Fraudsters and thieves of Hervey Bay, Maryborough, Bundaberg, Gympie

From elaborate frauds to relatively minor crimes of opportunity, we take a look at some of the most recent frauds and thefts in the Wide Bay, while a top cop reveals which crime is currently keeping police busy. See the full list.

Fraser Coast

Don't miss out on the headlines from Fraser Coast. Followed categories will be added to My News.

It’s a crime that can be opportunistic, or planned over months, even years.

It can have one victim or millions and none of us are safe – in fact, the conveniences of modern technology are putting us all more at risk.

In 2021 alone, Queenslanders lost more than $46 million to scams and fraud, many of them fake investment opportunities or dating and romance ploys.

Frauds and thefts are crimes Detective Acting Inspector Dave Harbison is all too familiar with.

At the moment, he says, a big one for police is payWave fraud.

“If one wallet is lost or stolen, the offender can purchase multiple small amounts of goods from stores until the complainant cancels the card or the bank detects strange behaviour,” Insp Harbison said.

“This could account for multiple offences in any one day.

“That is why credit card fraud is high and accounts for the majority of reported frauds.”

That kind of offending was opportunistic and hard to prevent, he said.

In the Wide Bay-Burnett region in the past three months, there have been hundreds of fraud offences.

In April 2022, there were 95 - five frauds by computer, 46 by credit card and six cases of identity fraud.

The rest fell into the category of “other frauds”.

In May, there were six frauds by computer, 37 frauds by credit card, 10 identity frauds, and 25 crimes recorded under “other frauds” for a total of 78 offences.

Then in June, 95 fraud offences were recorded, with three by computer, 57 by credit card and two identity frauds.

Thirty three crimes were listed under “other frauds”.

Across the North Coast policing region, of which the Wide Bay-Burnett is part, in 2022, so far 1784 offences have been reported in 2022.

In 2021, 4242 fraud offences were reported across the North Coast, while 4794 frauds were reported in 2020.

In recent times, plenty of frauds which fell into the category of “opportunistic” have been heard before Wide Bay courts.

Jessica Lynnette Tarbuck – fraud

A neighbour was not happy when she discovered the woman next door had claimed a Dominos delivery that was not hers.

Jessica Lynette Tarbuck pleaded guilty in Hervey Bay Magistrates Court to one count of fraud.

The court heard the incident happened on May 4, 2022. when one of Tarbuck’s neighbour’s failed to receive their pizza delivery.

The neighbour contacted Dominos and was informed their order, worth $40, had been delivered.

As the delivery person arrived, Tarbuck had gone to meet them and collected the pizzas herself, the court was told.

Police were called and Tarbuck made admissions that she had taken the pizza and she’d known it wasn’t hers but did it anyway.

Tarbuck was receiving Centrelink payments and as a result of her offending, it was going to be “an expensive pizza”, lawyer Daniel Hunter said.

Magistrate Trinity McGarvie said it was dishonest offending, telling Tarbuck she didn’t know what impact her actions would have as she did not know about other people’s financial circumstances.

Tarbuck was fined $300 and a conviction was recorded.

The impact of online fraud scams

Dr Jacqueline Drew, a scholar with the School of Criminology and Criminal Justice at Griffith University, has carried out years of research into the impact of fraud on the community.

More and more, fraudsters were turning to online avenues to scam money from unsuspecting victims.

In one particularly shocking incident in recent years, a Fraser Coast man scammed a cancer patient out of thousands of dollars.

Paul Shillingsworth – fraud

A cancer patient seeking relief from the pain of his treatment was scammed out of thousands of dollars by a Fraser Coast football player, leaving he and his family devastated.

The man who committed the fraud, Paul Shillingsworth, appeared before Hervey Bay Magistrates Court in 2018 and pleaded not guilty to the offence.

Magistrate Stephen Guttridge heard testimony from several witnesses during a hearing, including the widow of Ken Plummer, who died just months after he was scammed out of $2700 by the rugby league player.

Louise Plummer told the court her husband was seeking relief from his cancer treatment when he responded to an ad for a spa in the Trading Post in June 2016.

