Stories behind the Gold Coast’s most notorious white-collar criminals, developers and fraudsters revealed

The city has long had a reputation as a sunny place for shady people – but what is it about the city that seems to attract those with bad intentions? DISGRACED SUITS NAMED

Gold Coast

Don't miss out on the headlines from Gold Coast. Followed categories will be added to My News.

The Gold Coast has long had a reputation as a sunny place for shady people – but what is it about the city that seems to attract those with bad intentions?

From the 1980s to the present there have been plenty of business figures who have fallen afoul of the law, with victims losing tens of millions of dollars to scams, schemes and other misdeeds.

SCROLL DOWN FOR EIGHT DISGRACED BUSINESSMEN >>

Bond University criminologist Terry Goldsworthy said the Gold Coast’s attraction for white collar characters was “like moths to a bright light”.

“It’s got that kind of lifestyle where people come and go, there are a lot of tourists coming in so we’re used to people being a bit transient,” he said.

“It’s the tourist capital of Australia, so it’s the place to come to party and have a good time.

“If you’re a fraudster or someone who relies on defrauding other people to fund your lifestyle, this is probably a place that appeals to you.”

Dr Goldsworthy said the Gold Coast’s unique mix of people, pleasure and plentiful opportunity made it a prime location for the unscrupulous.

“There is a large pool of victims here, it’s a place for a lot of people to retire and we know that elderly people have often accumulated wealth,” he said.

“Also the lifestyle itself is quite pleasant – it lends itself to that confident trickster who comes in and goes out, wears the right clothes, says the right things, goes to the right places and gets the confidence of people very easily.”

A laid-back and friendly local population, while a plus when welcoming visitors, could also have its drawbacks.

“People like to believe the best in people, it’s human nature,” Dr Goldsworthy said.

“We don’t like to look at someone who’s offering us something and go `look I think you’re ripping me off’.

“People don’t like confrontation and they don’t like casting aspersions on people’s credibility if they don’t have to.”

From dodgy development deals to fleecing investors or the tax office, here are 10 of the Gold Coast’s least admirable corporate figures.

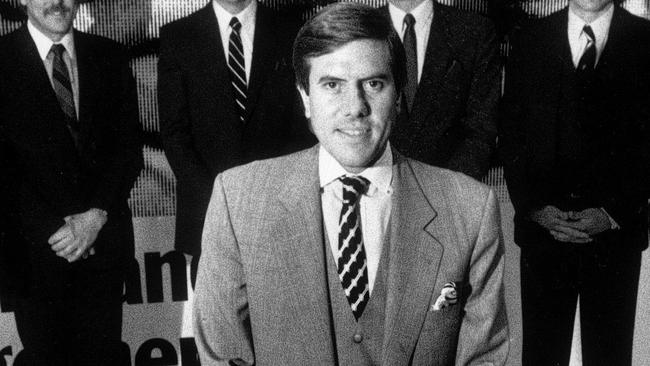

CHRISTOPHER SKASE

The poster child for corporate excess and misdeeds, Christopher Skase was the king of the Gold Coast in the 1980s.

The boss of mega corporation Qintex, Skase was known for his cash splashes, $6m superyacht Mirage III, giant parties and eyebrow-raising decision-making.

It included sending his private corporate jet from Port Douglas to Melbourne to pick up a dress for his wife, Pixie.

The House of Qintex’s fall at the end of the 1980s, before Skase’s 1991 escape to Spain, came after a wild five years of activity on the Gold Coast.

It would help reshape the city under a cloud of contrasting legacy. Between 1985 and 1988 Skase built Marina Mirage and the Sheraton Mirage at The Spit, co-founded the Carrara-based Brisbane Bears Aussie rules team, built its stadium and giant floodlights and bought the Seven network.

Skase was born in Melbourne in 1948 and worked as a journalist before making the jump to business in the 1970s, buying Qintex in 1975 for just $15,000. By the late-1980s it was worth $2.2bn and Skase was well-established on the Gold Coast, pitching big ideas to city leaders, including a highly controversial proposal to build a golf course at The Spit.

By 1989, Qintex collapsed and Skase was charged with assaulting a News Corp photographer.

