Cost of living intense as interest rates hit wallets, rentals

The average Queensland mortgage now costs 61 per cent more in repayments than it did in April 2022, with experts warning the fallout of this and more hikes to come will hit renters too.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The average Queensland mortgage now costs 61 per cent more in repayments than it did in April 2022, with experts warning the fallout of this and more hikes to come will hit renters too.

Landlords will now be reassessing their position along with homeowners, experts warn, with many at “the tipping point” in holding costs as they wait out their next legislated annual rent rise.

MORE: Rental shock: Massive new rent increase forecast for Brisbane

How much more your loan will cost you with next rate rise

Prize homeowner’s incredible win ends shock run of bad luck

Canstar money expert Effie Zahos said “the pressure of a 13th rate hike might simply be too much for some households” including both owner occupiers and investors.

“Queenslanders would be looking at well over a $1300 increase to what their regular mortgage repayments are (compared to pre-rate rises in April 2022),” she said. “That’s a lot of money to find in the budget over a year, like $16,000 – that’s more than what households spend on food.”

Property Investment Professionals of Australia chair Nicola McDougall said more investors would have to exit the market.

“The smart move obviously if you are in a financial situation like that is to sell the property before you’re forced to do so,” she said.

“What that will probably do would be to increase the undersupply of rental properties that we have in Queensland, and … where supply is dwindling, rents are continuing to go higher.”

She said it was almost guaranteed investors would use their rent rise card when it came around for their property.

Ms Zahos said Tuesday’s 0.25 percentage point rise means the average $527,452 Queensland mortgage holder would be forking out $85 more in monthly repayments in November – with the total increase since May 2022 at $1,352 or 61 per cent higher.

Queensland households with a $500,000 mortgage were looking at a 61.8 per cent higher repayment amount than April 2022 or about $1,301 more after November’s anticipated $84 extra payment.

The extra interest costs for those on a $750,000 mortgage were $1,952 or 61.89 per cent more than April 2022, while a million-dollar mortgage repayment was $2603 more in Queensland (+61.9 per cent).

The Parenthood interim CEO Jessica Rudd said 62 per cent of the families with young children were already struggling financially.

She warned the rate rise “brings many Australian families with young children to the brink if they are not better supported through the ongoing cost of living crisis”.

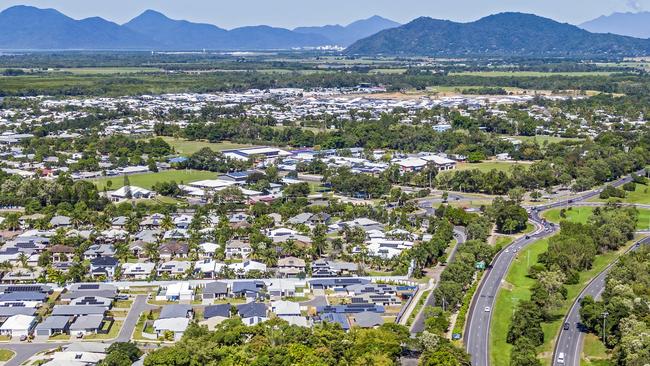

Real Estate Institute of Queensland COO Dean Milton said the number of first home buyers and building approvals have fallen away.

“There are warning signs about the impact rising interest rates have on the medium to long term outlook – with first home buyers dropping off and building approvals collapsing,” he said.

“This means that the dream of home ownership may be slipping further out of reach with every cash rate rise, and new housing supply is struggling to get off the ground.

“First homebuyer activity was down 16 per cent in the 12 months to April and there appears to be no desire from the state government to arrest this trend. We also know that building approvals are nowhere near where they need to be in Queensland, with 33,755 new dwellings approved across the state, falling well short of the 40,000 or more per annum we need just to meet SEQ demands according to HIA.”

Mr Milton said the younger generation and those on lower incomes were hurting the most.

“Spending is being driven by 55+ Australians who are a cohort that is largely mortgage-free and less likely to be negatively impacted by increases to interest rates – on the contrary, their savings are boosted by it.”

SEE THE LATEST PROPTRACK HOME PRICE INDEX

The cost of living crisis born of the rate rises is pushing more Queenslanders into homelessness, with tent cities popping up across Brisbane. In just two spots, one in a Brisbane park and another under a bridge, The Courier-Mail counted 28 tents on Tuesday. Adam Richards moved his and his 20-year-old son’s tent under the William Jolly Bridge two days ago after council told them to leave Fairfield park. There are 11 tents under the bridge.

“We built a structure at Fairfield park but the council tore it down,” Mr Richards said.

His son Jayden Richards said the high grocery prices had made it hard to get their hands on everyday items.

“I wish prices were like they were back in the 1970s,” he said. “A bag of chips has gone up to like $6, it’s high as f--k.”