Her husband deposited the money into the bank account of one of Shillingsworth‘s friends and he was assured the spa would arrive at the weekend.

But the spa never arrived at their Sydney home and the couple went to the police to tell them of the fraud.

The friend who received the payment from the Plummers testified against Shillingsworth, telling the court that the 27-year-old had approached him in the weeks before the offence.

Shillingsworth told his friend that his bank account wasn‘t working and asked if deposits could be made into his account.

The friend agreed and on July 1, 2016, he withdrew a total of $2700 for Shillingsworth.

Later police traced the payment to the account and questioned the friend, who told them the money had been withdrawn and given to Shillingsworth.

Magistrate Guttridge found Shillingsworth guilty of fraud.

A short adjournment followed and Shillingsworth then pleaded guilty to three additional fraud charges, two involving the sale of a spa for $3500 and one involving the sale of a jet ski for $3700.

The court heard Shillingsworth had served time in prison for $42,000 worth of fraud offences and had only just been released.

In total, his fraud offences amounted to $55,896, the court heard.

Police prosecutor Donna Sperling said at first Shillingsworth had given his victims his bank account number to deposit funds into, but by using his friend he had “brought a third party into his offending”.

Shillingsworth was given a head sentence of 12 months in prison and was ordered to serve two months.

A two-year operational period was ordered for the remainder of the sentence.

The court heard Shillingsworth had gained employment since serving his term of imprisonment and that he was working to overcome his addiction to poker machines, which had led to the offences.

Magistrate Guttridge said Shillingsworth’s offences were “calculated and planned” and had a degree of sophistication.

Mrs Plummer said she was glad to hear justice had been served, but she was sad it came too late for her husband to see it.

Mr Plummer died in November, 2016.

Impact of online romantic scams

One of Dr Jacqueline Drew’s particular interests was romance scams, where people were often robbed of their entire life savings by unscrupulous suitors.

Scammers could be incredibly convincing and manipulative, Dr Drew said.

“We think a lot about the financial impact, which is obviously significant,” she said.

“Many of the romance scam victims that I’ve spoken to are middle aged or later in life. they have substantial assists and will actually be convinced by these scammers to sell their house and rack up credit card bills.

“Borrowing money from family and friends, taking out loans – they become quite financially devastated and they have no chance to recover because they’re later in life.”

The emotional impact of the scams could be devastating, Dr Drew said.

“The psychological impact of being duped for sometimes years and years, often time being warned by family and friends but persists regardless because of the connected the offender has made.

“That psychological devastation is huge.”

Unlike most other crime victims, those caught up in romance scams tended to be unfairly blamed, Dr Drew said.

But she warned it could happen to anyone, so adept at manipulation were the scammers.

“It’s not people who are necessarily gullible or silly,” she said.

“These offenders are good at what they do, that’s why they are so successful.”

If they thought there would be a pay off worth it, scammers would spend months or even years grooming their victim, Dr Drew said.

To add to the pain of those who had been scammed, they sometimes got caught up in the scam and found themselves in legal trouble.

People, known as “money mules” were manipulated by the scammer and caught up in their fraudulent behaviour, Dr Drew said.

Two such instances where victims of romance scams found themselves before court were reported on in recent years in the Wide Bay.

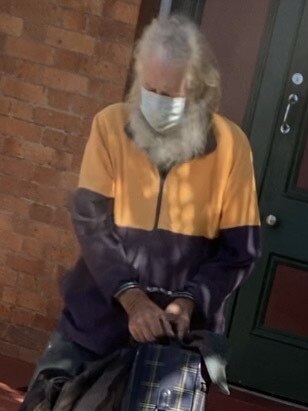

Clifford Stanley Perrin – fraud

An elderly scam victim fell foul of the law after he allowed an online temptress to transfer money into his bank account.

Clifford Stanley Perrin, 77, pleaded guilty to five counts of fraud when he appeared before Hervey Bay Magistrates Court in 2019.

Perrin, who was partially blind and deaf, reached out online in an effort to form friendships and romantic relationships.

It was while chatting online that he met Stella.

Defence lawyer Daniel Ould said Stella requested money from Perrin in order to travel to Australia.