The former high-flyer went bankrupt in 1991 and escaped to Spain, leaving $700m in debts.

He died in exile in August 2001.

ROGER MUNRO

Dr Munro was investigated over an alleged Ponzi scheme that left investors $60 million out of pocket and in 2016 was banned indefinitely by the Supreme Court from working as a financial Adviser.

He was charged with five counts of fraud in 2017, however two counts did not proceed and he averted a three-week criminal trial by pleading guilty to three charges.

He was due to be sentenced in July 2021, but the matter has been adjourned five times.

It is due back before Southport District Court on March 30.

Dr Munro received funds from investors for a trading fund called TradeStation Futures Trading Fund.

ASIC’s investigation found Dr Munro did not invest these funds into TradeStation as promised, instead spending them on himself.

Investors were not aware that their money was being used by Dr Munro in this way and Dr Munro continued to make representations to investors that their money was being invested in TradeStation by falsely reporting on the profits and losses being made by TradeStation.

The charge of aggravated fraud carries a maximum penalty of 12 years imprisonment.

Dr Munro was released on bail with reporting requirements and his passport remains surrendered to the Court.

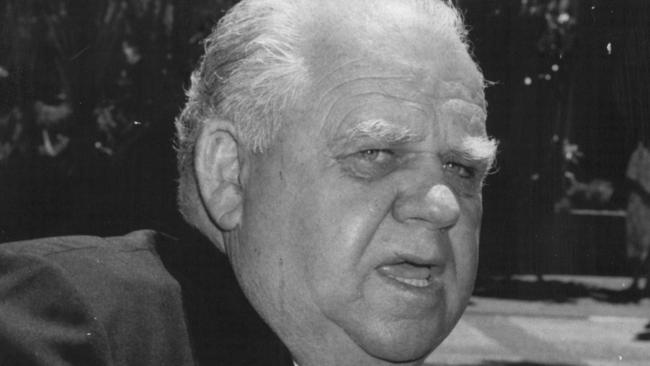

RUSS HINZE

The “Minister for everything”, Russ Hinze was the Gold Coast’s most powerful politician in the early 1980s and was a key player in Premier Sir Joh Bjelke-Petersen’s government.

But the National Party figure also tried his hand at being a developer, despite the significant conflict of interest such a role presented.

In 1982 Hinze’s links to the $45m Gemini Court tower project at Burleigh were exposed.

The Labor Opposition revealed Hinze was part of an “elaborate cover-up” relating to his business interests in the development and that he stood to receive a “million-dollar bribe” from its developers.

The project was linked to casino boss and North Queensland mining magnate Sir Leslie Thiess, who regularly tendered for government projects at the time.

It was claimed the development company Colwal was named for Hinze’s former press secretary, Colin Walker, while its directors were his electoral secretary turned wife Fay McQuillian and accountant Robert Murphy.

It was revealed that Hinze and McQuillian had both been directors of Colwal at the time the project was approved

Both Hinze and Bjelke-Petersen denied any wrongdoing at the time, but the affair delivered significant political damage.

It returned to haunt Hinze in 1988 during the Fitzgerald Inquiry.

The inquiry was told that Hinze had been living in one of the Gemini Court penthouses since 1982, paying just $1 a year in rent.

Hinze was charged in 1989 with receiving more than $500,000 in corrupt payments but died in mid-1991 before going to trial.

The Gemini Court deal proved to be one of the most infamous property developments of its era.

BRAD SILVER

The former property developer and company director was sentenced to eight years jail in 2019 for dishonesty offences that reaped $4.7m.

The court heard Silver had run a sophisticated scheme involving “calculated dishonesty”.

The Commonwealth Department of Public Prosecutions case followed an ASIC investigation, which culminated in July 2017 when he was nabbed at Brisbane Airport after flying in from Hobart, where he’d been living and operating a strip club.

Silver pleaded guilty in March 2019 to seven counts of fraud to the value of $2.763 million and six counts of dishonestly using his position as a director in the amount of $2.01 million.

ASIC Commissioner Sean Hughes said Silver “deliberately targeted the elderly, promised investors up to 20 per cent returns and convinced investors to borrow against their homes, which in many cases, was their only financial asset”.

