Stock market bloodbath: Will Central Banks pivot to prevent recession?

As trade wars and stock market sell offs spark fears of economic meltdown, all eyes are on Central Banks and if they’ll pivot quickly enough to prevent a recession, writes Craig Tapping.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

Trade wars, widespread sell offs and rate speculation has led to a global financial market bloodbath this week but will Central Banks pivot quickly enough to prevent a recession?

Stock markets and cryptocurrencies have plummeted amid the chaos engulfing US President Donald Trump’s steep tariffs on foreign trading partners that could push the US into recession.

The significant economic turbulence has put the microscope on how Central Banks - still holding tight monetary policy to contend with post-Covid era inflation pressures - will react and if they’ll pivot strategies quick enough to avoid a global financial meltdown.

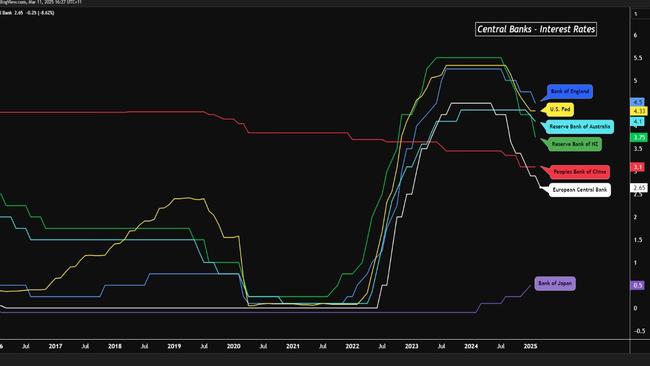

China, Japan, and the European Central Banks have initiated monetary policy changes through rate cuts and Quantitative Easing but the US Federal Reserve (Fed) and Australia’s Reserve Bank (RBA) continue to implement more conservative policy decisions.

With recent indicators of slowing economic growth, falling markets, and softening inflationary pressures, the question arises whether Central Bankers will pivot in time to stimulate economic and market conditions or act too slowly, leading to a potential recession.

The benchmark S&P 500 has declined by 9 per cent from its February highs, indicating a substantial market correction amid growing concerns over economic growth and inflation.

Conversely, US Treasury Bonds have increased by 8 per cent since January, reflecting a renewed interest in fixed-income securities as a safe haven.

US two-year and 10-year bond yields have been falling rapidly, prompting discussions about possible future rate cuts by the US Federal Reserve.

A decline in bond yields typically suggests market expectations of easing monetary policy, hinting that the Fed may consider reducing interest rates in response to economic weakness.

Moreover, trade tariffs imposed by the Trump administration have emerged as bearish catalysts for various sectors, creating uncertainty among businesses, increasing costs, and affecting profit margins, contributing further to the current negative sentiment across equity markets.

The significant divergence in Central Bankers’ monetary policy decision-making is evident when comparing the strategies of the US Federal Reserve (Fed) and the European Central Bank (ECB).

- The Fed is currently holding rates at 4.5 per cent while continuing to reduce assets off their balance sheet (Quantitative Tightening), aiming to curb inflationary pressure by reducing economic demand.

- In contrast, the ECB has adopted a more aggressive monetary strategy, implementing five rate cuts since June 2024, bringing key rates down to 2.65 per cent, reflecting a proactive approach to address economic stagnation in the Eurozone.

The Federal Reserve’s recent GDP forecast for Q1 2025 at -2.4 per cent underscores the seriousness of the current economic climate.

This contraction suggests significant challenges for the US economy, leading to a reassessment of growth prospects and increasing pressure on the Fed to maintain or adjust its current monetary policy strategy.

As the Fed holds steady with a 4.5 per cent interest rate and refrains from quantitative easing, the implications for the economy and market sentiment are notable.

The latest data from Truflation indicates US inflation has slowed to 1.4 per cent, presenting a dilemma: should the Fed pivot or maintain its course?

If the Fed decides to pivot by accelerating rate cuts or implementing new quantitative easing measures, it could provide a much-needed boost to equities and speculative assets, alleviating current market concerns.

Conversely, if the Fed opts not to pivot, maintaining rates despite the negative growth forecast, it may further dampen investor sentiment and increase market volatility.

Today’s financial landscape is complex, as market participants weigh the implications of rising bond prices, falling yields, and potential changes in Federal Reserve policy.

Ongoing discussions around growth forecasts, inflation trends, and external economic pressures continue to shape decision-making in an environment where both caution and opportunity coexist, especially with contrasting monetary policies between the ECB and the Fed adding layers of complexity to the global stage.

Will the Fed pivot in time to boost the market conditions? Or will they react too slowly and take us into a recession?

- Craig Tapping (MBA) is a lead educator with Mastering the Markets