In total it was estimated he had given her about $100,000.

After taking Perrin‘s money, Stella asked him if she could transfer funds into his bank account.

The court heard Perrin had been vulnerable and alone after the death of his mother.

Mr Ould said Stella had hacked email addresses and was scamming real estates by asking them to make rental payments into Perrin‘s account.

About $7700 was stolen by Stella and transferred by Perrin into her account.

Mr Ould said it was clear in Perrin‘s bank statements that the money was coming from real estates and he was suspicious about the activity.

“His desperation for the relationship to be real has caused him to not think clearly about his actions.”

He had no prior criminal history.

Magistrate Stephen Guttridge sentenced Perrin to three months in prison, wholly suspended, with an operational period of 12 months.

Hasniyah Murad – fraud

Lonely and lured into a scam by a former friend-turned internet love interest, a Bundaberg migrant accepted thousands in exchange for a puppy which didn’t exist.

The act, committed by Hasniyah Murad, 74, landed her in Bundaberg Magistrates Court in 2021, where she pleaded guilty to one count of fraud and another charge of possessing tainted property.

The court heard Murad had been speaking online to a man she had known while living in Malaysia and believed there was a chance of a relationship.

Police Prosecutor Grant Klaassen told the court Murad had been warned previously by police not to get involved with the man but said she “fell under the spell” of her friend.

He said in May last year, Murad was paid $2500 by a man who thought he was buying a puppy.

Murad then transferred that money to her Malaysian friend who told her to keep $200 of a sum of $4000.

Her barrister, Craig Ryan, said his client had separated from her husband after she immigrated to Australia some years ago.

Mr Ryan said the cultural implications meant the family was split and her children stayed with their father in her home country.

He said during a tough time, Murad connected with an old friend from her younger days and thought, after some time, there was the potential of a relationship.

The man told her he was running a business where he was selling things from Malaysia to people in Australia but it was difficult for him to obtain a bank account.

He asked her for help with transactions.

Mr Ryan said his client accepted that if she had followed the advice of police she wouldn’t have found herself in court.

He said Murad had not heard from the man since she told him police had become involved.

Mr Ryan asked a conviction not be recorded as Murad, who had no criminal history, was hoping to return home to Malaysia.

Magistrate Andrew Moloney described the incident as “almost a cliche” and said it was a classic example of online fraud.

He took into account Murad’s plea of guilty said he could see the shame on her face during the proceedings.

Murad was placed on a $1000 good behaviour bond for a period of 12 months.

She had to pay $200 restitution and a conviction was not recorded.

Risk of online shopping during Covid

Criminologist Dr Terry Goldsworthy, an associate professor at Bond University, was a detective inspector with the Queensland Police Service.

In his 28 years as an officer, he encountered all kinds of frauds and scams.

He said during Covid, online fraud went up substantially as people turned to online shopping to socially distance.

“Fraud’s something that’s problematic in the community, because we all expect to and want to believe the best in people and that’s how fraudsters operate, they rely on our good nature.”

Crimes of theft and fraud could be one-off and opportunistic or could be systemic, Dr Goldsworthy said.

Adrian Gepp, associate professor of Data Analytics at Bond Business School, said a lot of frauds went unreported and it was costing the economy billions of dollars a year.

When thefts impacted on businesses, either internally or from outside sources, at some point the cost of that was passed on the consumers, meaning everyone was paying the cost.

“Businesses either go under or at some point have to make it back,” Dr Gepp said.

A lot of fraud offences were opportunistic and aimed at “low hanging fruit”, he said.

But avoiding scams and frauds was next to impossible in a digital age, he said, with people trading convenience for security and unless one wanted to live out in the middle of Australia and never interact on technology, there was no way to fully avoid the risk, Dr Gepp said.

“We need to be aware there are those risks,” he said.

Here are some more cases that have been through Wide Bay courts recently.

Locklen Alexander Sheehy – fraud

A young Bundaberg man, who started reoffending two weeks into his parole for similar crimes, returned to court in 2022.

Locklen Alexander Sheehy was homeless and looking for property he could sell to buy drugs in October 2021, when fingerprints revealed he’d broken into a car on Walker St and stolen items from within it.