In 2020, Silver lost an appeal against the severity of the eight-year sentence, which the Queensland Court of Appeal decreed was not manifestly excessive.

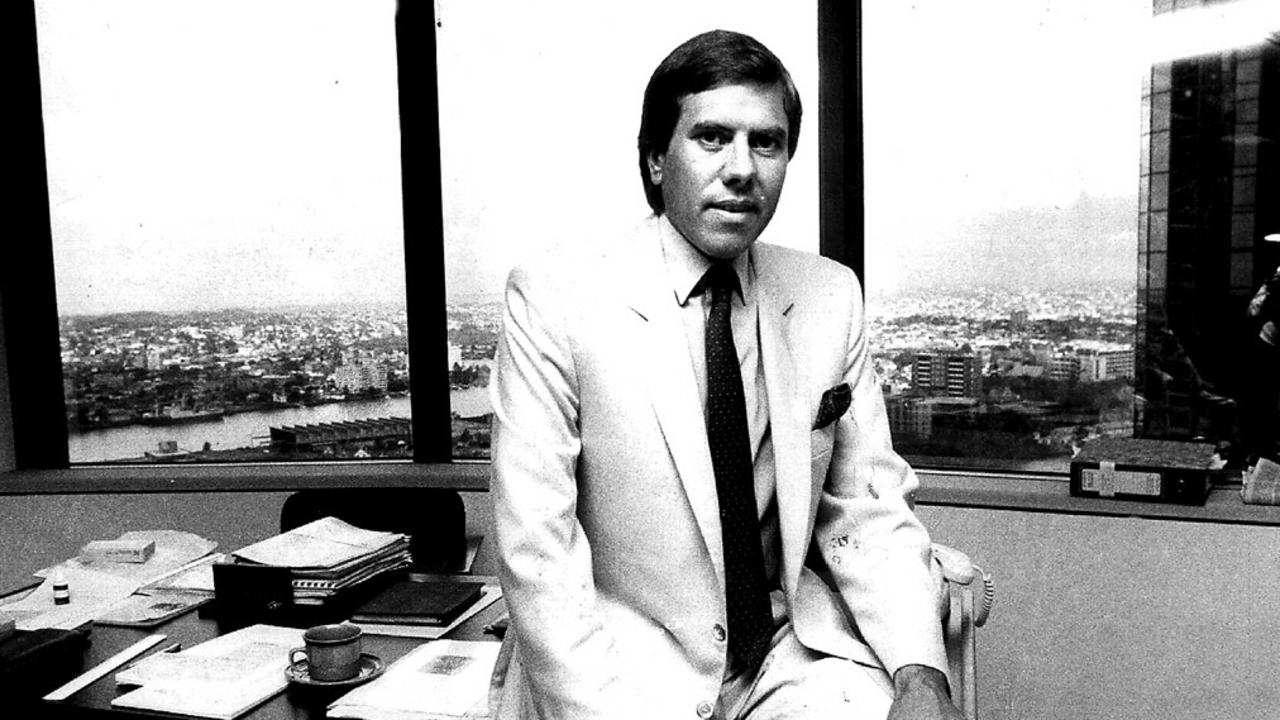

MIKE GORE

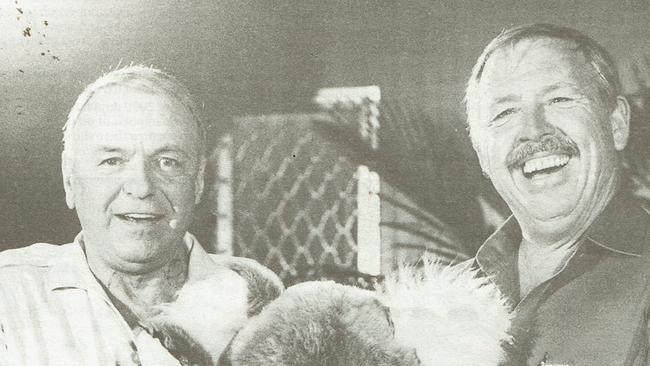

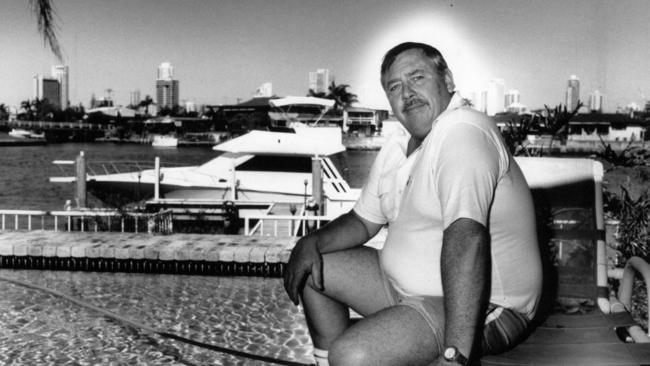

Mike Gore was the toast of the Coast in early 1988 when his $400m Sanctuary Cove resort development opened.

His masterpiece was January 1988’s The Ultimate Event – a gathering of celebrities including Frank Sinatra, Peter Allen and some of sports biggest names.

Gore vowed the event would be a success with the arrival of Sinatra and correctly predicted it would be the iconic singer’s final Australian appearance.

“All the legends are dead but Frank Sinatra is alive and he is still a legend,” he said.

“Let’s face it, this country is never going to see Frank Sinatra again.”

The success was short-lived – he sold his shares in the resort just two months later to Ariadne Australia.

Within weeks of this sale, Gore was hit with 32 charges, including having defrauded the Commonwealth of money payable as sales tax and 16 charges of having imposed on the Commonwealth by untrue representations between 1982 and 1984.

The charges related to alleged activities of Gore when he was a director, shareholder and public officer of Stirling Investments Pty Ltd.

During his trial, the court was told Gore flew to Hong Kong to destroy or falsify documents relating to the fraud.

Gore was acquitted of the charges and he announced plans to return to development with a major dude ranch project at Canungra.

By the early 1990s, the recession hit the Gold Coast economy, causing a major downturn in the property market which, along with a costly divorce, put Gore under significant financial pressure.

Gore’s empire collapsed into receivership in September 1991 with debts of more than $25m and ruined investors, including his former mother-in-law.

