Close to peak: Qld property values rise again amid strong demand

Brisbane property values rose 0.14 per cent in April as the River City claws back losses made since the peak of the pandemic property boom. And regional Qld is just 0.25% shy of its peak.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Brisbane property values rose 0.14 per cent in April as the River City claws back the losses made since the peak of the pandemic property boom.

Strong housing demand offset the deterioration in borrowing capacities, with dwelling values rising for the fourth consecutive month to $721,000, just 2.88 per cent below the peak in April last year.

Since the start of the Covid-19 pandemic in 2020, Brisbane dwelling values (houses and units) have recorded a staggering cumulative growth of 43.1 per cent, according to the latest PropTrack Home Price Index.

MORE NEWS: Qld suburbs named in top 30 national ‘no go zones’ report

And Regional Queensland is even closer to its peak value, with dwelling values rising 0.04 per cent in April to reach $600,000, just 0.25 per cent shy of its peak, also in April last year.

Dwelling values in regional Queensland, which includes the real estate powerhouses of the Gold Coast and Sunshine Coast, have posted cumulative growth of 50.4 per cent since the start of the pandemic, just short of Regional Tasmania’s eye-popping 51.5 per cent.

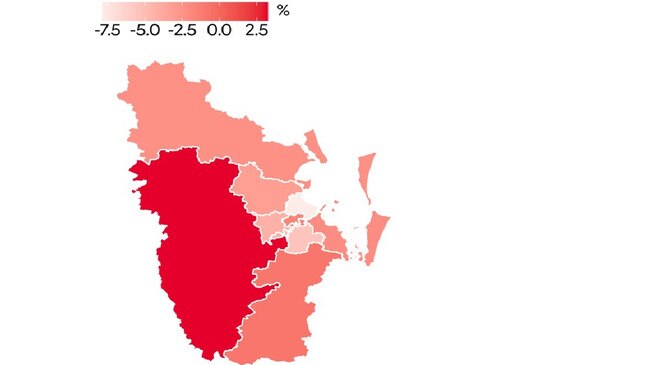

The top performing regions for annual growth (all dwellings) were Darling Downs-Maranoa (+8.32%), Toowoomba (+7.17%), Wide Bay (5.14%), Cairns (3.66%), Mackay-Isaac-Whitsunday (+3.35%) and Townsville (+3.34%).

Values fell over the same period on the Sunshine Coast (-5.16%) and the Gold Coast (-0.52%).

But compared to pre-pandemic levels in March 2020, regional Queensland has seen the second strongest increase in prices across the country, according to the report.

PropTrack senior economist and report author Eleanor Creagh said the price falls recorded over most of last year had begun to reverse in 2023, with April marking the fourth

consecutive rise in national home values.

“Strong migration, tight rental markets and limited supply are offsetting the impact of rapid interest rate rises,” she said.

“Supply constraints have eased slightly with respect to the total stock on market, but the flow of new listings remains soft, keeping a floor under prices.

“The decision by the Reserve Bank to hold the cash rate steady in April is also likely to have contributed to the uplift in home values as a higher degree of confidence with respect to future borrowing costs emerges.”

But Ms Creagh said that despite the recent stabilisation of home values, headwinds remained. “Interest rates may still rise further, and the economy is expected to slow,” she said.

“However, the continued tightness in the labour market, stronger housing demand and tight supply are likely to see the recovery sustain.

“A home shortage exacerbated by high construction costs will also underpin values as population growth increases.”

Speaking of Brisbane, Ms Creagh said that whether prices continued to rise, or resume their falls would depend on the level of supply, as well as the trajectory of interest rates.

But she added that Queensland also had the fastest growing population in Australia, and new supply would struggle to keep up with growing demand, further underpinning home values.

But while the lift in house values will be welcomed by homeowners, it remains bad news for those buyers who close to the peak, with analysis by Canstar revealing that even if the RBA keeps the cash rate on hold at 3.6 percentage points, many of those borrowers were likely already experiencing severe mortgage stress.

The research found a borrower who purchased a median priced house in April 2021 would now be contributing 38.9 per cent of their before-tax income towards their loan repayments, while a borrower who bought in April last year (the peak) would now be spending an alarming 42.3% of their before-tax income on repayments.

The benchmark for mortgage stress is typically when repayments exceed 30 per cent of a borrower’s before-tax income.

Canstar’s finance expert Steve Mickenbecker said it was a blow to borrowers who were emboldened by the outlook that interest rates would remain low into 2024.

“All borrowers are impacted to some degree but it takes a tougher toll on recent buyers who have little wriggle room to cut their spending and have had no time to build a buffer,” he said.

“A borrower who purchased a house in April last year has the added complication of eroding equity in their property.

“The problem with falling equity is that the banks become nervous when borrowers come looking for help with repayment relief, as they too are at risk of potentially having to write the loan off.”

The Emerging Mortgage Risk Report by PEXA (Property Exchange Australia) recently revealed that the number of postcodes in mortgage shock had soared.

The report found that the Queensland postcodes with the highest mortgage risk included Noosaville, Maleny, Tallebudgera, Tewantin, Doonan, Banksia Beach, Cooroy, Sunnybank Hills, Cooloola Cove, Burleigh Heads, Marcoola, Currumbin Waters, Pomona, Coolum Beach, Samford Valley, Palm Beach, Tamborine Mountain, Tugun, Burrum Heads and Ningi.

MORE: Mortgage shock: Report warns 274 postcodes now at significant risk

But in some good news, 55 per cent of the experts surveyed by Finder ahead of tomorrow’s RBA meeting tipped that the cash rate would likely hold for the second consecutive month.

MORE: Rate cut! 32 lenders slash home loan interest ahead of RBA move

AMP Capital’s Chief Economist Shane Oliver was among those tipping another month of reprieve for borrowers.

“Inflation has now peaked and is falling a bit faster than the RBA expected,” he said. “Although it's a close call this bolsters the case along with increasing evidence of slowing growth and a cooling labour market for the RBA to leave rates on hold in May ahead of an eventual cut in rates to support struggling economic growth from later this year and through 2024.”