On October 29, 2021, he broke into another car and fell asleep.

The court heard that when Sheehy was woken, he uttered “I didn’t mean to rob a car”.

But on that same day, Sheehy stole a woman’s purse, including personal papers and bank cards, and took one of her bank cards on a fraudulent spree where he clocked up $1240.87 worth of spending on 17 transactions around Bundaberg.

The court heard Sheehy had a disadvantaged upbringing and had suffered the loss of his brother and father which had pushed him into using meth from the age of 18.

Bundaberg Magistrate Edwina Rowan described Sheehy’s offending as low level, but persistent.

Sheehy’s history of crime however, had not been of the nature where anyone had ever been physically harmed.

He pleaded guilty to 20 charges, including one of enter premises and commit indictable offence by break, one of the unlaw entry of a vehicle for committing an indictable offence, one count of stealing and 17 counts of fraud relating to the bank card transactions.

Sheehy, who spent 115 days in custody, was given a head sentence of nine months, wholly suspended for 12 months.

Brayden Alex Cooper – stealing as a servant

A security guard did the opposite of the job he was paid to do when he stole from his employer.

Brayden Alex Cooper pleaded guilty in Hervey Bay Magistrates Court to one count of stealing as a servant in June 2022ar.

The court heard Cooper had been employed as a security guard at a marine services business when he took items, including various tool sets, from an area that could only be accessed with a pass.

Eventually, as others noticed the items were missing, Cooper was confronted by a manager at the business.

When police spoke to him, he told them he had taken the tools to “do some woodwork”, the court was told.

Defence lawyer Daniel Olds said his client was 23 and looking for work.

Cooper had previously worked in security for six years, the court was told, and during his employment at the business he had been allowed to borrow items.

However, he admitted he had taken items without the intention of bringing them back.

After his offending was discovered, the items had been returned, the court was told.

Mr Olds said his client, who had a previous conviction for fraud, was remorseful for his behaviour, adding that his role had been more involved in maintenance than security.

But Magistrate Trinity McGarvie did not accept that as an excuse.

She said when working as a security guard, Cooper had been not just an employee but a person trusted with the job of stopping people from stealing items from the business.

“You were employed in a very particular role of trust,” Ms McGarvie said, adding Cooper had been on a community-based order for a fraud offence when he stole items from the business he was working for.

Cooper was fined $2000 and a conviction was recorded.

Dylan Scott McCaw – fraud

A father of two, busted with dodgy bank and identification cards, fronted court months after appearing on a string of other serious charges.

Dylan Scott McCaw pleaded guilty in Bundaberg Magistrates Court in June 2021, to seven offences including fraud (dishonest application of property of another), obstructing police, two counts of possessing dangerous drugs and three counts of receiving tainted property.

The court heard on March 25, McCaw received a debit card which he had reason to believe had been tainted and used it to purchase cigarettes.

On March 26, he received a Medicare card and licence which he had reason to believe was tainted and on that same day, he took off from police because he was on parole and did not want to go to jail.

When police caught up with McCaw, they uncovered small amounts of cannabis and meth.

It was further heard that McCaw was sentenced over a “large volume” of similar offences on February 28.

However, Magistrate John McInnes said McCaw’s most recent list of offences was not “enormous” as the spree which landed him before the courts earlier in the year.

Mr McInnes said McCaw had made some positive steps while on parole and some lapses into reoffending were “not uncommon” while going through rehabilitation.

McCaw was sentenced to one month in jail for each of the seven offences, to run concurrently, suspended for nine months.