His $500,000 art collection, which included works by Norman Lindsay, Clifton Pugh, Hugh Sawrey, Lloyd Rees, Pro Hart, Donald Friend and Russell Drysdale, was put up for auction.

The disgraced developer mysteriously disappeared in mid-1992, leaving his investors and creditors to hold the bag for his massive debts.

It was later revealed he’d escaped to Vancouver while the courts and receivers continued to chase him.

In early 1994 Gore was ordered to pay back more than $800,000 to a Melbourne company which had loaned him money years earlier.

The chase for Gore ended in late 1994 when he died in his sleep at age 54.

KEVIN BARNARD

Another more recent case was that of an engineer who used fake invoices to siphon more than $174,000 in GST for a Broadbeach tower that did not exist.

Kevin John Barnard’s fraudulent fairytale was undone partly by the facts he did not own the land the tower was to be built on or lodge development applications with council.

The 59-year-old pleaded guilty in the Southport District Court in August 2021 to six counts of obtaining financial advantage by deception and two counts of attempting to gain financial advantage by deception.

Judge Rowan Jackson sentenced him to three years’ prison with immediate release on a $5000 good behaviour order.

“The offences are not victimless crimes, they are crimes against all Australians,” he said.

The court was told that in 2014 Barnard overstated his non-capital expenses on his BAS statements relating to a tower he was purportedly building in Broadbeach, resulting in GST refunds.

He received more than $147,000 than he was entitled.

Barnard attempted two more refunds totalling about $76,000 and was refused.

His deception was discovered during an audit by the Australian Taxation Office in which he used fake or unpaid invoices.

The court was told it was unlikely a prison would be able to cater to Barnard’s medical needs.

“The only reason you are not serving time in prison is because of your health,” Judge Jackson said.

