White also called on banks not to increases rates outside of rises in their cost of funding.

“If banks raise consumer lending rates higher than they need to, it will backfire and create a greater problem. So we call on banks to do the right thing.”

He urged struggling borrowers to seek assistance “before the lender comes knocking”.

“Call your bank, mortgage broker or landlord the moment you are concerned that you may not be able to handle the increased payments. Lenders can often help and mortgage brokers have many options.”

Mr White said mortgage brokers were legally obligated to act in the borrower’s best interest.

According the latest Proptrack Home Price Index, national home prices continued to stabilise in April after rising for the fourth consecutive month, rising 0.14 per cent. The cumulative increase in 2023 is now 0.75 per cent.

The Reserve Bank board meets for its monthly monetary policy meeting Tuesday, with the market expecting 100 per cent that it will hold the official cash rate at the current level of 3.6 per cent.

FOLLOW SOPHIE FOSTER ON TWITTER

More Coverage