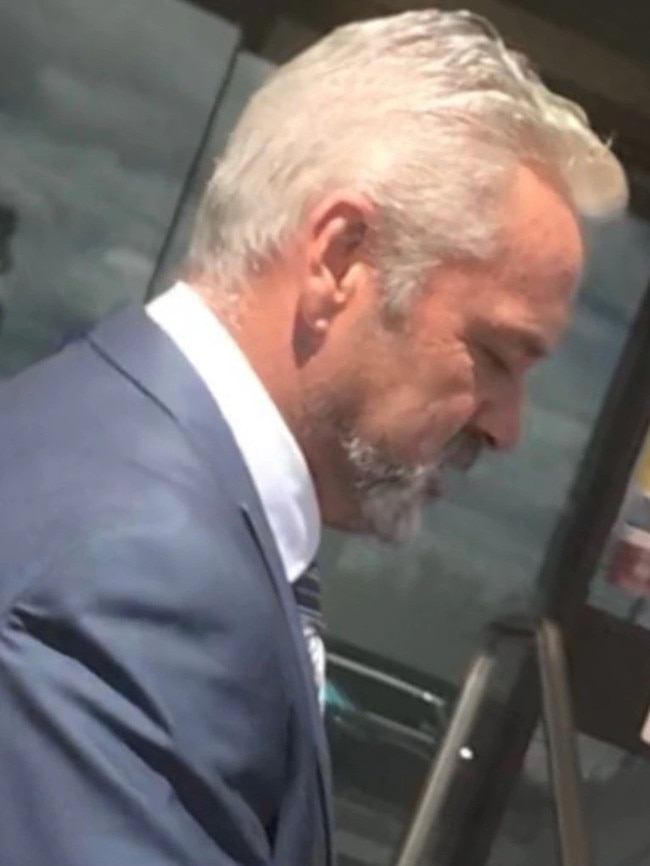

Peter John Hogar – fraud

A Gympie security guard was charged with dishonestly obtaining more than $50,000 in government benefits, after he did not report changes to his income.

Peter John Hoger, 49, appeared in Gympie Magistrates Court in April 2022 over what his lawyer said was an expensive mistake.

He was supported by two people in the public gallery.

The court heard Hoger, who was between the ages of 43 and 46-years-old at the time of the offending, had received $50,643.31 in Government benefits between November 26, 2015 and October 7, 2018, after he failed to report a change to his income after starting a job as a security guard.

At the time he earned $163,697.48 over the same period.

Had he reported the change to his income, he would have qualified to receive $463.61 in benefits.

This was only detected by the Australian Taxation Office on May 21, 2020, and was immediately brought to the attention of Hoger’s, who co-operated with authorities.

“He understood he was supposed to inform Services Australia if he started work or if he was not giving care anymore … he said he was working 30 to 40 hours per week on a casual basis,” Commonwealth prosecutor Ms Gill said.

“He had asked his wife to report his earnings … he relied on his wife to look after the finances and also had access to his Centrelink account to sort out the carer payment.”

Defence lawyer Chris Anderson said Hoger has since repaid about $14,000 of the $50,000 debt.

He said his client was unaware of the ongoing benefit payments because of issues with bank accounts, and did not check the account the payments were going into.

Acting magistrate John Millburn sentenced Hoger to two years behind bars, but he was immediately released into a $2000 good behaviour bond for the same amount of time.

He was also ordered to pay the remaining $36,085 in restitution.

District court

Lloyd John Tree – fraud

A 79-year-old Tin Can Bay man was jailed after it was revealed he scammed the Australian Government out of more than $330,000.

Lloyd John Tree was supported by two people in the Gympie District Court in July 2022, as details of how he spent nearly two decades using a false identity to obtain a second passport and numerous government benefits were shared.

The court heard Tree, who was 58 at the time, first assumed the identity of Russell Graham Tree in 1998, after the real Russell Tree died in Western Australia almost 50 years earlier in 1948.

He used the false identity to obtain a second passport, and proceeded to scam the Federal Government out of $337,313.77 in social security benefits, while already receiving social security benefits in his own name.

The court heard Tree even appealed a decision to reject a disability support pension application under the false identity during this time.

This continued for more than 18 years, until Tree was caught on August 20, 2019, while making an application for a new passport using his real identity.

The court heard he was undone with facial recognition technology from the Australian Passport Office, which launched an investigation.

Tree was arrested on October 1, 2019, at 76 years-of-age.

Defence barrister Mark Dixon said his client was in “good health” for someone his age, despite being a diabetic, and lived an “isolated” existence on a boat in Tin Can Bay.

The court heard Tree had already repaid $8973.30 in restitution.

