30+ days behind: Qld’s most stressed mortgage suburbs revealed

Queensland’s top 10 worst performing suburbs for mortgage arrears have been revealed, as the number of homeowners falling behind in their repayments continues to climb. See where!

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Queensland’s top 10 worst performing suburbs for mortgage arrears have been revealed, as the number of homeowners falling behind in their repayments continues to climb.

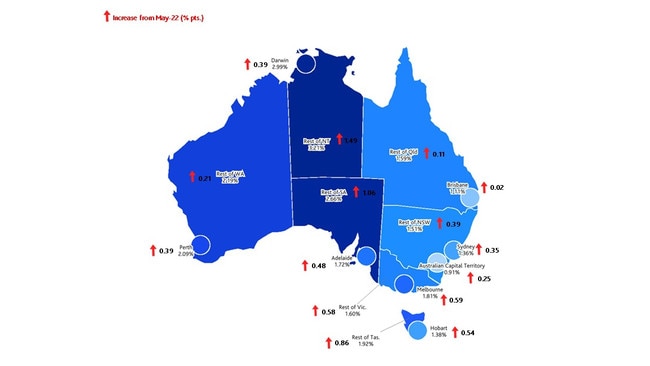

The latest Australian Residential Mortgage Delinquency Map from Moody’s Investors Service found that the average number of borrowers that were 30 or more days behind on their repayments had increased in every state in the 12 months to May.

And the number of financially-stressed households is expected to continue to rise “moderately” over the rest of the year.

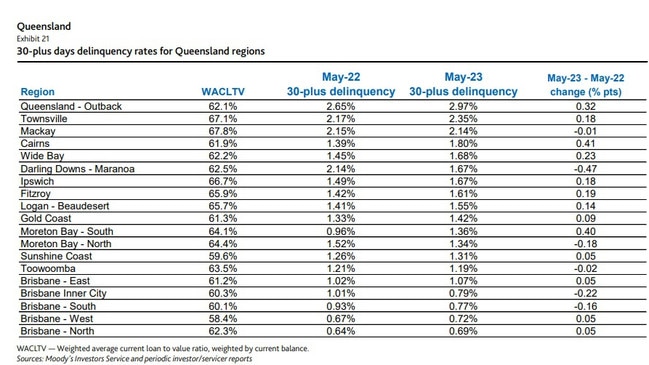

In Queensland, the top five worst performing regions for mortgage delinquencies were Outback Queensland, Townsville, Mackay, Cairns and Wide Bay, with between 1.68 per cent (Wide Bay) and 2.97 per cent (Outback) of mortgageholders at least 30 days behind in their repayments.

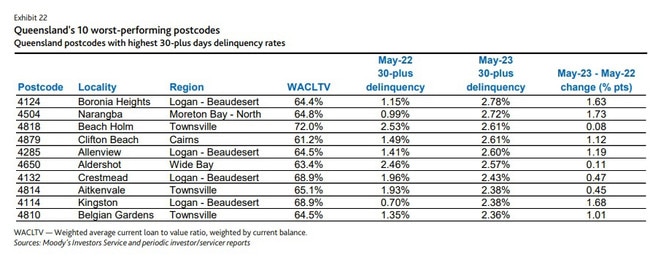

The top five postcodes behind in repayments were Boronia Heights (2.78%), Narangba (2.72%), Beach Holm (2.61%), Clifton Beach (2.61%) and Allenview (2.6%).

The Logan-Beaudesert region had the most distressed suburbs – Boronia Heights, Allenview, Crestmead and Kingston.

Townvsille had three suburbs – Beach Holm, Aitkenvale and Belgian Gardens.

Moreton Bay (Narangba), Cairns (Clifton Beach) and Wide Bay (Aldershot) each had one suburb in the top 10 list.

MORE NEWS: Where you can buy a $20m riverfront house for $2m

NRL entrepreneur lists epic $3.5m Qld estate with two footy fields, grandstand

Land release fail: Qld unable to keep up with growth forecasts

A property in New Farm recently sold for $3.85 million after the mortgagee took possession.

A three-bedroom house in Southport also sold for $776,000 after the bank took back the property.

Other mortgagee sales since the start of this year have included a house on a 741sq m block in Balmoral for $1.475 million, a low-set house dwarfed by apartments at Kings Beach for $2,188,500, an old Queenslander in Torbanlee for $300,000, a two-bedroom renovator in Tannum Sands for $295,000 and a five-bedroom house at Mount Isa for $345,000.

On the flip side, Brisbane was the top performing region for repayments.

All of the top performing suburbs were located in the southeast corner and included Macgregor, Holland Park, Cannon Hill, Rochedale, Bowen Hills, Jamboree Heights, Helensvale Aspley, Thornlands and Bray Park.

Each have seen a decline in the number of households falling behind in their repayments in the 12 months to May this year.

But the report noted that with a “considerable number of mortgages” set to end their fixed rate periods over the next six months, the risk of increased mortgage stress would rise.

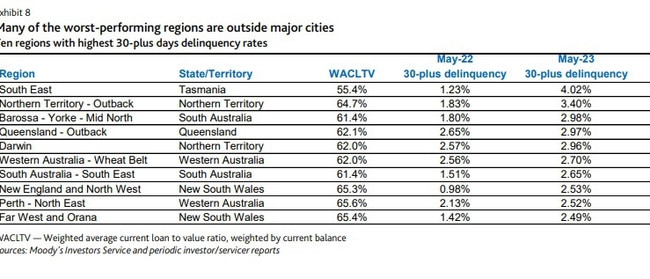

The analysis revealed that home loan delinquency rates were generally higher and had increased the most in regions where the median household income was in the bottom third of the state.

“While mortgage delinquencies are rising broadly across Australia, the problem is most pronounced in low-income regions, typically located outside of major cities, where borrowers are bearing the brunt of high interest rates and inflation,” the report said.

“The risk of mortgage delinquencies will remain higher in these areas than more affluent regions in an environment of high interest rates and ongoing cost-of-living pressures.”

Overall, mortgage delinquency rates increased in 77 regions in Australia and declined in 10 over the year to May.

Consecutive rate hikes have seen the cash rate lift from a historic low of 0.1 per cent in April last year to 4.1 per cent, marking the fastest and largest rate hiking cycle on record.

But in some good news, experts and economists surveyed ahead of the next meeting of the Reserve Bank of Australia (RBA) on Tuesday have tipped that the central bank would keep interest rates on hold again in October.

All 38 experts surveyed for the Finder RBA Cash Rate Survey believed the cash rate would remain on hold, the first time the survey has achieved 100 per cent agreement this year.

“Aussies are being hit with price increases almost everywhere – and we have seen a sharp rise in stress caused by housing, energy, petrol and grocery bills,” Finder head of consumer research Graham Cooke said.

“Our data shows that many households are at breaking point – 36% of mortgage holders struggled to pay their home loan in September.

“Another rate hold will be welcome news to the many homeowners who are already at the end of their tether.”

But he warned that inflationary pressures were persisting, with the experts divided on whether the cash rate had peaked at 4.1 per cent.

The survey revealed that 42 per cent of those surveyed thought it would peak at either 4.35 per cent or 4.6 per cent.

That would be a further hit to struggling Aussies, with the Finder research revealing that 18 per cent of workers were already living day-to-day, with 44 per cent of Aussie workers unable to survive financially for more than a month if their income dried up.

The panel of experts believe the unemployment rate with rise to 3.9 per cent by the end of the year.

“Even a small increase of 0.2 percentage points in the unemployment rate would mean over 30,000 Aussies losing their jobs,” Mr Cooke said.

More Coverage