Families left exposed as higher costs see many ditch insurance

Families struggling with cost of living surges have taken to ditching home insurance policies rather than face more increased costs – leaving many exposed in disaster-prone areas.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Families struggling with cost of living surges have taken to ditching home insurance policies rather than face more increased costs – leaving many exposed in disaster-prone areas.

Home and contents insurance packages jumped by a median of $250, with a massive 83 per cent of people facing increases in the past year, according to exclusive survey data for News Corp Australia.

MORE: 61 homes approved in Ash Barty’s neighbourhood

‘Real life Monopoly’: Aussie 32-year-old who has 100 properties

Australia’s kindest landlord: 80pc of his rentals are ‘under rented’

The survey conducted by Compare the Market found 12 per cent were forced to reduce their level of cover, 2 per cent cancelled their home and contents policy and around 1pc entered a hardship program with their provider.

Compare the Market property expert Andrew Winter said it was “a serious issue creating a great deal of stress, not only in disaster-prone communities but across the board in communities battling the rising cost of living”.

“Catastrophic floods in Queensland, Victoria and New South Wales haven’t just seen premiums increase in affected areas. Even homeowners in low-risk parts of the country, who have never made a claim, will likely have seen a hike as the cost burden is spread.”

The median increase in premiums for home and contents insurance across the country was surveyed at $1,100 at the start of the year, with the March survey finding the median increase in NSW at $300, $250 in Victoria and $200 in Queensland.

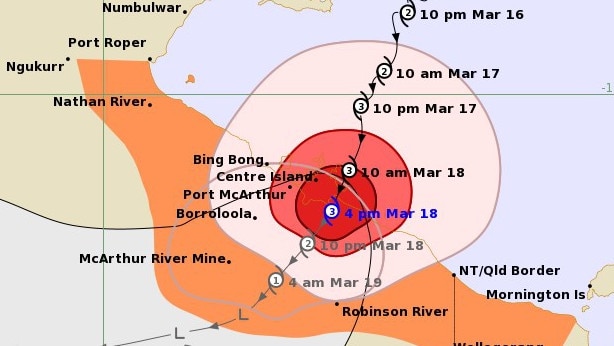

Peak body for risk assessment professionals, The Actuaries Institute – which is currently assessing premium increases and their impacts across LGAs for a report due mid year – has warned that extreme home insurance affordability pressure was highest in Northern Queensland, Northern Rivers region of New South Wales and Northern Western Australia.

It found half the population in those areas paid more than a month’s worth of gross household income for their annual home insurance premium because of “high perils risk” including cyclones for Queensland and WA and flood for NSW.

Mr Winter pleaded with homeowners to find ways to “switch, not ditch” their home and contents cover in such trying times.

“Insurers have paid out over $16.8b in claims since the black summer bushfires. Now they are starting to account for the impact of climate change, to ensure they are prepared for future wild weather events. On top of that, building material and labour supply shortages have caused the cost of repairs to surge.”

“Rather than ditching cover completely, which is a last resort option that could leave you terribly exposed should the worst ever happen, it’s worth doing some research to look for a cheaper alternative.”

He said “every insurer calculates risk differently so it’s quite possible you could find similar cover for less elsewhere. When you switch you also stand to benefit from offers and discounts reserved for new customers”.

See the latest PropTrack Home Price Index

Over half of those in the March survey took the increased premiums on the chin, 18 per cent compared and switched to a cheaper deal, 15pc increased their excess to lower their premium, and 9pc tried to negotiate a discount with their insurer.

“A common mistake we see is people insuring their land value, or paying for extras they don’t need, which can needlessly add hundreds to their insurance bill. Other saving tactics include increasing your excess – this bumps up the amount you’ll pay should you need to claim but reduces your regular premium.”

The survey of 1,010 Australians was conducted by Compare the Market for News Corp Australia in March 2024 and found three quarters of those surveyed (75pc) said they had insurance, 54 per cent had both home and contents cover, 12.6pc had contents only and 7.8pc had home only.