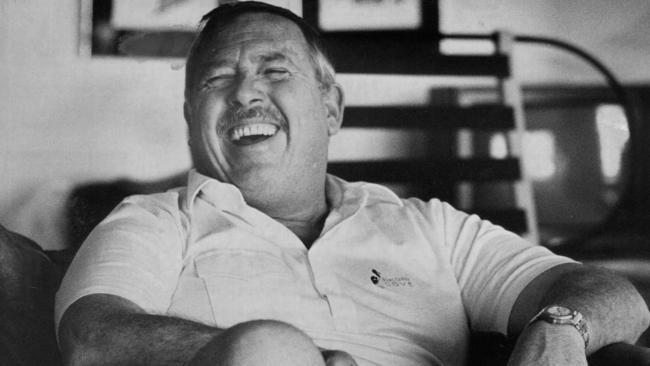

CRAIG GORE

Mike Gore’s son, Craig Gore was a major business tycoon in his own right.

During the 1990s and early 2000s he was one of the Gold Coast’s most prominent business figures, becoming a leading property developer, owning a V8 supercars team and was involved in property development.

By 2007 he had built a fortune of more than $183m.

But, like so many other business figures, he was left financially crippled by the global financial crisis and he declared bankruptcy, citing debts of $282.9m

The disgraced former rich-lister was found guilty in November 2020 of defrauding almost $350,000 from self-managed super fund investors.

He used the money to pay company debts and rent on his Queensland home.

He faced a judge-alone trial in the Brisbane District Court over 12 counts of fraud, totalling about $350,000, which occurred in 2013-14 at Southport.

At the time, Judge Michael Byrne said Gore, then-53, showed “no remorse” for his “deliberate and targeted” criminal offending

Gore was sentenced to five years’ imprisonment to be suspended in late 2022.

Gore lodged an appeal against the convictions on the grounds they were unreasonable and could not be supported having regard to the evidence but the appeal was denied in late 2021.

Gore was permanently barred from the financial services sector.

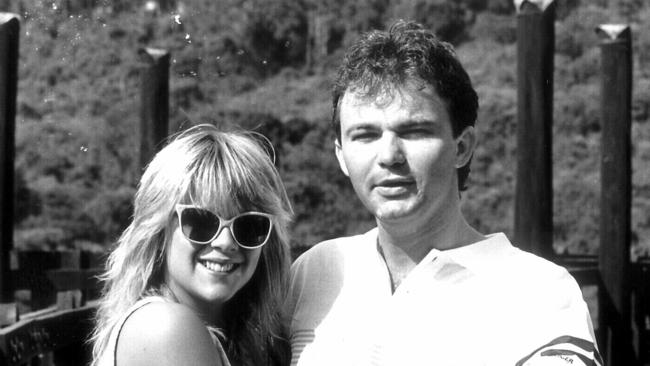

PETER FOSTER

He’s best-known today as Australia’s most prominent conman but the self-described “international man of mischief” started off as a boxing promoter on the Gold Coast in the mid-1980s.

Foster dated singer and international model Samantha Fox and made a documentary with legendary boxer Muhammad Ali.

But by 1985 Foster began selling Bai Lin tea through his Slimway Tea Company which he claimed reduced weight.

Forster was just 22 when he was made bankrupt in November 1985, after he failed to pay Gold Coast Publications (the publisher of the Bulletin) nearly $7500 in advertising fees for an abortive Ali tour.

He also owed more than $40,000 in legal costs to an insurance company he unsuccessfully sued in 1983 to recover insurance on an abandoned fight between Tony Mundine and Buddy Johnson.

This didn’t stop him taking his tea to the UK where hundreds of people lined up to buy his “wonder drug”.

Within a year British police hunted Foster on fraud charges over his tea venture but he escaped to the US where he again began marketing his products.

Foster has been in and out of jail for much of his adult life and also made international headlines again in 2002 when he was at the centre of a major British political scandal involving then prime minister Tony Blair’s wife Cherie.

It was revealed he had helped her buy two units for a discount in Bristol.

Foster has continued to make headlines in recent decades and has repeatedly been convicted and jailed for multiple fraud cases.

He has been behind bars since 2020 when he was famously tackled and arrested on a Port Douglas beach for alleged links to an international betting scam.

More Coverage

Originally published as Stories behind the Gold Coast’s most notorious white-collar criminals, developers and fraudsters revealed