He pleaded guilty to five charges, including defrauding the commonwealth, giving false or misleading information in relation to an Australian travel document, and three charges of obtaining financial advantage by deception.

He was jailed for four years, but will be released on parole on January 18, 2024.

A conviction was recorded.

Margaret Hull – fraud

A respected Hervey Bay businessman was implicated in the theft of more than $1 million from body corporate clients over seven years after his former employee faced court on fraud charges, which saw her sentenced to five-and-a-half years jail.

Margaret Joyce Hull, 67, pleaded guilty to two counts of fraud when she faced Hervey Bay District Court earlier in 2022.

Hull had been an administrator at Richardson and Wrench since 1996, a real estate agency which was owned and operated by popular and prominent businessman, Trevor Cecil.

But in 2010, after Hull informed Mr Cecil the business was in financial trouble, money was taken from 29 of the body corporate accounts managed by the business to help keep it afloat, the court heard.

The fraudulent transfers amounted to about $1.1 million and occurred over a period of about seven years, with some of the money used to keep the business afloat and some used for personal benefit.

The exact amount that Hull had personally benefited from was not known, the court heard.

In addition to the fraudulent funds, there had been a payment made to her account – which was not the subject of any charges – of $700,000 following Mr Cecil’s death, the court was told.

No action had been taken in regards to that money because it was not known what agreement she and Mr Cecil had in place in regards to those funds, it heard.

The prosecutor could not refute that Mr Cecil would have had involvement and knowledge of transfers being made out of the body corporate accounts.

The court heard the offending had come to light after Mr Cecil’s death from a stroke on October 14, 2017.

The last fraudulent transfer had been made out of a body corporate account the day before his sudden death, the court was told, at which time Hull had stopped offending.

Hull had no prior criminal history and was caring for her husband, who had ongoing health issues.

Judge Nathan Jarro said misplaced loyalty to Mr Cecil had seen Hull become involved in the fraudulent activities.

He said Hull had taken the money to aid the business and ensure it survived and then to benefit herself personally.

“It is unlikely in my view that you will ever offend or you will ever place yourself or be in a position where you could reoffend given your age and that you’re now out of the workforce,” he said.

Judge Jarro said four references provided to the court on Hull’s behalf spoke of her generosity and her otherwise good character.

Hull was given a head sentence of five-and-a-half years in prison, and will be eligible for parole from October 27, 2023.

Convictions were recorded.

Ronald Glenn Stakenburg – stealing

A building certifier who kept $71,400 which had been sent to him accidentally by an elderly man, has now got 12 months to sell his family home and return the money he took.

Ronald Glenn Stakenburg, 53, pleaded guilty in Bundaberg District Court to one count of stealing property valued over $5000 in April 2022.

Crown Prosecutor Carla Ahern told the court the victim had enlisted the services of a business to relocate his home, a job that came with a $71,400 price tag.

The house relocation business had then put forward Stakenburg’s services to carry out certification duties, which would cost the victim between $1200 and $1500.

But when the 88-year-old victim went to pay the house removal company, he mistakenly placed the money into Stakenburg’s business account instead.

It was heard that between June 13, 2021, and August 26, 2021, Stakenburg’s company stated it had received the money in error and that it would be transferred to the house removal company, but claimed there were issues and it would be faster if the victim tried to reverse the transaction.

The court heard that on one occasion, the victim had been issued a false invoice to pretend his money had been transferred to the correct business.

Stakenburg’s lawyer John Dodd argued that his client’s involvement in the scam was comparable to someone who took $10 to spend on the pokies, believing they’d receive a return and could give it back.

The court heard Stakenburg did eventually make admissions to police, but Ms Ahern said the defendant’s version of events were “self-serving” and not accepted by the Crown.

“He lied to the complainant about returning the money on multiple occasions,” she said.

“There is evidence that he took steps to hide that lie, for example, by writing a false invoice.”

The victim, who still had to pay the house removal company, was forced to sell other property in order to foot the $71,400 bill.

Stakenburg, with approval from his wife, had agreed to sell their family home in order to return the victim’s money.

He was sentenced to three years’ imprisonment with immediate parole and must pay $71,400 restitution within 12 months.

Convictions were recorded.